|

If you haven’t read Part 1 yet it is probably a good idea to do so and you can find it here:

https://wheeliedealer.weebly.com/educational-blogs/bubble-bubble-toil-and-trouble-part-1-of-2 When that Part finished I was going through the reasons why I am thinking that a proper full-on Bubble has become more likely, and here are a load more: Technical ‘Breakouts’ on Major Indexes If you keep up with my Weekly ‘Stocks & Markets’ Blogs which usually come out late on a Sunday Night, then you will probably have seen me mentioning the strength in the Indexes and how many have either recently ‘Broken-out’ to new All Time Highs (the US Markets) or they are very near such Break-outs and I expect to see them soon (German DAX, CAC40, FTSE100) and such Price Action is extremely Bullish and supportive of the start of a Bubble if that is how things are going to play out. It is pretty remarkable that after 11 years of the Longest Bull Market ever, we still have such strength and demand for Stocks.

0 Comments

In a recent TPI Podcast we talked at length about a potential Stockmarket Bubble and I also wrote a bit in a Weekend Charts Blog. Both times I think I promised to write a more detailed Blog specifically on the subject and in theory as I start writing, this Blog is intended to fulfil that commitment. You can find the Podcast here by the way:

https://soundcloud.com/user-479955511/conkers3-wheeliedealer-152-market-bubbles-high-pe-stocks-gaw-fevr-amzn-googl-mpac-1 First off I must make it very clear that I am not saying a Bubble is definitely going to happen; nobody can foresee the future (least of all me !!) and all we can realistically do is to assign probabilities to possible future outcomes. Using such an approach, I would guesstimate that perhaps a year or more ago, I would have said that a Bubble was a very low likelihood, perhaps something like 5 to 10%. The fact is that Stockmarket Bubbles are very rare and hence a low probability is appropriate, but with the various factors that I will get onto shortly, I would now say that the probability has risen to perhaps 15 to 20%.

This is the last part of this Blog Series and you can read the earlier bits at these Links:

http://wheeliedealer.weebly.com/educational-blogs/the-spectrum-of-how-to-organise-a-nations-economy-part-1-of-3 http://wheeliedealer.weebly.com/educational-blogs/the-spectrum-of-how-to-organise-a-nations-economy-part-2-of-4 http://wheeliedealer.weebly.com/educational-blogs/the-spectrum-of-how-to-organise-a-nations-economy-part-3-of-4 The Counterpart to High State Spending - High Borrowing Invariably whenever a Socialist Government embarks on a high level of State Spending, it has to fund that Spending and it is usually too difficult within the Political constraints of Western Economies to tax People and Businesses within the Economy at a level that would cover all the Spending (and to be fair that would make little sense anyway because a CONTROLLED amount of State Borrowing can be worth doing and affordable provided that the Economy is growing at a sufficient rate), and as a result the Government has to borrow money by issuing Bonds.

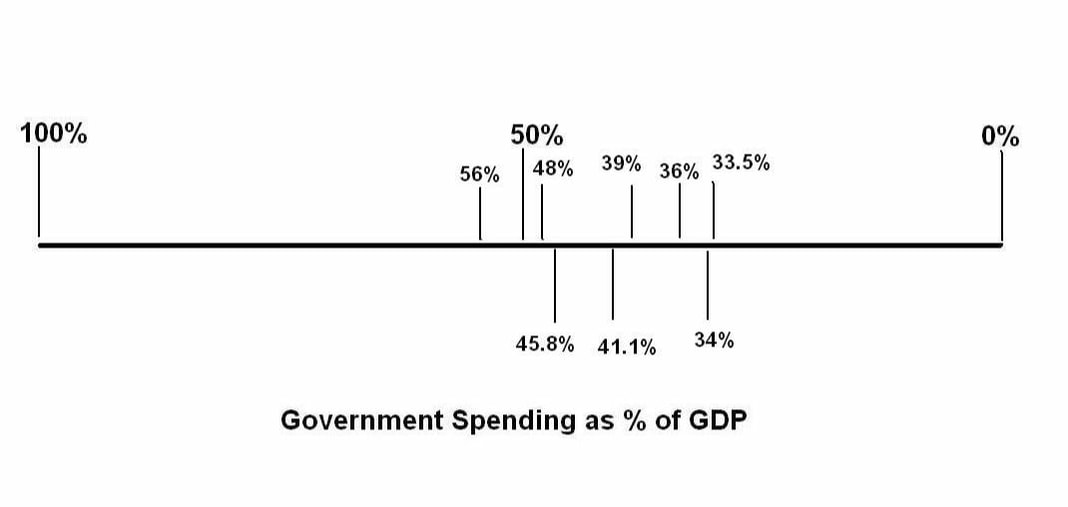

So how do various Governments shape-up on their Levels of Spending?

As with all the Pictures here I have created them using Microsoft Paint and I find it unbelievably difficult to use and I suspect much of this is because in a former life I did all such Image creation using Microsoft Powerpoint which I found superb and very intuitive. Paint could most definitely never be called ‘intuitive’ !!

