|

I say this every year, and I will say it again, but writing these ‘Scores on the Doors’ blogs is either a huge chore or something quite enjoyable, depending upon how my Portfolio did on the given year !!

Fortunately, despite all the plague and its associated shenanigans, my Stocks did generally pretty well and the headlines are as follows:

There’s a lot more to it than just those items, but they are probably the ones I am most interested in. There are some caveats and assumptions etc. but in the main I think the numbers I am showing here are conservative, as I will explain as I go through each Account.

Needless to say, after the horrific year we have had to endure with Lockdowns and suchlike, to come out with some pretty decent gains is very pleasing and in the main I am pretty happy with how I ‘performed’ myself in terms of Decisions and Actions which I took during the year.

I have often mentioned my conceptual framework of how there are 5 possible Outcomes for each year, regarding my Portfolio (note, I am really talking about the WD40 here and for comparison reasons the ‘Normal Portfolio and Spreadbets up 12.3% on Exposure’ item at the top of my Bullet List above), and these are roughly:

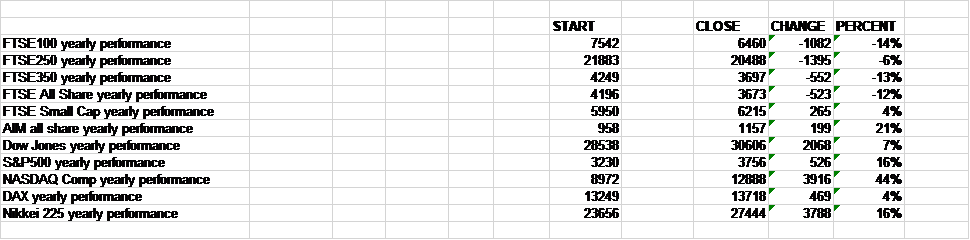

The key point regarding these 5 possible Outcomes is that I want to avoid the ‘Down more than 10%’ one and I want to achieve as many ‘Up more than 10% on the year’ as I possibly can. The relevance here is that for 2020, despite all its immense challenges, I managed to achieve the Best Outcome of the 5 possible alternatives. Again, I will highlight in the text below where I need to improve and what I screwed up on, but the main things are that yet again I need to focus more on my Spreadbet Account and how that can be improved, and this particularly applies to Index Trades which are definitely not working as I would like. Something I am very pleased about it how my Hedging Strategy worked back in March/April when the Markets got totally butchered, and my approach of keeping my Portfolio pretty much 100% invested at all times really paid off. I am pleased with my lack of activity and letting my good Stocks do their thing and my Diversification has most definitely helped. Recently I did a Blog which talked about what I would like to achieve on a CAGR basis in terms of making 10% CAGR on my Normal Share ISA and then adding a few % by using a Leveraged ‘Mirror’ Share Portfolio using Spreadbets and then to add some more % from Spreadbet Index Trades. Doing this I hope to hit around 16%/17% CAGR and I think that is very possible. I also think that with some application and effort, I should be able to push the 10% CAGR on my Normal Shares up to 12% which would make 16%/17% far more likely. If you like the 12% is a sort of ‘Base’ Rate from which my other gains will flow using Leverage. You can read that Blog here: https://wheeliedealer.weebly.com/educational-blogs/a-string-of-tweets-from-5th-june-on-my-approachexecutionoptimization In terms of what I can do better, one thing is to hold more Cash as I go into the year and for 2021 I already have about 5% of my Portfolio value in Cash which I intend to take out of my ‘Normal’ ISA and this will be used partly for Living Expenses but also for more ‘Buffer’ to enable me to run my Spreadbet Account more effectively. I strongly believe in being ‘efficient’ with my Capital but it seems that quite often in recent years I have run my Cash a bit tight and I worry it forces me to make sub-optimal decisions. I am trying to correct that by holding a bit more Cash, but not too much. On the subject of Living Expenses, I will go through this