|

It’s funny the things in life than can really get under our skin and something that really grates with me is when I see people on Twitter sending out a Tweet to the effect of “A big Buy for 200,000 Shares just went through on XYZ……” (heck, even just typing this is getting my Blood Pressure up !!).

Apart from the fact that the vast majority of people who Tweet sh*te like this are probably Rampers (or perhaps they are just not very clued up on what is really going on), the big issue with this is that if there is a Buy for any Shares then it is a simple truth that there is always one or more Sells on the other side. So if you are taking notice of a Buy Trade and thinking that this is a good thing, then you must be making the cognitive leap that whoever was on the Buy side knows more than whoever is on the Sell side. Without knowing who the individuals are, that is obviously impossible to know and even if you did know who was Buying, you are making an assumption that they are correct (no one is 100% right - even Warren Buffett gets things wrong).

And of course there is yet another problem here. I wrote a Blog a gazillion hours ago which mentioned this and if I remember I will include a Link to it at the bottom of this Blog (or ‘these Blogs’ if it becomes a Series) but you cannot just look at the ‘Trades’ Lists you will see on Websites like ADVFN or MoneyAM etc. and know what a Trade actually is. The way it works is that a computer is looking at the Price of a Trade that has gone through and it is making an assumption that it is either a Buy or a Sell based on what the ‘Bid/Offer’ Prices were at the time the Trade went through. Often this will be spot on but it is not totally reliable by a long way and things you think are Buys are often actually Sells.