If you click on the picture it should grow bigger to help you see the detail.

More implications of the Different Levels of State Spending

Communism When the level of State Spending gets to very high proportions of a Nation’s GDP, there can initially be some benefits and in fact, back in the early 1920s when Communism in the USSR got started, the Economic Figures coming out were far superior to other Countries for a period of time (of course, that is assuming that the Figures were correct - it was very much a huge part of the Propaganda of the Commies to exaggerate how successful they were when in fact that was far from the truth). This initial boost comes because State organisation of various Industries (in the USSR they grouped Production into particular geographical regions - for example Shoe making would be done in one particular Town or whatever and Kitchen Utensils would be made in another Town) and the simple fact of concentrating production in this way was highly efficient for a while, through efficiencies from factors like labour specialism (Division of Labour), centralised purchasing and ease of logistics, etc.

It’s pretty darned rare for me to write a Blog about Macroeconomics but with all the Brexit turmoil and the fears of a Labour Government run by Jezza Corbyn and his Marxist buddies, I thought it was a good time to write a Blog about a very simple Economic Concept that I suspect very few People really understand and it might make Readers think about what the various Political shenanigans might really mean for Economic Growth and how our Society is managed (or mis-managed most of the time !!). And of course that could impact on our Investments.

I guess it is from being one of ‘Thatcher’s Babies’ that my interest in Economics was first ignited and back in those days in the late 1970s and for most of the 1980s the Economic Debate was very much at the forefront and it is only in more recent times in the ‘Goldilocks’ years (‘not too hot and not too cold‘) of the 1990s and up to the Credit Crunch in 2008 that Economics rarely seems to get much proper coverage in the Media and I wouldn’t be surprised if many People just latch onto Left Wing and Right Wing Politicians on the basis of them being ‘Nasty’ Individuals or ‘Nice’ ones. Of course it really is not that simple and Political choices along the lines of ‘Left’ or ‘Right’ imply very different ways to organise Society and the Economic Structure and the Freedom or not of the Individual. Hopefully this Blog will help explain in a very simple way what the Political slants of Left and Right really mean in terms of a National Economy.

I often get ideas for Blogs from various chats on Twitter and this one has come about in this way, and it also has the added bonus of being sort of linked to the recent lengthy Blog Series I wrote on ‘Wheelie’s New Improved Index Trading System’.

We were having a debate about what drives Indexes in terms of Price Rises and Falls etc. (I think it was with @Old_Man_Trading who is really hot on the TA stuff and well worth following on the Tweetster) and I put forth the idea that to a large extent we cannot know what is driving them as there are simply too many factors involved. To illustrate this, let me start off by listing things that might be drivers, and note they can probably be broken down into a few Headings:

Last weekend I started my Charts Blog with: “Finally the Bears have come out for their Honey………” my goodness, they certainly came out and I didn’t realise they would be so greedy and scoff so much !!!

My Portfolio took a right kicking last week and it ended up dropping 4.3% in the 5 days and this means that for 2018 overall I am now in a Loss situation with damage to the tune of 3.3%. It has been such a funny start to the year because I had a super strong first week but then did nothing much through the rest of January and then got whacked last week - not the sort of start I wanted !! As usual I will look at some Index Charts later to try to get a feel for where we are likely to go next but before that I just want to re-iterate what I think I said last week about how I just don’t see this as being the start of a full-on proper Bear Market like many ‘talking heads’ on Bloomberg and the like are saying. Financial TV loves sensationalism (like all Media because it captures people’s attention and that means Subscription and Advertising Revenues) and wheeling out the Ultra-Bear and Ultra Bull at various Market Troughs and Peaks totally pumps up Viewers’/Readers’ emotions and feeds the Fear and Greed.

I was out at a old (literally) mate’s 50th Birthday Party last night and because I wasn’t driving I probably imbibed far too much lager than is perhaps wise and as a result I got up extremely late today and I have consequently been in a bad mood and chasing my tail all day. Lord only knows when I will finish this Blog but I suspect I will be uploading it in the wee small hours and looking at the list of stuff I want to cover, I am not actually sure which day that will be on !!

First up let me just mention in passing that I have finally completed the Full Series of the Income Portfolio Blogs - I am pleased with what I have produced here but I won’t be lying if I say I am happy to see it finished - I always start things with huge enthusiasm and then as time goes on it starts to bore me and I have new ideas I want to be working on (not forgetting a long abandoned piece on a New Stock which I really will focus on finishing as my next Blog to come out - it is in quite a good state and I might end up splitting it into 2 parts just to get things moving).

The thought that we still have about 3 Weeks to go on this General Election run-in is beyond depressing. We all know what the result will be and thankfully the Markets should take this in their stride and any negative forces on Stocks are likely to come from completely different factors if they do occur.

The Campaigns are just so dire - T May seems to have totally absorbed her Conference Speech from many years back where she talked about “The Nasty Party” and consequently you wouldn’t even know she was the Leader of the Tories if you just had a quick look at the Campaign Marketing fodder. It is very much a Campaign to elect T May as the President. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|