|

THIS IS NOT A TIP OR RECOMMENDATION. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITE. IF YOU COPY MY TRADES, YOU WILL PROBABLY LOSE MONEY. I HAVE A LARGE PORTFOLIO AND I USE DIVERSIFICATION TO SPREAD RISK ALONG WITH TRICKS LIKE HEDGING AND OCCASIONALLY BY THE USE OF STOPLOSSES - IF YOU BUY ANY STOCK YOU REALLY SHOULD FOCUS ON HOW IT FITS IN WITH THE REST OF YOUR PORTFOLIO AND KEEP RISK MANAGEMENT AT THE FOREFRONT OF EVERYTHING YOU DO. BE AWARE THAT ALL INVESTORS/TRADERS GET THINGS WRONG AND MANY STOCK SELECTIONS WILL WORK OUT BADLY

This is Part 1 of what might be 2 Blogs or it might be 3 !! Hopefully this will give Readers a good insight into what HOTC does and some important information like details about Directors, Strategy and the Risks that I have identified. In the next Part I intend to cover the Valuation aspects and suchlike which should complete the picture. Please note this is only touching on the information that is available and I suggest that Readers have a good look around the Company Website and also the latest Report & Accounts is worth reading. At the time of publishing Part 1 I do not have a Position in HOTC and there are no guarantees I will buy any Shares but it is certainly something that I think has excellent Long-term potential. There are plenty of images within this document so please click on them if you wish to see more details and in theory they should get bigger. Enjoy……..

I have been aware of Hotel Chocolat HOTC for pretty much 20 years now; I know this because I was first introduced to their yummy delights around this time when I was in Hospital following a Motorcycle accident and a friend used their website to send me a small box of chocolates. I thought at the time the chocs were well tasty but also I liked the idea that I could use the website to send chocs to friends etc. and it made a nice change from Flowers and the usual gifts we inflict on people when we have something that requires celebrating.

Back in those days it really was just a website and quite a limited range and then over the years it added more products and now they have Shops in the UK and have recently opened Shops in Copenhagen, Hong Kong, New York and Tokyo. The thing that really attracts me here is that over the last 20 years I have been able to clearly see the steady progress they have been making and I think it is highly likely they can continue this kind of growth (steady, not spectacular) for many years to come – especially as they move overseas and exploit their Brand in new territories. I think there are some obvious Risks and the main one is the ‘Key Man Risk’ around the Founder Angus Thirlwell (he is not all that old at 53) and in terms of the Stock it is pretty highly valued but I think the growth justifies this and it can grow into its valuation. I will look more into these specific points further into this Blog. At the time of writing this I am not really ready to pounce on HOTC but I wanted to do a ‘Stock Blog’ because I have not written one for ages and ages but also I thought that doing this Blog will give structure to my Research into the Stock and this way WD Readers can benefit from my findings as well. My thinking at the time being is to produce the Blog and get it out there and when I eventually get around to buying some HOTC (assuming I do so as that is not certain and I might find something in my Research that puts me off) I will apply an appropriate one of the ‘Stock Buy Checklists’ I wrote and I will issue that as a Blog. Well that’s my thinking at the moment. Company Overview Before we get into all the heavy wordy stuff, watch this 2 minute video and that will give you a flavour (sadly not the flavour of the Chocs !!): https://www.youtube.com/watch?v=bz22VTrtSyg&feature=youtu.be This text that I pinched from the Company Website gives a neat overview in 2 paragraphs: “When the very first Hotel Chocolat shop opened its doors to guests in North London in 2004, it was the start of a revolution in British chocolate. Two entrepreneurs, Angus Thirlwell and Peter Harris, were on a mission to make chocolate exciting again. Today, we have 103 shops as well as cafés and restaurants, we’ve opened our first three boutiques in Copenhagen and we have a hotel on our working cocoa plantation in the Caribbean. It’s been a busy period of change and growth, but everything we do is still guided by the three basic values that we started with – and it always will be.” It is important to realise that HOTC puts a lot of emphasis on the Quality of its products and I see this as a key differentiator which creates their competitive position in the UK and is likely to be something that can be exported to other markets fairly well. At the moment they have Shops in Copenhagen and Hong Kong and have recently opened in New York and Tokyo. They talk about having originality in their Products such as huge slabs of Chocolate and extra-thick Easter Eggs. This is also enhanced by authenticity whereby they grow the cocoa and make and retail the Chocolate products. They talk about ethics and having been a customer and known about HOTC for many years I would endorse the sense that they are an ethical operator. It is worth noting the strong customer loyalty as well. Something that impresses me a lot is how they have innovated in the products they offer and the ways they ‘get to market’. For example they now have things such as:

I just noticed they now have something called the ‘Chocmobile’ and this looks like a Van that goes around to Summer Festivals and suchlike flogging Hot Chocolate and Ice Cream. I would guess this isn’t a huge money spinner but it helps to get the Brand around to all those Middle-Class wannabe hippies. I must keep an eye out of the kitchen window to see if it ever comes up my Road !! Key Risks:

