|

This subject is quite complicated so if you have not read the first Part then it is probably best to look at that first - you can find it here:

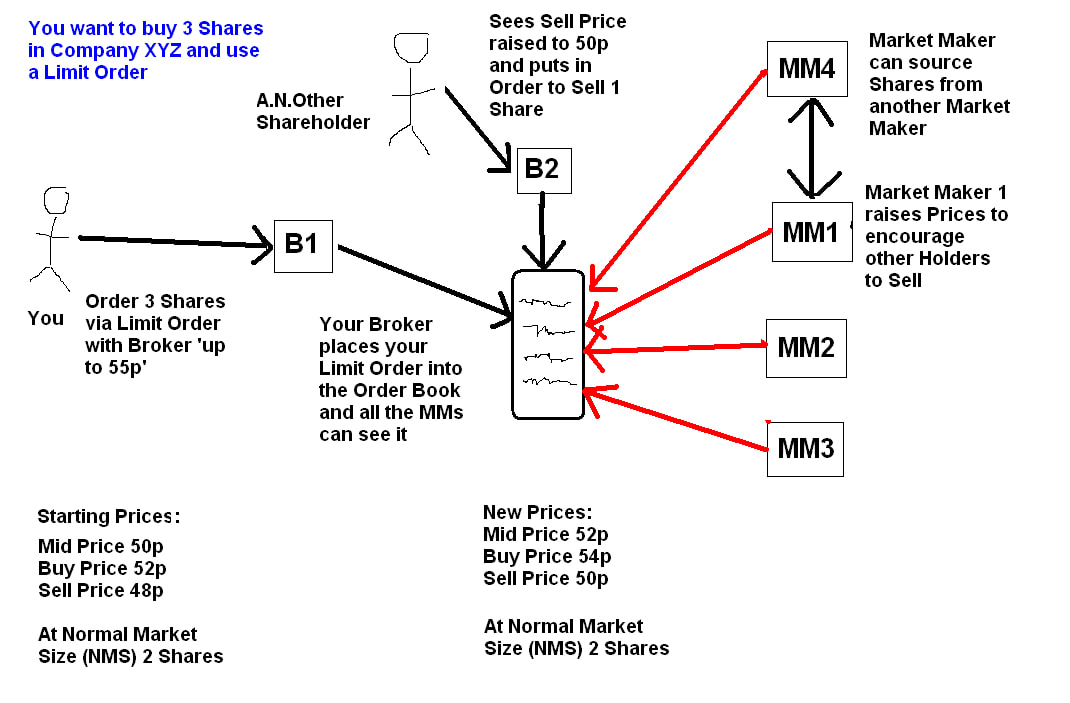

http://wheeliedealer.weebly.com/educational-blogs/the-mechanics-of-a-trade-part-1-of-3 Example 2 - You want to buy 3 Shares in Company XYZ but this time you use a ‘Limit Order’ The basic Assumptions are as I listed at the start of Example 1. This time you still want your 3 Shares in XYZ but because it got kicked back at you in Example 1, you have decided to use a Limit Order through your Broker, where you indicate a maximum Price you are prepared to pay for the Shares. For this one, here are the steps as your Order flows through the various Processes:

So in this example the important point to realise (‘take on board’ in the Business Jargon BS speak) is that Market Makers can obtain Stock from Shareholders by raising the Buy/Sell Price in order to encourage Holders to sell. So this is an extremely important concept - the ‘Free Float’ for a Stock at a given time and price is not static and it can vary to a large extent and this depends on the Conviction of the Shareholders (Institutions like Fund Managers will be very firm Holders) and the Price, because a very High Price will encourage Sellers (even among Fund Managers) and very low Prices can encourage Buyers (again this can be Fund Manager buying - it is often the case that Fund Managers do not buy or sell huge chunks of Shares but they trim their Holdings or add to their Holdings at various times, depending on how ‘tactical‘ their approach is). Of course that level of ‘Conviction’ by Holders also depends on the News around the Company that is current at that time.

The other important thing to think about in this Example is what I started this Blog off with about how Buyers and Sellers are always matched - there might be periods where a Market Maker has Shares sat on their Books, but with a finite and limited number of Shares there always has to be a Buyer and a Seller (or one Buyer and many Sellers or many Buyers and one Seller etc.). Market Makers tend to be specialists in their Stock and this is particularly the case on AIM Shares and Smallcap Shares. I understand that these Market Makers might hold Stock on their Books for a few Days but they tend to ‘go flat’ over a Weekend although this all depends. In general the Market Makers in a given Stock will always have some amount of Stock on their Books so they can do their role in making a Market and ensuring some liquidity for Traders/Investors. Obviously they don’t want to hold too much Stock because in effect that would be dead money if it is a Stock that doesn’t get traded much. Because they know their Stocks really well, they have a good understanding of Results Announcements coming up and any Broker Reports that are due to come out and any News that is likely to move the Market like perhaps a new Product Launch or a Share Placing or something (having said that I understand they are not supposed to know about Placings due to ‘Chinese Walls‘ but I suspect this is rather debatable !!). They are always ahead of you !! On a Share where very few Trades go through on the average Day, the Spread between the Buy and Sell Price will be very wide because the Market Maker turns a Profit by making a wider percentage on a low turnover. On a Stock that is traded lots, for example on a MegaCap like Vodafone VOD, the Profit Margins are tiny with a tight Spread but the volumes are huge so the Market Makers can do very well thank you very much !! In such cases there is a lot of competition with many, many Market Makers and they are all competing to get the Trade volumes so that they can make more Money - this squeezes the Spread closer together than on a rarely traded, low volume, Stock. Order Book This Link gives more information on the Order Book and how it works etc: https://www.investopedia.com/terms/o/order-book.asp And this bit on Limit Order Book is worth reading: https://www.investopedia.com/terms/l/limitorderbook.asp One point worth stressing from this is that it must be appreciated that there is a difference between Unfilled Orders sat on the Order Book which can perhaps gives clues to the kind of Buying or Selling interest for a given Stock, and the ‘Trades’ data which you can find on various Websites which is historic and shows Trades that were executed (this stuff is pretty useless as I have explained in other places). Hopefully this example of why a Price would move up on a Stock because of a particular Trade gives Readers an appreciation of the kinds of granular events that take place when you Buy or Sell a chunk of Shares. Clearly if you were to add lots of these kinds of Trades together then you can see how a Price would move up substantially especially if there was a limited Free Float and existing Holders were very committed to holding on to their Shares and needed a lot of encouragement to make them Sell any. In Part 3 we will look at more examples of Trade Types with a ‘Tree-Shake and what happens when a Big Buyer wants a load of Stock. Cheers, WD. Related Blogs This one is exactly my earlier point about it being better to be on the Train when it leaves the Station than to miss it because you wanted a slightly better Price: http://wheeliedealer.weebly.com/educational-blogs/i-cant-buy-that-ive-missed-the-boat

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|