|

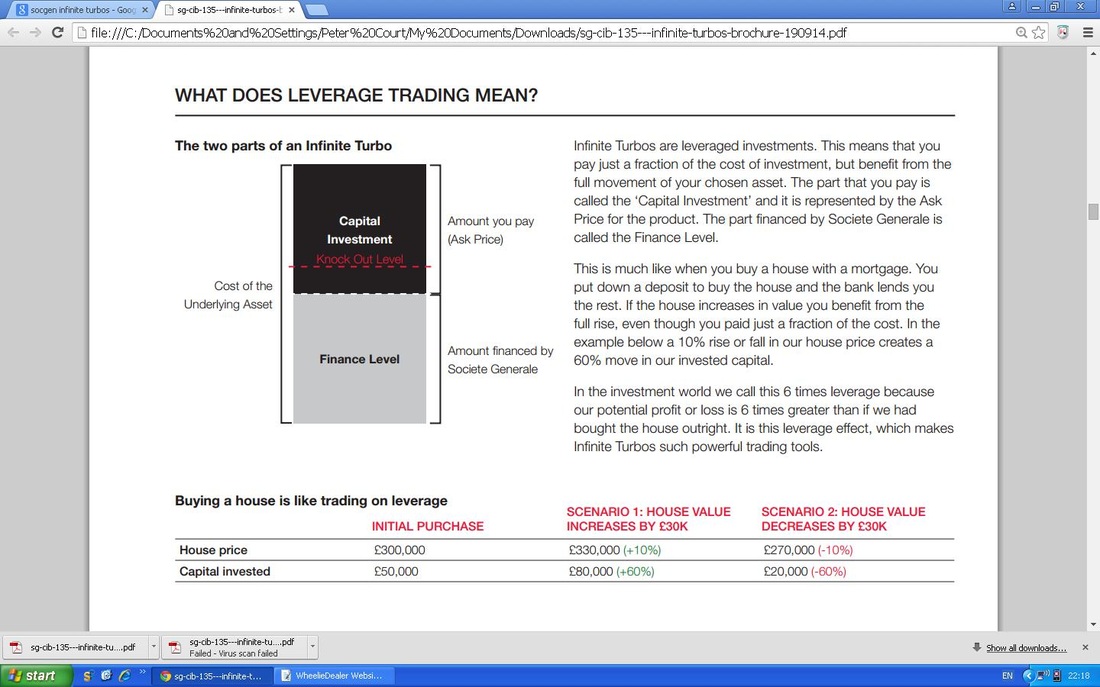

THIS IS NOT A TIP. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITES. THE PRODUCTS MENTIONED IN THIS ARTICLE ARE COMPLEX AND AIMED AT SOPHISTICATED INVESTORS ONLY. PLEASE SPEAK TO YOUR FINANCIAL ADVISER. I am sure most regular Readers and Twitter Followers are aware that I am a bit nervous on the Markets after a good run up and with Spring approaching and a very uncertain General Election in May, I think we could see a proper Pullback. Following on from this, David Greer (@DavGreer on Twitter) helpfully suggested that one of the Societe Generale ‘Infinite Turbo’ Products might be worth trying in order to Hedge (go Short) in a Normal Share account. Unfortunately, they cannot be used in ISAs (shame) but are allowed in a SIPP or in a Normal Share Account that does not sit in a Tax Wrapper. David Stevenson in Investors Chronicle has recently been buying some of these Products within his SIPP. If you do not have a Spreadbet Account, this could be a great way of being able to Short with Gearing and the safety of a Guaranteed Stoploss. Thanks also to Craig (@PFhunting on twitter) for helping to clarify my understanding of these Products. With me not too keen on buying stuff, I have a bit of time so I thought it would be a good idea to dig deep into these Infinite Turbo efforts and figure out what they can do for me, how exactly they work, and what are the risks involved. They are very complex so this has been quite a task !! I will really focus on the FTSE100 Short Products that are available, but the discussion around these will stray into the wider Infinite Turbos arena - in essence they are Leveraged Products with Guaranteed Stoplosses built in that can be traded like Normal Shares but you can go Long or Short, and they are available on a variety of Assets including Indexes and individual Stocks. I think SocGen class them as ‘Warrants’ but that is irrelevant really. The full list of Infinite Turbos available is listed here: https://sglistedproducts.co.uk/welcomeDisclaimer It’s a bit of a pain but you actually have to scroll slowly through the Disclaimer thing and read all the fine print. They are only ‘allowed’ for ‘Sophisticated Retail Investors’ (and Institutions obviously) which means you need to have some experience of the Stockmarket really - you will need to fill out a Form with your Broker to show your level of experience I think. You can download an excellent PDF on Infinite Turbos here: https://sglistedproducts.co.uk/infiniteturbos Click on the bit that says ‘Infinite Turbos brochure’. They have many similarities to Spreadbets and other Leveraged products - it might be worth reading my entire Blog Series on these at: http://wheeliedealer.weebly.com/blog/how-to-use-leverage-safely-and-successfully-spreadbetting-and-cfds-part-1-of-5 What is an Infinite Turbo? They are very much like an ETF (Exchange Traded Fund) where you can but them like Normal Shares and hold them for pretty much as long as you like, as they do not have an Expiry Date. However, they incorporate a level of Gearing that you can pretty much choose and they have 100% Guaranteed Stoplosses built in. You can use them to take Positions on all sorts of Underlying Assets like Stocks, Indexes, Commodities, FOREX Pairs, etc. and you can go Long or Short. They appear to be very complicated Products but in reality I don’t think they amount to much more than I have put in this paragraph. The Leverage is the beauty of these products - for instance, if the ‘Instrument’ you choose has Gearing of 12 times, this means that for £1000 of Risk you can get £12,000 worth of Exposure to the Underlying Asset. So you have much more reward and limited Risk (the £1000 is the most you could possibly lose, and in practice you could well lose less than this as will become sort of clear later on !!) They have the following ‘Levels’ which are derived from the Underlying Asset in which you are getting Exposure:

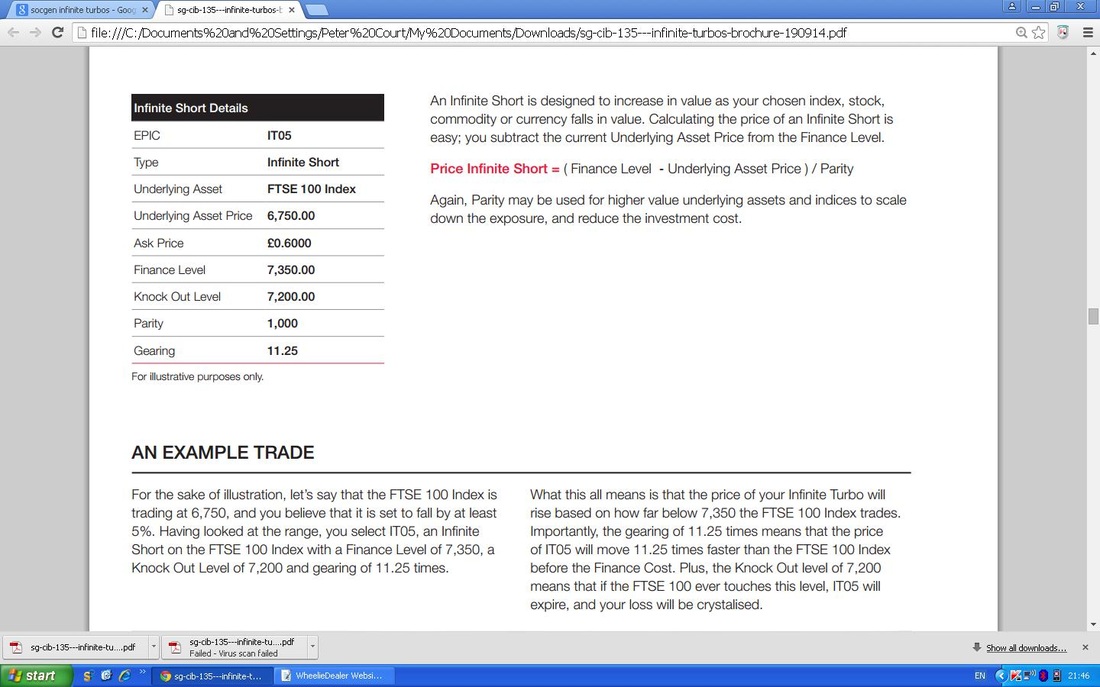

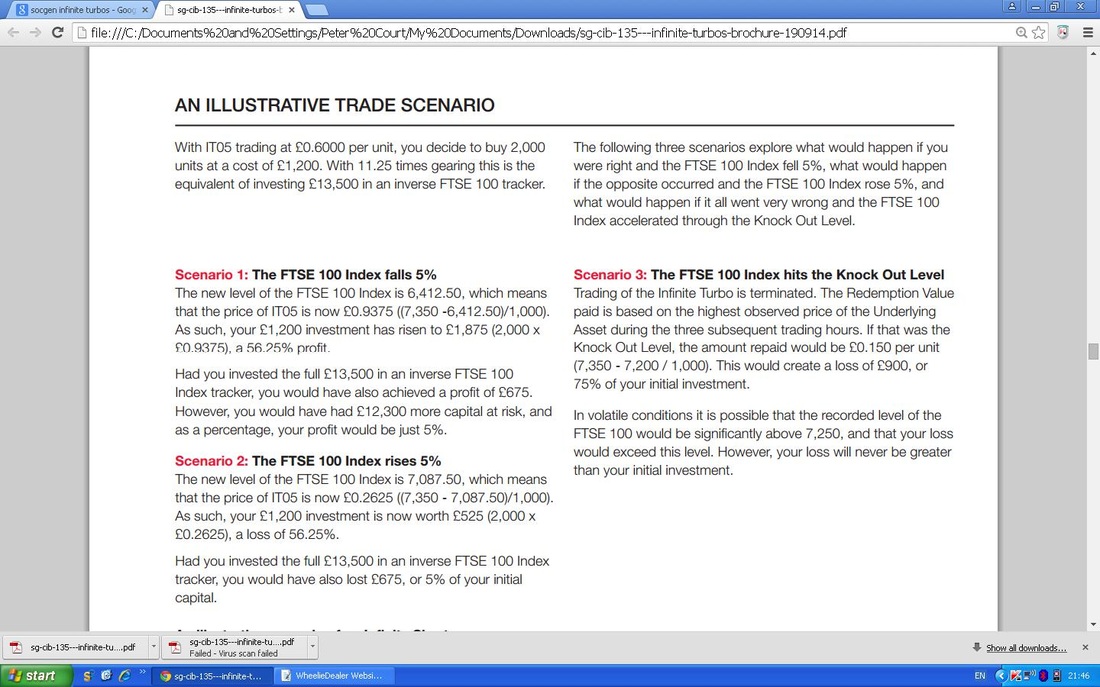

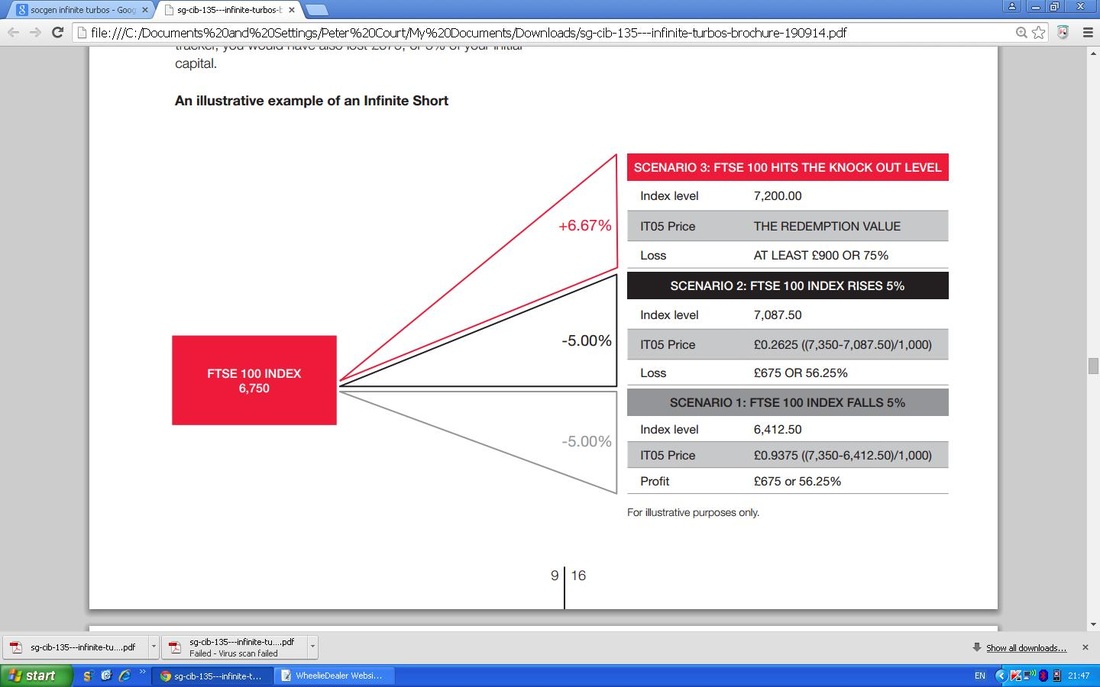

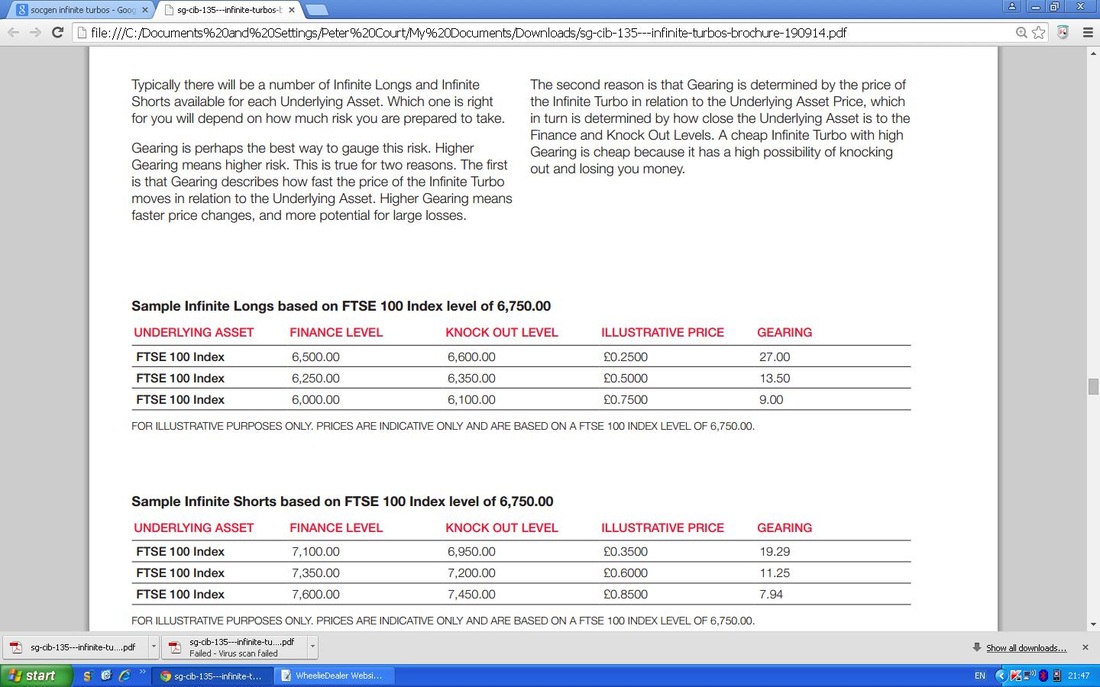

As mentioned above, these Products incorporate a Financing Charge - however, in a similar way to Spreadbets and CFDs, it is pretty tiny really. The rate currently is roughly 2% per Annum plus a Monthly LIBOR Finance Rate - the Finance Charge is applied daily to the ‘Financed Level’ and it is applied Monthly to the KO Level (please note the rate varies for each different Infinite Turbo - the SocGen website lists each instrument and its associated Finance Fee - they vary from 1.5% to 2.6% on top of the Monthly Libor at the moment.) Due to these pretty