Key Attractions:

Company History I lifted this piece of text from the Customer Website and it shows the growth that the Company has achieved over nearly 3 decades: “A bite-sized history of Hotel Chocolat 1993 We start selling chocolates online, becoming one of the UK’s earliest ever ‘e-tailers’, predating the likes of Amazon and eBay. 1998 The Chocolate Tasting Club is created – a vast community of chocolate tasters who receive unique selections each month. 2004 The first-ever Hotel Chocolat shop opens! 2006 To realise their dream of becoming cocoa farmers, Angus and Peter buy a beautiful 250-year-old cocoa plantation in Saint Lucia – Rabot Estate. 2010 Hotel Chocolat’s first cafe opens in London’s Borough Market, serving a range of innovative cocoa-centred food and drinks. It quickly becomes popular. We launch the world’s first ‘Chocolate Bond’ to fund our development. We raise £4.2 million from enthusiastic supporters, who receive their interest paid in our chocolate! 2011 Boucan, our luxury hotel, restaurant and spa, opens on our cocoa plantation in Saint Lucia, to huge acclaim. People start flying in from New York for the food. 2012 Hotel Chocolat is voted the UK’s ‘most advocated’ British brand. We love you too! 2013 London is chosen as the home for our new restaurant, Rabot 1745, bringing the cocoa plantation experience to Britain. Our resident chocolatiers start making chocolates fresh in our cocoa bar-cafés. 2014 The School of Chocolate at Cocoa Vaults opens in Covent Garden, offering a world of chocolate adventures and experiences. Copenhagen sees the launch of two brand new stores, powered by a second Chocolate Bond launch and you, our loyal customers! 2015 Our cookbook, A New Way of Cooking with Chocolate, is published, giving a unique insight into the award-winning dishes from our restaurants and allowing you to make them at home. The School of Chocolate opens its doors at our Copenhagen City store, offering new chocolate adventures and experiences in Denmark. Our first West End store opens on Regent Street. Our first ‘refuel station’ café opens in Cambridge. It sets a trend that we later roll out across all of our cafés: there’s a Chocolate Whip Bar, Fuel-Up Station with brownies and snacks, Selector Library and our flavour-matched selection of hot drinks. 2016 We list on the London Stock Exchange, and raise new funds so that we can innovate even more. We’re awarded Mid-Market Business of the Year at the Lloyds Bank National Business Awards, open to any PLC with an annual turnover of £25 to £500 million. We take home 18 Academy of Chocolate Awards, including three Golds. 2017 Hello Hong Kong: Hotel Chocolat launches in Sogo department store – local tastes align with our mantra, ‘more cocoa, less sugar’. Our first ever no added sugar milk chocolate: Supermilk Pure. Simply 80% cocoa and organic milk. Nothing to hide: no artificial sugar substitutes. 2018 Whoosh! Instant Gifts by Text launches across the UK. Guests can order gifts using a mobile number, no address required. Their recipient is free to organise delivery at a time and place to suit them. Hello Tokyo! First store opens in Japan, in the country’s largest eco-friendly shopping centre, Aeon Lake Town. Products land with aplomb: hot chocolate, batons and Selectors are in high demand. New York, New York… We arrive in NYC on Lexington Avenue, Manhattan, our new store opening just weeks after Japan launch. Hot chocolate and batons are an instant sell-out here too. 2019 Chocolate Dreams – Inside Hotel Chocolat. Two-part documentary shot by BBC Studios is shown on Channel 5. It goes behind the scenes of our chocolate Inventing Room, Saint Lucia cocoa estate and day-to-day life in our stores. And the story continues…” Strategy I took this short piece of text from the 2018 Report & Accounts and it summarises the Strategy nicely: “The growth strategy remains unchanged and is based on proven and profitable business models; to carefully continue to open more stores, to invest in digital to make it easier for consumers to access our brand and to link with selected partners to extend our reach and accessibility This growth enables on going return-enhancing investment opportunities in our infrastructure whilst we increase capacity and improve efficiency. The growth of the Group and improved profitability means that the business now has the bandwidth and resources to extend its tests of international markets, taking a cautious ‘test, learn, grow’ approach.” HOTC sees itself as operating across 4 large and growing markets:

