|

THIS IS NOT A TIP OR RECOMMENDATION. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITE. IF YOU COPY MY TRADES, YOU WILL PROBABLY LOSE MONEY. I HAVE A LARGE PORTFOLIO AND I USE DIVERSIFICATION TO SPREAD RISK ALONG WITH TRICKS LIKE HEDGING AND OCCASIONALLY BY THE USE OF STOPLOSSES - IF YOU BUY ANY STOCK YOU REALLY SHOULD FOCUS ON HOW IT FITS IN YOUR PORTFOLIO AND KEEP RISK MANAGEMENT AT THE FOREFRONT OF EVERYTHING YOU DO. BE AWARE THAT ALL INVESTORS/TRADERS GET THINGS WRONG AND MANY STOCK SELECTIONS WILL WORK OUT BADLY.

This is the second and final Part of my Blogs on Hostelworld HSW - you should be able to find Part 1 just under this one on my Blog page but because I am so super kind to you peeps, here is a Link to it: http://wheeliedealer.weebly.com/blog/stock-idea-hostelworld-group-hsw-part-1-of-2

Valuation

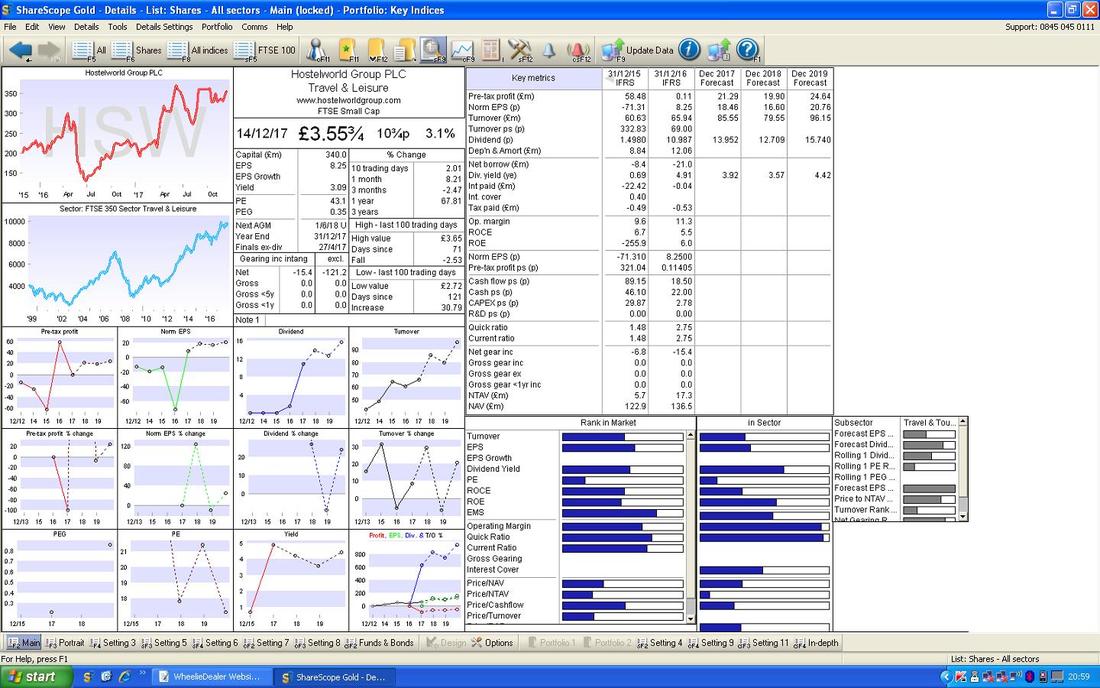

The image below is a ScreenShot from the ShareScope ‘Details‘ page for HSW. As always, if you click on the Picture you should see a bigger version so you have a small hope of being able to see it. In the Top Right Hand Corner for ‘Dec 2018 Forecast‘, you should see ’Norm EPS (p)’ (Earnings Per Share) of 16.6p. On a Share Price of 355p, that gives a Forward P/E of 21.4 (355p divided by 16.6p) and if you look further down you should see ‘Div yield (ye)’ of 3.57%. If you look at the Forecasts for 2019 then we have EPS of 20.76p which on a Share Price of 355p gives a Forward P/E 2 years out at 17.1 and just below you should see a Forward Dividend Yield 2 years out of 4.42%. These aren’t bad numbers and I think it is reasonable Value for a growth Stock which sits in the Internet space - and if you strip the Cash out (around 15p a Share), the Numbers are a little bit more attractive. None of these numbers strike me as ‘cheap’ although the Dividend Yield at 3.57% next year is actually pretty good for a Growth Stock and that is a major attraction for me and I suspect it will also suck in other Investors with a Long Term Outlook. As I have already mentioned, I do not hold HSW myself but if it was to drop in a Market Sell-off or whatever, then I might be a lot more interested because of course (barring a Profit Warning) a lower Share Price would improve these Ratios a lot. However, as always with these things, this whole valuation area is rather complicated. When I look at the Turnover and Pre-tax profit numbers for 2017, 2018, 2019, something doesn’t quite make sense. Both the Turnover and Profit numbers seem to drop off in 2018 and I am totally unsure on why this should be. I had thought there was a Data Error on ShareScope but I have queried this and I was told they would be right tonight - but I can’t say I am confident about these. Anyway, I want to get this Blog issued so I will go ahead on the basis of the Numbers I have here - however, my suspicion is that the Forecasts understate the Revenues and Profits that will be achieved in practice and this means that the Forward P/E Numbers I have used actually are erring on the conservative side. Needless to say if I do decide that I am ready to buy HSW then I will be checking these Numbers again and trying to get a precise handle on what is going on here. I think the Dividend Yield Numbers are about right though.