reasonable Finance Rates, it is not a big issue to hold for long periods - possibly even months if need be. For Underlying Assets that pay a decent Dividend, the Divvy can offset the Finance Charge. The actual Finance Cost is dependent on the Underlying Asset chosen and the type of Infinite Turbo - this will be shown in the list of Products available on the SocGen website (see below). I think the ScreenShot below from the PDF, explains the above Levels and financing stuff quite well: An Example Short FTSE100 Trade The ScreenShot below is taken from the PDF and shows how it works when using an Infinite Turbo Short. Note, they mention ‘Parity’ which is explained as follows: ‘In some cases a scaling factor called `Parity’ is used to reduce the cost of investment. A parity of 1,000 for example means that one Infinite Turbo is equivalent to 1,000th of the Underlying Asset. As such, any move in the Underlying Asset is divided by 1,000 in the Infinite Turbo.’ I found this quite a complex idea - I don’t think we need to worry about it too much if we don’t get it. Seems like detail that is pretty irrelevant. The Screenshot below show an Example FTSE100 Short Trade and how it might play out and the Second Screenshot just beneath it shows it diagrammatically: Selecting an Infinite Turbo This ScreenShot from the PDF pretty much explains it: What are the Risks?

What are the Advantages / Benefits?

Are there any Limitations / Disadvantages?