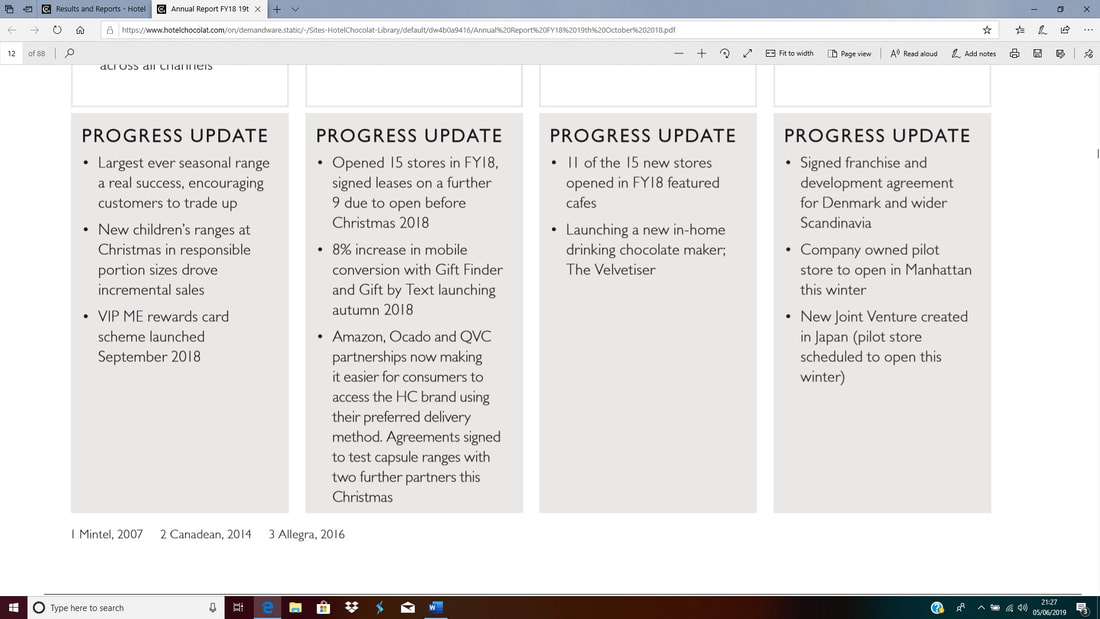

I have taken the 2 images below from the 2018 Report & Accounts page 10 and this has good stuff on the Strategy for each market and the progress at that time (note this may have changed a bit recently both in terms of the Strategy pursued and the progress made):

There is a lot more on Strategy in both the latest Report & Accounts and also on the Website – I recommend you have a good nose around those.

HOTC Competitive Environment To an extent I see the HOTC offering as quite unique – in fact, that is a major part of why it appeals to me. In the UK, I can think of no other sizeable competitor and Chocolate makers like Thorntons are much more mainstream and are a shadow of their former selves anyway. The premium quality of the HOTC products differentiates them from all the usual brands that you see in supermarkets and even ones that are seen as a more expensive product like Green & Blacks are really not much competition for HOTC. For specific parts of the HOTC offering such as the Café there are obviously loads of decent competitors but the HOTC Cafes are very up market and there are few of them. In fact, to a large extent it is all about locations and if these are chosen well then I would expect them to have a strong competitive position if they are in the right sites. Obviously there would be more but slightly different competition in countries such as Belgium where there is a strong tradition of Chocolate making but I don’t know if HOTC has any plans to move to such geographies and I assume they would be best to avoid them. I don’t see this as much of a problem because there are so many places they can open Stores etc. and it could well be that they have sufficient differentiation to even open shops in many parts of Europe. My mate Martin (@InvestingMartin on the Tweets) flagged up this Company called ‘Montezuma’ to me which he had come across in Chichester I think he said. It looks more down market and a lot smaller and there are probably other similar competitors but HOTC clearly has a premium offering: https://www.montezumas.co.uk/ I cannot stress the differentiation aspect enough. It is a big part of what makes me interested in HOTC that the products are extremely top-end and if you look on their Website at the prices of many of the Gifts etc., then it is clear that customers are likely to be wealthy and yet also it has appeal for people lower down the income-spectrum who will see the products as ‘affordable but pricey treats’. Website Address Here is the Customer Website where you can get the scrummy Chocs (remember, these sorts of food stuffs can be fattening): https://www.hotelchocolat.com/uk You can get to the Investor Relations bit from the bottom of the Customer Website but this Link takes you there anyway: https://www.hotelchocolat.com/uk/investor-relations.html Risks

“The Group is currently assessing the impact of IFRS 16 on its existing lease portfolio and it is expected to impact the majority of their operating lease commitments. This includes a significant impact on the balance sheet, as both assets and liabilities will increase, and it is also expected to have a significant impact on key components on the income statement, such as depreciation on the right-of-use asset and interest recognised on the lease liability. This will result in a change to the profile of the income statement over the life of the lease and will consequently impact profit before tax. There will be no impact on cashflows, although the presentation of the cash flow statement will change significantly.” HOTC are saying that they cannot calculate the full impact yet but it looks likely it will impact the Reported Profit and this has to be a concern. Note it will not impact Cashflow which is a good thing.