in detail later, but the headline figure is that I just spent £15,266 which is down a lot on my normal yearly spending. This was obviously because the Pub was shut, but it is still surprising really. I would say my normal Spending would be more like £18,000 and after 11 years of ‘retirement’, this is my lowest spending year in all that time. One challenge I always face is that on paper I make loads more than my yearly spending, but in practice a lot of the gains are in terms of increased value of my Portfolios or in my Prudential ‘With Profits’ Bond etc., this means that I am in theory quite wealthy, but I never actually have any Cash. It can be quite irritating at times and this year was the first year where I covered all of my Living Expenses from Income which was outside of my Stockmarket activities – but still I had no Cash !! Therefore, taking out a chunk of Cash from my Normal Shares ISA and leaving it parked will hopefully reduce this feeling of never having any Cash. One rather nice thing that has happened this year is that I have got to a position where I can easily cover my Living Expenses (based on my normal £18,000 spend) with only a tiny uptick on my Share Portfolios. This is because I get Income from other sources although I do have the high class ‘problem’ that much of my Income is not actually in the form of Cash, as I mentioned above. I am in a lovely position where I have managed to be ‘retired’ for 11 years and to feed and dress myself all that time, but also to have steadily added to my wealth. I truly can’t ask for more and without doubt, giving up real work was the best decision I have ever made. For various reasons (mostly because it is simple and consistent with previous years), I will follow the flow of the ‘Scores on the Doors 2019’ blog from last year and you can find that here: https://wheeliedealer.weebly.com/educational-blogs/scores-on-the-doors-2019 If you go to the ‘Educational Blogs’ page on WD1 and then click on the ‘Category’ ‘Scores on the Doors’ then you should find all the blogs regarding my yearly performance going back through time. How the Indexes Performed I created the Table below myself by hovering my mouse over the Candlesticks on the SharePad Charts for 31st Dec 2019 and 31st Dec 2020 and entering the numbers into my Spreadsheet. Please note these raw returns do not include Dividends, so you need to add about 4% to the FTSE100 return and around 2% to the FTSE250. I am very pleased to have beaten the big UK Indexes by quite a margin but in reality, the better performance of AIM and Smallcaps has helped me because my Portfolio has a mix of Stocks from pretty much all the UK Indexes. Having said that, even with my Income Portfolio disappointing a bit, the minus 7% Return is better than the FTSE100 even when you factor in the Dividends (my Income Portfolio includes the Dividends and the FTSE100 would be about minus 10% with Dividends factored in). The performance of the Nasdaq in particular has been immense – I caught a bit of that from having a Long Spreadbet on Paypal $PYPL and I hold Polar Capital Technology Trust PCT in my ISA, but other than that my exposure to the US was quite limited (oh, my Health Trust, Worldwide Healthcare WWH will be mostly US exposed). I am not overly stressed about this – there is a huge amount of hindsight and outcome bias involved in looking back and wondering why I was so light on US exposure. In fact, it will be interesting to see if the UK and European Indexes do a bit of catch up in 2020 with Brexit out of the way. That’s possible but of course the high growth nature of US Tech does give those Indexes a huge advantage.

