|

This Blog Series covers some pretty complicated stuff and I recommend that you read Parts 1 and 2 before you attack this one - you can find them here:

http://wheeliedealer.weebly.com/educational-blogs/the-mechanics-of-a-trade-part-1-of-3 http://wheeliedealer.weebly.com/educational-blogs/the-mechanics-of-a-trade-part-2-of-3 Example 3 - You want to buy 3 Shares in Company XYZ - a ‘Tree-Shake’ This next situation only tends to happen on Small Stocks which are illiquid and where the actions of one Market Maker can affect the Price - on a large and liquid Stock, this kind of thing simply cannot happen as in effect it can throw up an arbitrage opportunity where another Market Maker can take advantage of the artificial Price move and in addition such big Stocks are watched by Traders in general for every tiny move and any mis-pricings would be quickly bought or sold away.

The basic Assumptions are as I listed at the start of Example 1 and your actions as a Buyer are similar to Example 2. This time you still want your 3 Shares in XYZ but because it got kicked back at you on Example 1, you have decided to use a Limit Order through your Broker. For this one, here are the steps as your Order flows through the various Processes; and this time rather than raising the Price to get more Stock to fulfil your Limit Order, the Market Maker ‘Shakes the Tree’ to scare weak Holders into panicking and dumping their Shares at a low Price:

Understanding this Example and how a Tree-Shake works in practice can be very helpful when trying to figure out what is going on when a Small Stock you hold does some ‘funny moves’. Such an appreciation can avoid you selling out in panic when the Price plunges unexpectedly and if you do not hold the Stock, or if you want to buy more, then a Tree-Shake can be an opportunity for you to Buy well although often the Price drop soon disappears so it is hard to take advantage of it (it may also be only in small size so hard to buy a meaningful amount). When I see such a move on a Stock I hold I tend to instantly assume it is a Tree-Shake and I never let myself panic about it. I go to the News for that Stock on my ADVFN App and I look at the Free Bulletin Board as well - usually if there is something real and of note then it shows up on the Board. You can also put out a Tweet along the lines of “What the heck is going on a XYZ?” and usually someone will know what has caused the move if it is something proper rather than Market Maker fun and games.