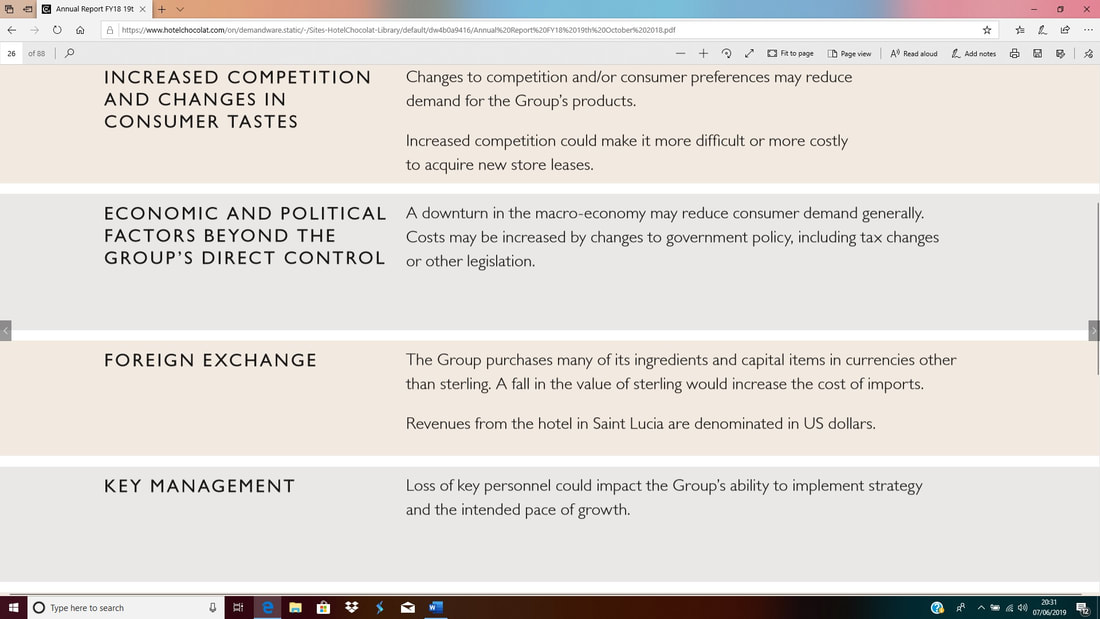

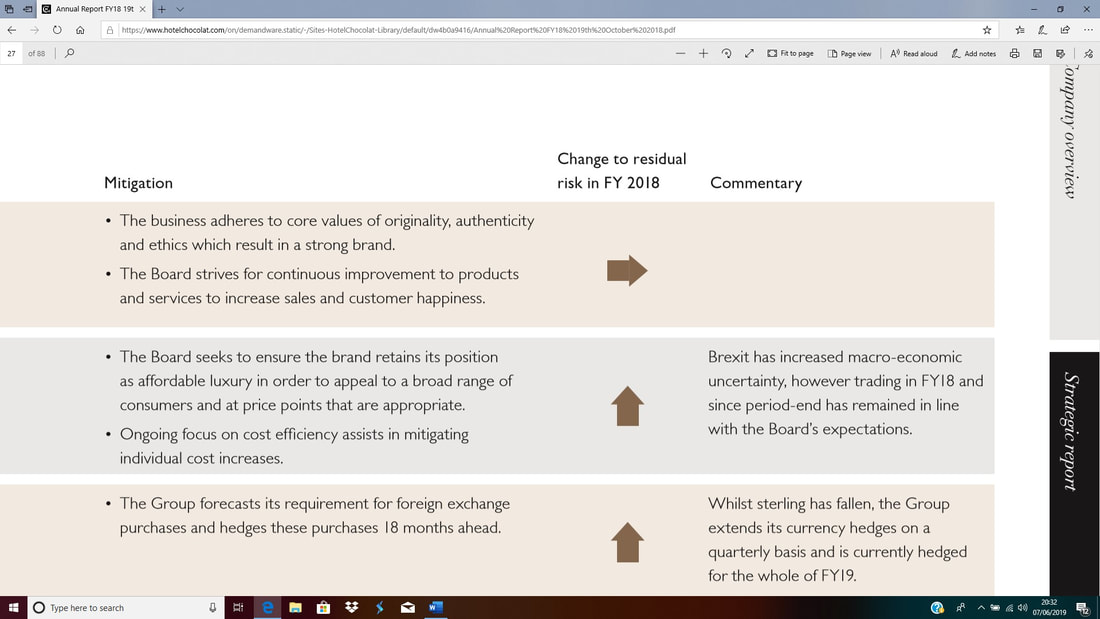

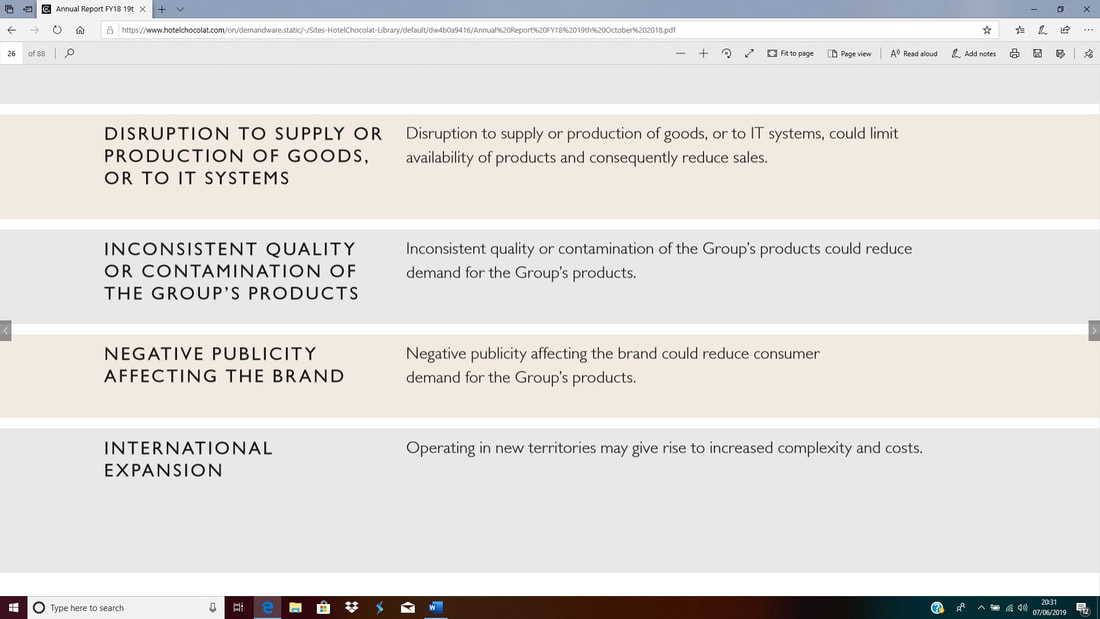

The Screenshots below are from Pages 24 and 25 of the 2018 Report & Accounts. For time reasons I have just copied and pasted these and I have put the Mitigations (from Page 25) underneath part of the Risks (that are on Page 24) and they do not line up perfectly – so if it gets too much then go to the Report (there is a Link further down this Blog).

Listing Details:

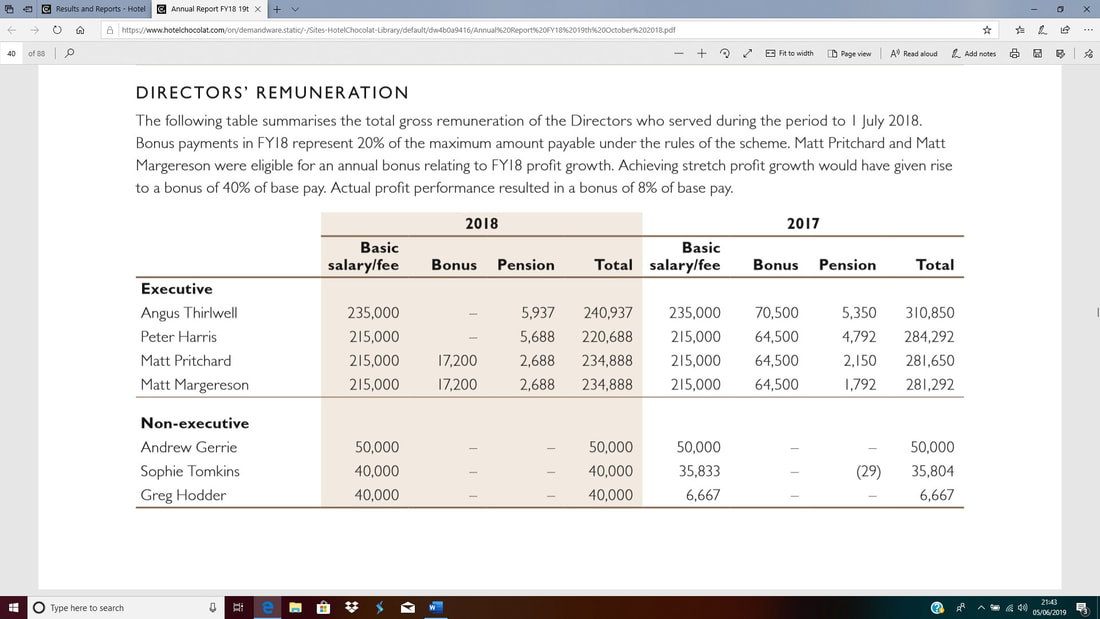

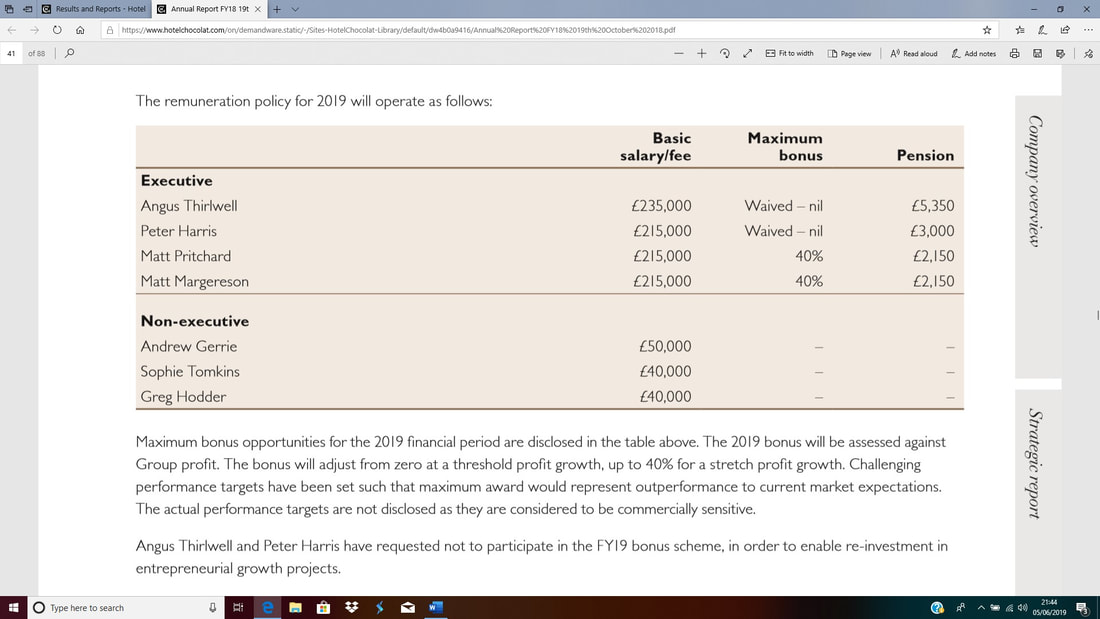

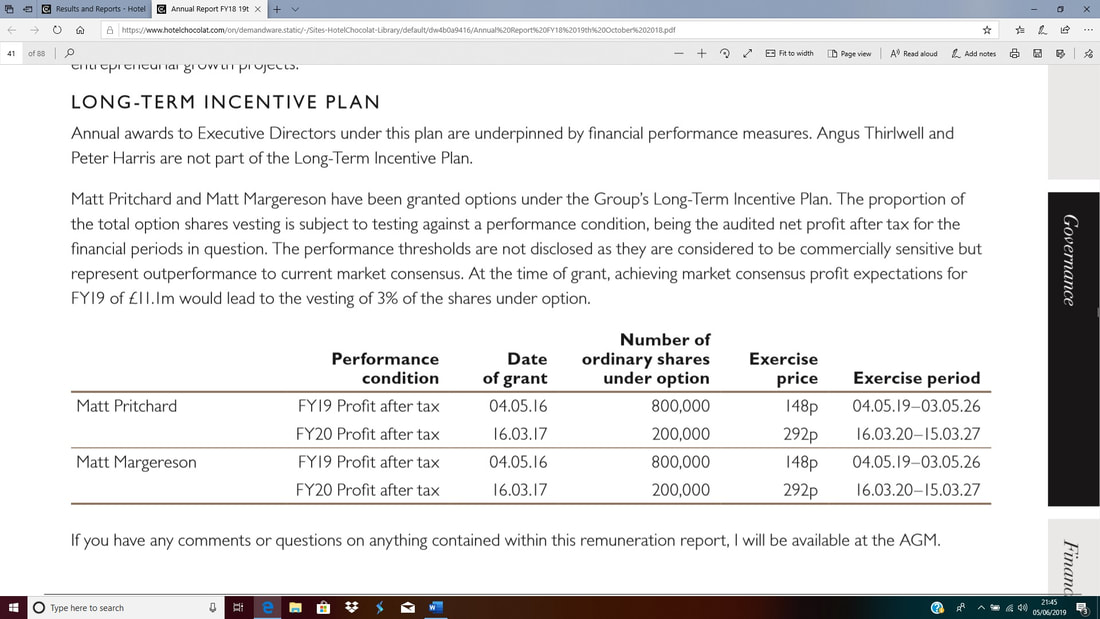

Index AIM Country of Incorporation England and Wales Company Registration Number 08612206 Registered Office Mint House Newark Close Royston Hertfordshire SG8 5H Company Secretary Peter M Harris. Nominated Advisers (NOMAD) and Broker Liberum Capital Limited Ropemaker Place 25 Ropemaker Street London EC2Y 9LY Legal Advisers Stephenson Harwood LLP 1 Finsbury Circus London EC2M 7SH Auditors BDO LLP 55 Baker Street London W1U 7EU Registrars Capita Registrars Limited The Registry 34 Beckenham Road Beckenham Kent BR3 4TU Bankers Lloyds Bank. Annual Reports You can find the most recent Report here: https://www.hotelchocolat.com/on/demandware.static/-/Sites-HotelChocolat-Library/default/dw4b0a9416/Annual%20Report%20FY18%2019th%20October%202018.pdf And more Results and Reports here: https://www.hotelchocolat.com/uk/investor-relations-results-and-reports.html Directors Angus Thirlwell is the current CEO - Angus co-founded Hotel Chocolat with Peter Harris in 1993 and has a particular focus on brand strategy, product and channel models, marketing and creative. Angus attended Cranfield School of Management and is a committee member for The Academy of Chocolate. You can read more about him