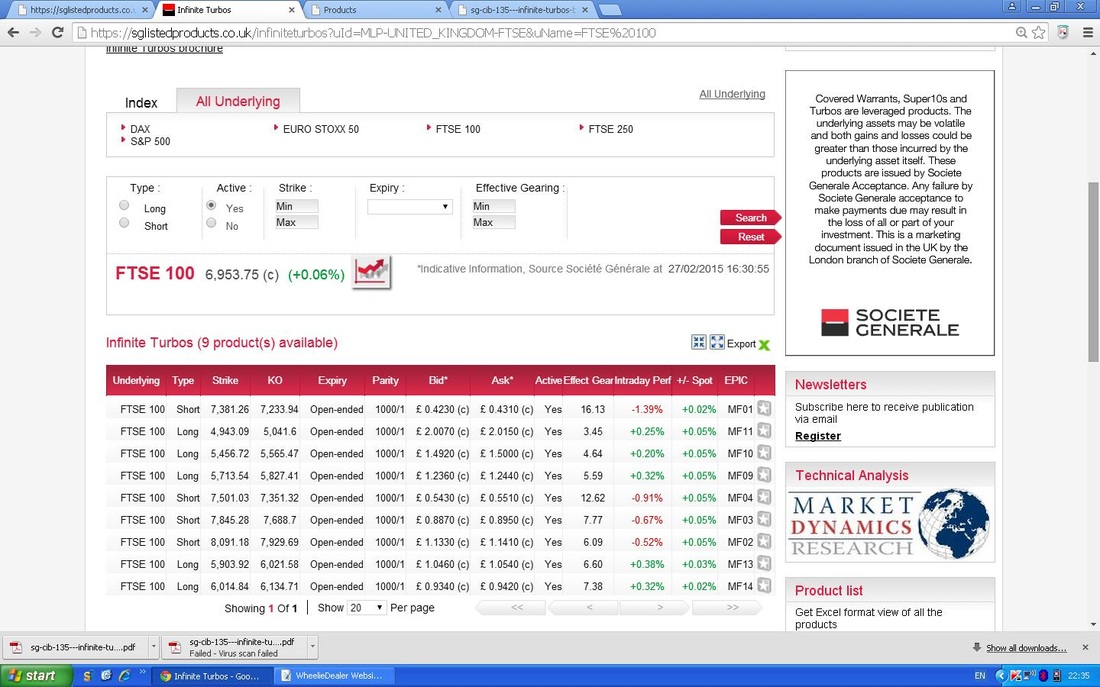

How do I trade an Infinite Turbo? To an extent they are like a Normal Share that you just Buy when you want it and Sell when you don’t !! Due to the Guaranteed Stoploss nature of the things, you need to have a defined Stoploss Level in mind before you buy the Product - this is because you need to select the right Product for you from the List of Infinite Turbos that are available. For example, you may wish to Short the FTSE100 and you will find there are several Infinite Turbos available that will do this for you - but they all have different Guaranteed Stoploss Levels (KO Levels) and Gearing Levels. They have an EPIC code which you can find on the SocGen website - see below. As mentioned earlier, you need to have already set up with your Broker that you wish to trade these Products and you will have had to fill out a Form I suspect. Here is a list of the Stockbrokers that SocGen says will do their products - there are probably some others as well, for example, igIndex and their new Share Dealing service: https://sglistedproducts.co.uk/howto-trade-stockbrokers It seems like pretty much the ‘usual suspects.’ Where is the Full Range of Infinite Turbos Listed? Use the link below to find the Full Range: https://sglistedproducts.co.uk/infiniteturbos This ScreenShot gives you an idea of how it looks: As you can see, there are loads of different FTSE100 Long and Short Products and the Gearing and Knockout Levels are clearly shown. You choose the one you want and the EPIC code is on the right. Personally, I think they are pretty damned neat.

Finale I hope this has given you a good insight into what I think could be a very useful tool for Hedging purposes and some Readers may wish to use the broader spectrum of Infinite Turbos to access other Underlying Assets in a Geared way with the safety of a Guaranteed Stoploss. I particularly like the idea of the Gearing - this is because I often Topslice a few things prior to a general Market Pullback, but this means I often only have about 5% or 10% Cash available. If I was to Short using XUKS (an ETF that enables you to Short the FTSE100), then I have no gearing so the Hedging effect is pretty limited. By using the Gearing, I can get a lot more Bang for my Buck. As ever, make sure you understand your Exposure when using these products. I have put in a Support Email