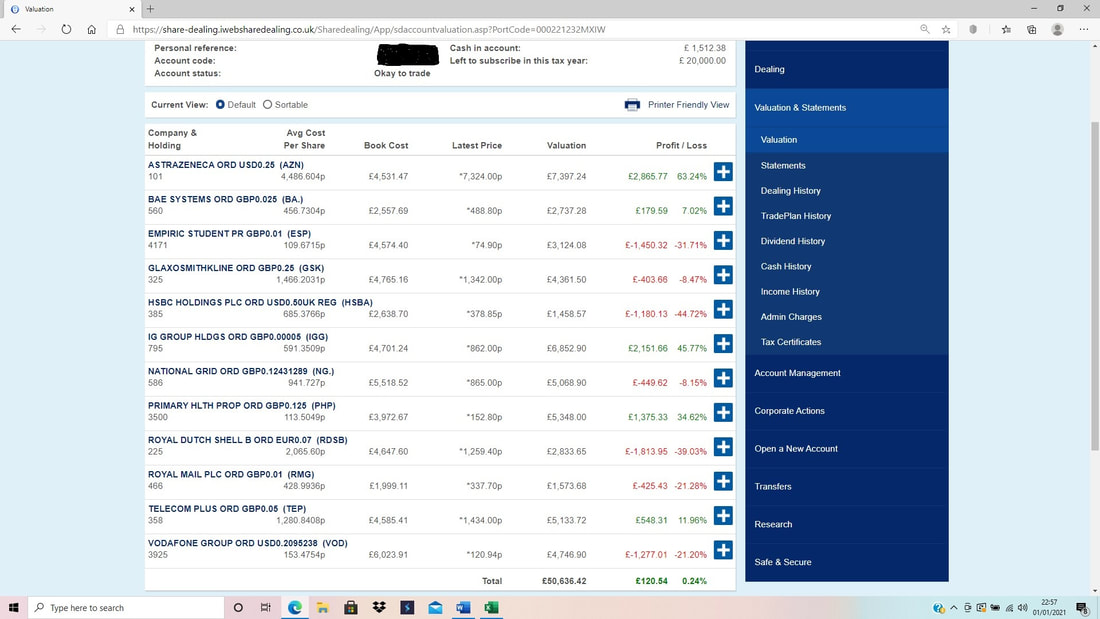

My Overall Stockmarket Portfolio Performance

Adding together my direct Stockmarket Portfolios which I manage myself (this does not include my Prudential ‘With Profits’ Bond which is a mix of stuff), the overall Return was a gain of 10% and this incorporates the drag of the Income Portfolio and is a Return on Capital Employed figure, rather than the Return on Exposure (I use Leverage via my Spreadbets which is the reason for this difference). In truth, when I think about the turmoil and angst we all endured in 2020, I really cannot complain about a return of this size. Trading ISA Portfolio ‘The WD40’ This is my biggest Portfolio and, in many ways, the most important (not just because of its size !!). I view this as very much the ‘Core’ of what I do, and when I talk about a ‘Base Rate’ of Return, it is the Return on this Portfolio that I am concerned with and then I ‘mirror’ this as Spreadbets to use limited and controlled leverage to juice up the Returns. My Target Return for this Portfolio is 10% CAGR (Compound Annual Growth Rate) and I have been achieving this for many years, but I would like to nudge this up to 12% which I think is very possible if I could just stop doing stupid things !! I see the WD40 as so important because it is the one that I put most effort into and although I am not exactly the world’s most active trader, I do more with this Portfolio than I do with the likes of my Income Portfolio, which I barely ever touch. So for 2020, the WD40 Portfolio returned a gain of 14% and I am very pleased with this. Not only did it beat my CAGR Target figure of 10%, it was also quite a bit higher and this was in what was an extremely difficult year, and I did an incredibly small number of Trades and I pretty much just sat on what I had but chucked in some Hedging via my Spreadbet Account when the turd hit the spinney thing back in March/April. The 14% Return is after all Costs (such as Dealing Fees, Buy/Sell Spreads, Account Management Fee of £20, Stamp Duty) and it includes the benefit from Dividends received in the Account which might have amounted to around 3% or so I suspect. I don’t really focus on Dividends in the WD40 although I always like to be picking up something. As I see it, Dividends are effectively ‘Free Money’ and it bemuses me how many Share Punters buy Stocks without the benefit of these easy gains. Throw in some Compounding over the years and Dividends will have a huge impact on your Total Returns over time. The WD40 is really a mix of all sorts of sized Stocks and has a bit of FTSE100 (not much), FTSE250, FTSE Smallcap and AIM. If you skip over to the ‘Portfolios’ page on this Website (WD1) then you can see the full list of what I hold in the WD40. Spreadbetting Account It seems to be an ongoing theme but it is very rare that I am completely happy with how I have done with my Spreadbetting Account in a given year. In recent years it has been dogged by my struggles with Hedging but this year the Hedges actually helped it a lot but I think other things I did detracted from the performance. Anyway, my Spreadbet Account gained 30% on the year when you compare the Capital I have on 31st December 2020 to the Starting Capital on January 1st 2020. Having said that, the true return is arguably higher because I took quite a bit of Cash out of that Account and the true ‘Capital employed’ was really lower throughout the year. Simplistically a 30% gain seems pretty good but this is much lower than I think should be realistically possible if I could apply myself better and I would like to see a 50% gain really and that is obviously more the kind of outcome I will be looking for in 2021. The way it works because of the Leverage, the gain on the Starting Capital situation on a Spreadbet Account can change very fast, and not long before the end of 2020 my Account was up near 50% but a couple of weaker days pulled it down swiftly. I think the biggest drags on my Spreadbet Account were the exposure to several larger Stocks like ones I have in my Income Portfolio but the bigger hit came from my substandard performance in Index Trades. I did very well on my initial Shorts when the Markets tanked in March 2020, but then I proceeded to have too many Index Trades that got stopped out and I think the position size was too big – something that I will be addressing going forwards. If I managed to get some proper discipline (there is most definitely an ongoing theme here !!) and to ‘mirror’ my WD40 properly and purely do this kind of activity, I think the outcome on my Spreadbet Portfolio