Targets

In line with my comments about the Valuation in the Section above, I don’t foresee much scope for the P/E Ratio to rise over time - so really it is sensible to project a Target based on mainly the growth of the Earnings over time. On this basis, and using a P/E Ratio of 20 (I think that is pretty realistic) and projecting that the EPS could sensibly hit 25p in a few years, this gives a Target Price of 500p (20 times 25p) - this would be 40% Upside on the Current Price of 355p - well worth going for and remember Buyers will also be picking up that Tasty Dividend. Getting a bit more adventurous, perhaps a P/E of 22 is feasible and the EPS might get to 27p or so if there are some Acquisitions which enhance Earnings - if this was to happen, then a Target of nearly 600p would be possible - that is almost 70% Upside on 355p. And of course a Takeover is quite possible which would perhaps bring a decent Return up near these Targets a bit sooner. Chart Situation HSW has not been listed all that long so there is not a huge amount of Chart history. As always it is best practice to go to the Long Term View first and that is what my Chart below is showing. The key things to note are the wide, but a bit wedgy, Uptrend Channel between my Red and Black Lines and my Blue Arrow is pointing to the 200 Day Moving Average Line (sorry, it is very faint) and note how that is rising and the Price is up above it at the moment.

On the Chart below I have squeezed in the Timeframe to about the last 8 months or so and the main things here are the Horizontal Resistance Levels shown by my Blue Horizontal Lines at 360p and then 380p. A move over the All Time High at 380p would be an extremely Bullish development and would be a Buy Signal.

To the downside, my Blue Arrow is pointing to the 200 Day Moving Average Line and this should act as Support at about 320p. If this fails to hold as Support, then the next area is on the Black Line at about 300p and then down to about 270p.

The Chart below has one of my favourite and most reliable Indicators - my Black Arrow is pointing to where we recently had a Bullish ‘Golden Cross’ between the Red Wiggly Line which is the 13 Day Exponential Moving Average and the Green Wiggly Line which is the 21 Day EMA. This often predicts an Up move of a few Weeks or Months - if you look to the left my Blue Arrow is pointing to where we last got such a 13/21 Day EMA Golden Cross and you can see how well the Price performed after this.

Conclusion

I’ve been aware of HSW for many years now and I distinctly remember reading a tip on them in one of the Sunday Newspapers and I recall a mate buying some near that time (she has done well on it !!). The big standouts for me were the sizeable Dividend Yield and the Internet nature of the business along with the dominance that HSW seems to have built in their Marketplace - impressive. I am no great lover of Travel Stocks but I am prepared to make an exception for something that is purely Internet based as it is obvious this is how things are going and it would not surprise me if we are really only in the Foothills of the massive Technological Change that our Society is rapidly moving towards - and I want to play this space as much as I can with truly quality businesses that have established records of achievement. HSW does not scream ‘Cheap’ at me but I think it is a Fair Price and it is worth remembering the old Warren Buffett maxim that “it is better to buy a Good Business at a Fair Price than to buy a Bad Business at a Cheap Price” (something like that) - I think it applies here a lot and if HSW can grow in coming years, then it will look very cheap from the perspective of a few years of achievement when scanning back on the Share Price Chart. HSW has a dominant position with regards to the Hostel Booking market but there are lots of competing Websites. One that was recently suggested to me was booking.com which you can see here: https://www.booking.com/index.en-gb.html?label=gen173nr-1BCAEoggJCAlhYSDNYBGhQiAEBmAEuuAELyAEM2AEB6AEBkgIBeagCAw;sid=07ab8eef03d76c617557579b7a253522;sb_price_type=total& I expect Growth to come from the following factors:

On the downside the main Risk that I think could impact HSW is around the Cyclical nature of the Travel Industry and of course there are plenty of catalysts which could hit demand for Hostels, such as further Terror Attacks and Consumers coming under more pressure from stagnant Wages and relatively high Inflation. There is a lot to like about HSW but at the moment I do not have a Position in it. I am very tempted but held back by the simple fact I don’t have either any spare ‘Slots’ in the WD40 Portfolio (ok, WD41 at the moment !!) and more crucially I don’t have sufficient Spare Cash to use. In addition, Travel is not historically a Sector I have loved and I already hold On The Beach OTB so I am in a bit of a quandary about whether or not I want additional exposure. We shall see. The Chart situation clearly looks pretty good for Buyers now. I hope this helps Readers get a better understanding of HSW and it has been a very useful exercise for me to do some structured Research on a possible Stock for me to invest in. Cheers, WD.

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|