to TDDirect asking them how I can trade within the Normal Share Account I hold with them. As yet I have not received a reply - so I intend to chase in the next few days if I have received nothing. I would like to get the ability to trade these Products setup so I can act when I feel the need. I bet your brain aches now, mine certainly does - although that is fairly normal….. Cheerio, wd

7 Comments

SmallCaps

5/3/2015 04:20:50 am

very interesting

Reply

wheeliedealer

20/7/2015 02:38:51 pm

Hi SmallCaps - huge apologies, I hadn't realised you had posted this comment - anyhow, I suspect we discussed it on Twitter anyway. Just to clarify for readers, I have had huge trouble finding one of my Brokers who actually provides these SocGen Turbos - TDDirect were unable to do it.

Reply

Ken

17/7/2015 01:53:07 am

That was very helpful. I have a trade on right now with the same one you used in your e.g. (short FTSE equivalent) and I still don't think I am 100% across what everything means! I am only in for a tiny amount though, so no major loss if it all goes wrong. I think one of the best ways to learn the ins and outs of Infinite Turbos' nitty gritty (once you've read the material thoroughly) is by doing. One thing which I think you ought to have mentioned in your article is the illiquidity. More than anything else, this is what puts me off. The lack of participation is such that the charting package I use does not draw full candles for most intervals (daily, etc.). A bad sign. My tolerance of the low volume, rather than the complexity or binary risk will be the biggest factor on whether I choose to continue trading this asset or not. Good luck with your own forays! K

Reply

WheelieDealer

20/7/2015 02:43:12 pm

Hi Ken,

Reply

25/3/2017 07:51:56 am

Forex trading can be somewhat intimidating, especially for someone new to the game. Many Forex traders can suffer from information overload due to the sheer number of trading systems, books, studies and indicators that are available.

Reply

Hi, just found your run-through on SocGen Infinite Turbos. Very interesting, I wish I had read it a year ago.... I use the MF series as Hedging on my ISA - shame it's not ISA'able. I use JarvisIM as a broker; the new regs. meant I had to pass a test before I could trade the first time (after the regs.).

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|