would be considerably better. I must try to focus more on this in 2021 and to ensure that where possible I have ‘mirrored’ positions on all my WD40 Stocks and I need to make sure the sizes are in appropriate proportions. The other thing I must do is to be very controlled in now many Index Trades I do and the majority of these should be Long Trades because the trend of the markets tends to be up most of the time. Obviously, I will do Hedges via Shorts as and when appropriate, but for Trades that are not Hedges, I will try to reduce the size of the Trades until I get more consistent at being successful with them. Income Portfolio You have probably figured this out by now, but whilst creating this blog I have been looking back at the ‘Scores on the Doors 2019’ blog I did and pinching chunks of text and tweaking them as needed. Anyway, I am really surprised to see that in 2019 my Income Portfolio was up 19% which is really impressive but sadly for 2020 it was a Loss of 7% which is rather disappointing. However, as with everything some context is needed and when you look at the Screenshot below of what is in my Income Portfolio Account, it is clear that there is quite a bit of big chunky FTSE100 stuff and with that Index falling around 10% when Dividends are factored in, then my Income Portfolio was not hugely out of line. It is important to appreciate that my Income Portfolio is very much a ‘do nothing’ account and something where I simply buy the Stocks and just leave them be. It is very much driven by the Dividend Return and I will come on to that in a bit. For 2020 there were some cuts to Dividends amidst the Coronavirus shenanigans and this didn’t help the performance. I am generally targeting a Return of about 7% CAGR and over time I think this is very possible and I am probably not far off that in the few years I have been running this Portfolio. There is something important to note which most likely hurt the performance of my Income Portfolio, both in terms of potential Capital upside and in terms of the Dividend Income generated during the year. This factor was that I actually took £3,500 out of the Account in the form of Cash because I wanted to bolster my Cash position outside of my Share Accounts and also because I needed money to eat and drink !! So when you look at the Screenshot of the Account below, you need to imagine another £3,500 being added to the ‘Cash in account’ line at the top. Although I spend very little money during a year (more on that later in this blog) one of the challenges I have is that very little of my Yearly Income actually arrives in the form of Cash – much of it is from appreciation in value of my Prudential ‘With Profits’ Bond or from Capital Gains in my Share Accounts. Therefore, in order to get Cash, one route is to generate it in my Spreadbet Account which is fine when things are going well, but you still need to hold a sizeable ‘Cash Buffer’ to enable the Spreadbet Open Positions to wiggle around and not to cause too much angst (it is also vital to monitor and understand Exposure all the time). The other course is to sell Shares or sell Units from my Prudential ‘With Profits’ Bond – but over time I am finding that my higher risk Stockmarket stuff is increasing in proportion to my Total Wealth and I would prefer to let my Prudential ‘With Profits’ Bond keep going up in value because I see it as lower Risk and a good Core Holding and safety play. Anyway, for simple ease I took out £3,500 from my Income Portfolio (it was from money received from Dividends mostly that I did not reinvest in 2020) and because this money was not reinvested, this dragged on the performance I suspect. However, of course this is not strictly true – I could have reinvested the Cash and then seen the Markets fall more so it is not simply a one-way thing. Anyway, since 2021 started I have already put £1000 back into the Account to help buy some Hipgnosis Songs Fund SONG (see my ‘Trades’ page for details) and I am actually taking quite a chunk of Cash out of my WD40 Account so I should be able to buy more in the Income Portfolio soon and I have some ideas for new Stocks and I might just buy more of something I have already. To an extent I am a bit miffed/frustrated that I did not reinvest the Cash straight away in my Income Portfolio, but on the flipside it is probably fair to say that as a true ‘experiment’ with a dose of reality, it is more realistic that there are often pressures outside of our Accounts which mean that we don’t or cannot always do the most optimal actions regarding how we operate those Portfolios.