here: https://www.hotelchocolat.com/uk/engaged-ethics/our-people/angus-thirlwell.html Peter Harris Development Director - co-founded Hotel Chocolat with Angus Thirlwell in 1993 and is responsible for real estate, legal and intellectual property. Peter qualified as a Chartered Accountant in 1979. Andrew Gerrie is the Non-Executive Chairman - Andrew joined Hotel Chocolat as Non-executive Chairman in June 2015 and has extensive retail experience, having served as CEO of Lush Cosmetics from 1994 to 2014. During this period Lush grew to over 900 stores across 49 countries, with sales in excess of £450m. Andrew holds a B.Com degree from Auckland University. Matt Pritchard is the CFO - Matt joined Hotel Chocolat as Chief Financial Officer in 2014 and is responsible for the finance function, retail operations and IT. He has over 20 years of experience of finance gained in blue chip retail organisations. Matt qualified as a Certified Accountant in 1998. This Link takes you to a PDF with some detail on 6 Board Directors: https://www.hotelchocolat.com/on/demandware.static/-/Sites-HotelChocolat-Library/default/dwd6d20b45/Hotel-Chocolat-Directors.pdf Director’s Pay I took these images from the 2018 Report & Accounts:

I am not an expert on Corporate Pay but these amounts do not look excessive or greedy to me.