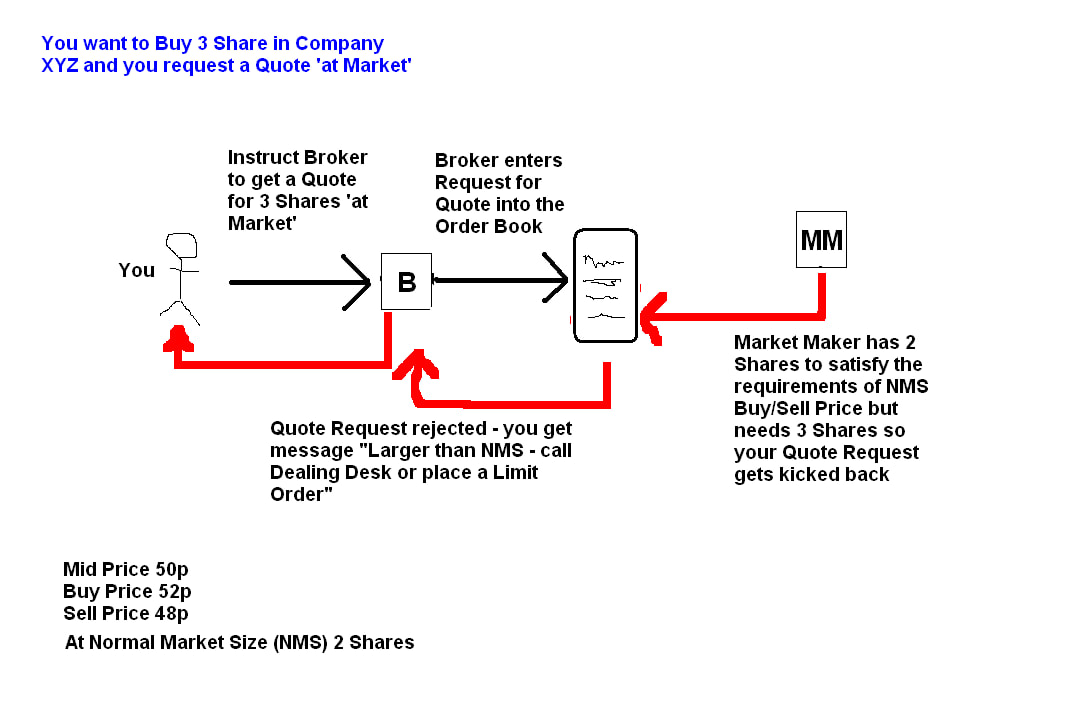

To be honest, I think this ‘Trades’ stuff is a total waste of time and if you really must muck about with such things then you need to invest in getting a Level2 Feed which can actually provide you with something useful (other than as a tool for Ramping your garbage Stock !!). And by coincidence as I am working on the Final Version of this bit ready for publishing, I saw a Tweet earlier today which was needless to say concerned with some total garbage AIM Stock and the Tweet had an image of loads of Blue Trades that had gone through and the claim that “these are all Buys and no Sells”. Man, that really grates with me. Anyway, the reason I am scribbling all this is that I want to set the scene on why I am writing this Blog and what I hope to achieve is to give Readers a much better understanding of the mechanics of what happens when we place a Trade and the roles of entities like the Market Maker and our Broker and the actions of other Traders/Investors as well. I really think it is an area that very few people actually understand and when I see comments like “there is a big Buy on XYZ…..” it just confirms my thinking. In addition, I think very few People really understand how the Buyers and Sellers interact and how on top of that we have Market Makers and their activities and the role of the Price in helping to balance out Supply of Shares and the Demand for them. Like any Market, it all comes down to Supply and Demand (I just had a particularly unpleasant flashback to doing Supply/Demand Curves in my Economics Lectures at College). In fact, I don’t even think I fully understand the precise ins and outs of some of this stuff and in the text and diagrams I will show later I have come up with the best understanding I have which should give Readers a much better view of the reality. In many cases my conceptual description is correct although the precise terminology is perhaps not 100% spot on - but it should be sufficient. I must also thank Michael (@vilage_idoit on the Tweets) for his help in discussing some stuff I needed clarity on and for reviewing a Draft of the Blogs. Of course as with so many of my Blogs, I start off all fired up and with great intentions and a sort of very nebulous idea of what I am going to write and then when I actually get around to punching the Keyboard, I find that it is a lot harder than I had envisaged !! Needless to say I always think these things will be a piece of pi** to write and I doubt I have ever written a Blog that was ‘easy’ (perhaps the first ever Blog I wrote was ‘easy‘ but you can tell this by the fact it is so awful !!). In this particular case I decided that I will need to create a load of diagrams with all the various entities and the information flows and suchlike (I am sure I did something like this in College in my ‘Computing’ lessons - it might have had a posh name like ’Information Technology’ - I really didn’t understand much of it and I remember something called ‘Normalisation’ which just made no sense whatsoever). I had managed to convince myself that I was some sort of Microsoft Paint genius because I did those Macroeconomics Blogs recently and had to ‘learn’ how to use MS Paint. In a former life I actually was pretty sharp at using PowerPoint (yes, honestly !!) and I just assumed that my skills would be transferable quite swiftly but in the event I have found Paint to be totally different and a right pig to use. So not only did I have practical issues with the ‘drawing’ aspects of creating the Diagrams, I also then found that deciding on how to draw the information flows and stuff was really difficult - you will probably realise this when you see the total mess I have made of these diagrams !! (and that is after several complete revamps). My hope is that I have done them well enough that you can understand them but if you just sit there all baffled and scratching your nut I won’t be surprised and it probably doesn’t mean you are as thick as pig poo (I didn‘t say “scratching your nuts“ so you can stop that right away !!). The approach I have taken is to start off with a hypothetical (maybe that should say ‘theoretical’?) Company which has 100 Shares and I have randomly allocated some Prices and stuff to illustrate how particular Trades are executed and the information flows behind this and how the Prices can move. As I do each example I will try to explain all the assumptions and the steps as the Trade progresses from you pressing the button (or making a Phone Call to your Broker) to the Shares finally getting shoved into your Portfolio Account. Fair enough, let’s get on with them examples…… Example 1 - You want to Buy 3 Shares in Company XYZ via a Market Quote Below this text you will see the Diagram which has all the entities and the information flows which are the Quotes/Orders etc. Before going into this, here are the Assumptions for this example:

This text is quite good on Market Makers: https://www.fool.co.uk/investing-basics/how-the-stock-market-works/market-makers/ And this bit explains more about SETS and SEAQ: https://www.fool.co.uk/investing-basics/how-the-stock-market-works/sets-and-seaq/ This first example is really quite a simple one and this is completely unintentional but it should mean a nice gentle introduction into the examples and help make sense of it all. However, I have deliberately not showed more Market Markets and other complications but when we get on to Example 2 I will bring these other elements in. It is pretty much as per what I have written on the diagram - start with the funny little Stick Bod on the left (yes, that’s you !!) and follow the Arrows to the right and then back. To illustrate this further - here is the flow of your Request for a Quote through the Processes:

Of course, if you had just wanted two Shares and were prepared to pay the Buy Price quoted, then you would have got your Shares very easily. In such a case your Broker would have given you a ‘Market Quote’ with 10 Seconds to press the ‘Accept Quote’ Button or whatever your Broker has for this part of the process. If dealing by Phone, it would be verbal where your Broker would tell you the Price and you would verbally say ‘Accept’ or ‘Reject‘. If you do not respond within 10 Seconds (it usually has a Countdown Timer - no pressure !!) then it times out and you have to submit another Request for an ‘At Market’ Quote. By the way, if you use the Phone method to place Orders etc. then it usually costs you more and I recommend you use the Online Computer methods (I tend to use Apps via a Tablet mostly these days). Most Brokers will however let you use their Phone Dealing Desk method if there is a technical problem with their Computers/Website/App etc. - even if it is a technical problem at your end if you sweet talk them the chances are that they will only charge you the cheaper Computer/Online Dealing Fees. If you click on the Diagram it should get bigger if you are struggling to see the detail.

That’s it for Part 1. In the next Parts I cover several different Trade Scenarios including a ‘Tree-shake’ and also when you get a Big Buyer who wants a lot of Stock.

In the meantime, have a look at Michael Taylor’s (@vilage_idoit) FREE eBook which has a superb section on Level 2 and some other related stuff to these Blogs. You can grab a copy at his Website here: https://www.shiftingshares.com/ If you can’t see the eBook when you click the link, have a look for a little Orange Button in the Top Right Hand Corner marked ‘Get the Book’. Regards, WD.

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|