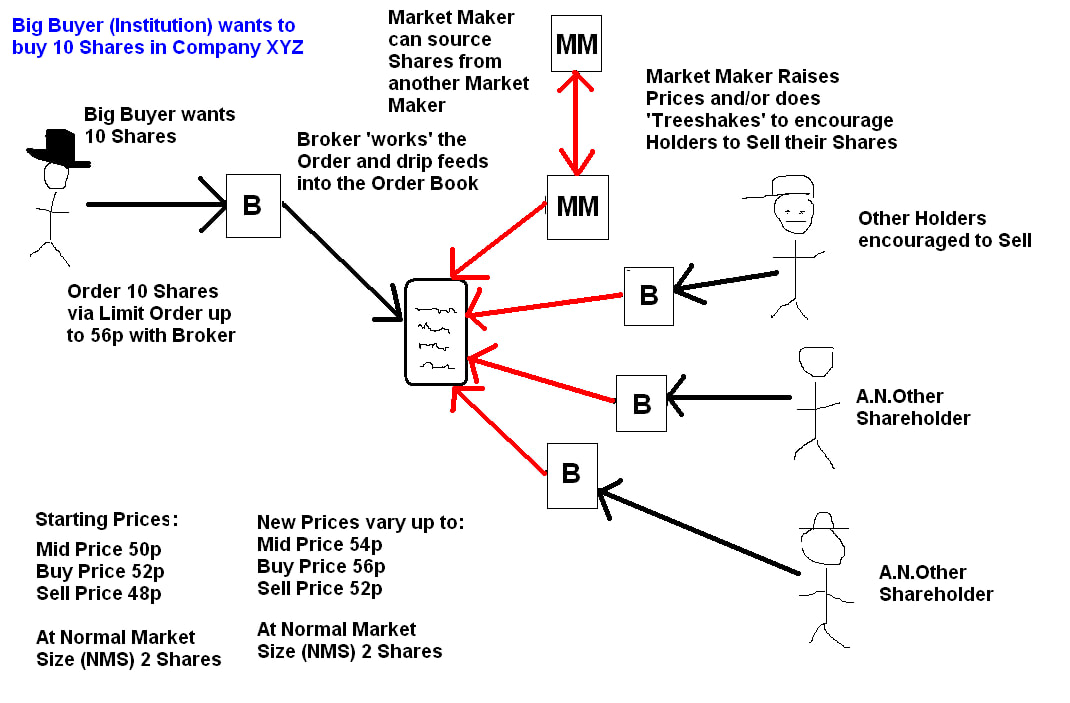

Example 4 - Big Buyer (Institution) wants to buy 10 Shares in Company XYZ

Again we are talking about the same Company XYZ and it has 100 Shares and the Free-Float is quite small. In this Example the Big Buyer (you can tell he/she is big because he/she has a hat !!) tells his or her Broker that they want to Buy 10 Shares and they will indicate a Maximum Price that they are prepared to pay - for example they might cap the Price at 56p as per the diagram, even though the Market Price is 52p to Buy when they initiate the Order. Note, the Big Buyer is prepared to pay more than the 52p because they are keen to get hold of the Stock and they realise that Sellers will only part with what they hold if the Price is high enough to motivate them to Sell. They could of course be more aggressive and tell the Broker to Buy at a Price below the Market Price, for example up to 49p, but this will be troublesome for the Broker and need a lot of effort to manage the Order and take a lot longer. There is of course no guarantee the Broker will be able to get the Stock required either and most Big Buyers who are Fund Managers or Pensions or some other sort of Institutional Buyer are very much Long Term Investors and they will be more focussed on obtaining the Company Shares they want after spending a lot of time doing analysis, than whether or not they get a ‘perfect’ Buy Price for a point in time. The Broker will have told the Big Buyer that it will take some time to get the Stock and it might be a Week or something. The Broker will then ‘work’ the Order which means that they break the Order for 10 Shares up into smaller Parcels which are more likely to get Shares from Holders because none of the Holders wants to sell 10 Shares even if they had them. The Broker will perhaps buy some Shares using a Market Order as per Example 1 in some instances or they may place Limit Orders in the Order Book which the Market Maker will then try to fill by doing Tree-Shakes or Raising the Price like in Examples 2 and 3. The Market Makers could also buy Shares from another Market Maker. It is in the Broker’s interest to try to get the best Prices they can (‘the Best Execution’) even though the Big Buyer said they would pay up to 56p. This is because the Big Buyer can easily switch to another Broker who would get them better Prices if they are unhappy. That is how markets work !!! Brokers have relationships with Market Makers and can speak to them on the phone and stuff and the ability of a Broker to work with a Market Maker to get hold of Stock is an important skill (and of course to be able to dump it if necessary). I am sure there are many Rules governing these relationships but I suspect there are quite a lot of practices that happen that may not be truly to the benefit of End-Customers - it is a murky game I am sure. So the Broker splits the Order for 10 Shares into several smaller Chunks and this will be reflected in the ‘Trades’ information which you can see on Websites like MoneyAM or ADVFN etc. after the Trades have been executed. The important thing to realise though is that an Order for 10 Shares would probably appear at the end of a Day and would show as 10 Shares Bought but in reality it was several smaller Buys of Shares which occurred at various times during the Day. So that is a bit misleading and yet another example of how this ‘Trades’ information is not all that useful. In the Example on the diagram, because of the limited number of Shares and the actions by the Market Makers and the Broker to get hold of Shares to fulfil the needs of the Big Buyer, the Price will have moved about lots as Tree-Shakes were done or the Price was pushed up to encourage Holders to Sell.

Conclusion

There are perhaps other scenarios which could be used but what I have included here should cover the main ones and give Readers a pretty good feel of how things work in practice. As I mentioned it is all very complicated and I am sure that I have not got every bit of detail 100% spot on here but I am mostly right - at lease conceptually even if some of my definitions are wrong. That in itself should be enough to give Readers a better appreciation of what is involved and in specific practical terms it should make you more aware of what is happening during a Tree-Shake and also make you more wary of the ‘Trades’ information. Just below I have included a link to Michael Taylor’s (@vilage_idoit) FREE eBook and I recommend you read that and in particular the chunk on Level 2. My head hurts now………….Well done for getting through all this. Cheers, WD. Related Blogs Here is the one I wrote years ago about this sort of thing. Much of this will be repetitive on what I have written in this new Blog (and I won’t be surprised if there are a few contradictions !!) but it is probably worth taking the time to read it again. Especially if you are at work and let’s face it you have nothing better to do and the Boss is out on the Golf Course !! http://wheeliedealer.weebly.com/educational-blogs/why-do-share-prices-rise-and-fall This Blog is about Candlestick Charting - it is short and sweet but should demonstrate why I am such a big fan: http://wheeliedealer.weebly.com/educational-blogs/a-cheap-alternative-to-level2 And you can find Michael’s Book via a Link on my ‘Weekly Performance’ page but here is a Link anyway (if it doesn‘t appear as a pop-up, then there is an Orange Button at the top right hand corner of Michael‘s Homepage): https://www.shiftingshares.com/

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|