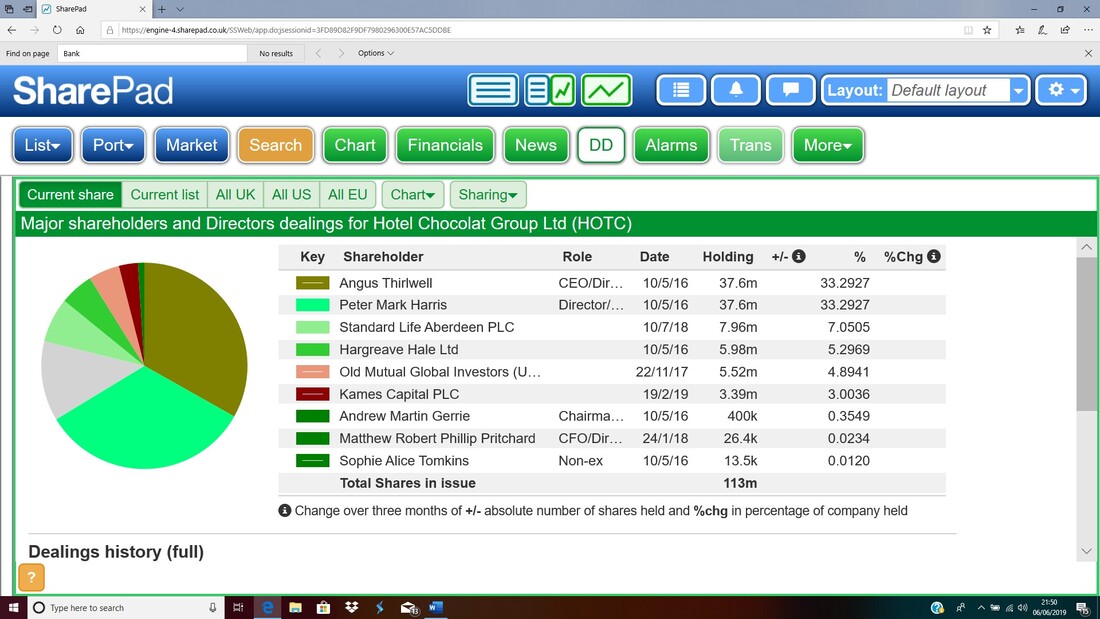

Director Shareholdings and Major Shareholders

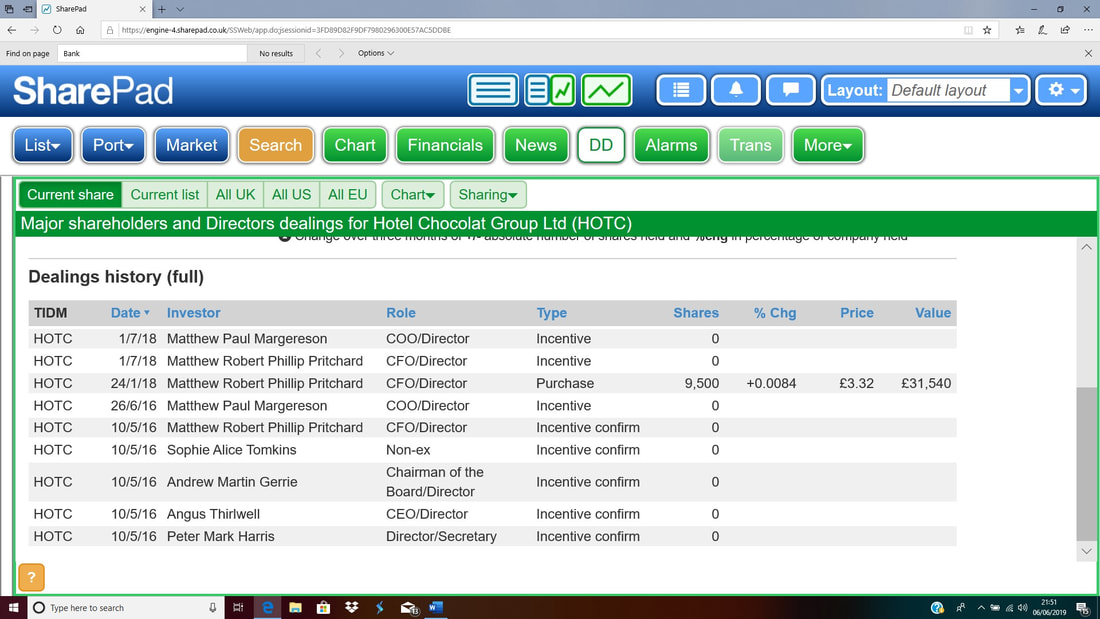

Recent Director Dealings

I have obviously taken this image from SharePad and I note there are few recent Director Buys or Sells on here. I am assuming the ‘Incentive’ items are Share Options granted and suchlike.

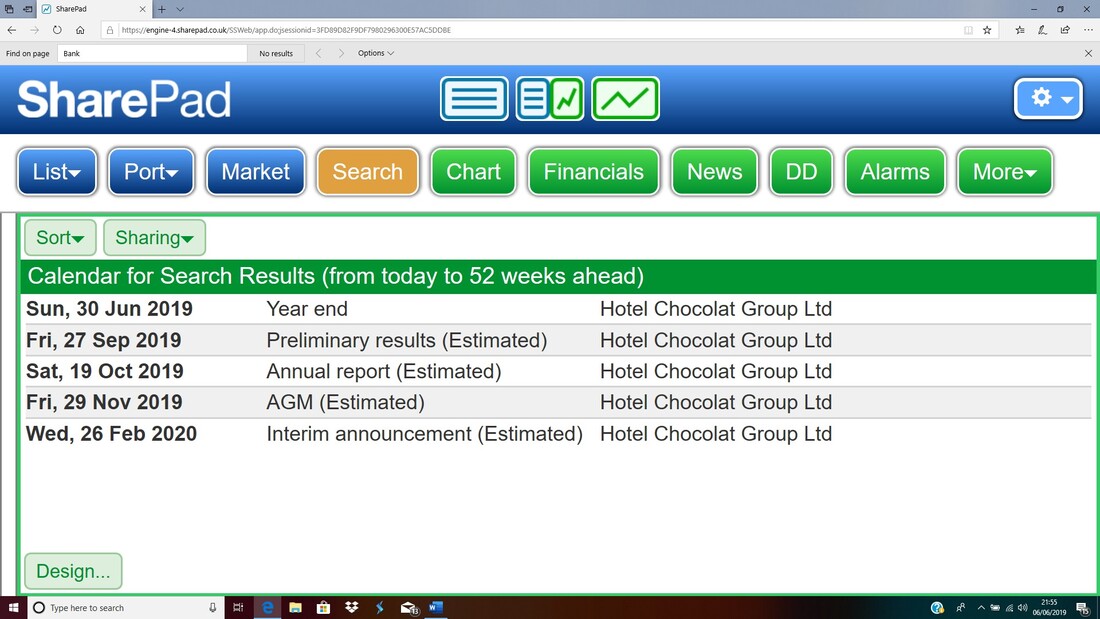

Calendar

I have taken the image below direct from SharePad – I see ‘Year End’ on 30th June is next up but I guess this is just a statement of fact and we may not see any news released around this. I notice that last year there was a Trading Update on the 18th July 2018.

4 Comments

Damo

8/6/2019 03:05:49 pm

Great in depth write up WD !

Reply

WheelieDealer

8/6/2019 10:44:26 pm

Hi Damo, Thanks for the comments - it's certainly a very interesting business and I am particularly impressed by the evident progress in growing the operations year after year - and this is quite likely to continue.

Reply

Enjoyed the write-up Pete. One thing I'd be keen to know is how come they didn't clean up shop if they were online in 1993!

Reply

WheelieDealer

28/6/2019 10:48:56 pm

Hi Michael,

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|