In previous ‘Scores on the Doors’ blogs I have taken Screenshots of the Dividends I have received but this year I won’t bother. If you look back at the one for 2019 then you can see them there and the point I was merely trying to make was that running an Income Portfolio in this way, you can get a regularly monthly drip, drip, drip of Dividend Cash flowing in and that can be extremely useful if you need the money to live off (and of course your Portfolio needs to be pretty chunky !!).

On the Starting Value of the Income Portfolio on 1st January 2020, the Dividend Yield was 3.7% which is a lot lower than I would ideally like. My intention when setting up the Portfolio was to Target 5% in Dividend Yield per year but I have learnt over the years that this is difficult to achieve as your Portfolio grows, especially if your Stocks do well. For example, AstraZeneca AZN probably had a Dividend Yield up around 4.5% or so when I first bought it for the Portfolio, but because it has gone up so nicely, the Dividend Yield on it now is probably around 2.8% and I am starting to ponder whether or not I should sell it and buy something else with a higher yield. I am not rushing such a decision because AZN seems a pretty good Stock from a Capital Gain viewpoint, but clearly it is something I need to think carefully about. On the Cash I actually invested into the Portfolio in the first place a few years ago (which was £38,670), the Dividend Yield was 5.7% for 2020 which is clearly pretty good. Against the Closing Value of the Income Portfolio on 31st December 2020, the Dividend Yield is 4% - this figure is arguably the most useful because it factors in the fall in the value of the Portfolio and represents where we are now really. My Mate’s Unit Trust Portfolio On my ‘Funds’ page which sits on WD2 I think, there is an Example Portfolio that I run with a friend that is made up of several Unit Trusts. Normally I would report on this but this year I do not have a meaningful figure because she is buying a new House and has liquidated about 80% of the Portfolio. Once the dust settles I will have a chat with her and try to establish what she now holds, and hopefully I can update the Website with any relevant details and in ‘Scores on the Doors 2021’ I should have some numbers !! Another Mate’s SIPP Portfolio This friend pretty much mirrors what I do with my own Shares and it is mostly like the WD40 although she does hold a few that are in my Income Portfolio as well. Anyway, her Portfolio gained 9.8% which is a decent enough result and I suspect the reason she lagged my WD40 is because I was very overweight on MPAC which did me proud. Related to this, my mate came round a few weeks ago and we mapped her Portfolio to some modelling we did when she started her SIPP about 9 years ago, and we are knocking out 10% CAGR which is a pretty good result. As I have mentioned earlier, I think 12% CAGR is doable and we will be trying to achieve this going forwards. To understand how we do such Models over time, please see my infamous Compounding Blog here: https://wheeliedealer.weebly.com/educational-blogs/why-bother-investing-the-power-of-compounding Prudential ‘With Profits’ Bond This is very much a Core Holding for me and a ‘do nothing’ thing that just sits there and goes up over the years !! It is the biggest Fund of its kind that there is and it invests in all sorts of stuff and the Return per Year is done in the form of a Bonus that gets added according to how well the Fund has done and the outlook etc. This in effect ‘smooths’ the Returns over the years but I have to say it has been an excellent Investment for me and I would guess it has returned 4% or 5% CAGR. It has certainly stuffed Cash. Anyway, this year it simply blew things out of the park and registered a Gain of 12%. I was utterly stunned when I checked the numbers and of course I am over the moon with this. I doubt this kind of performance will recur much in coming years, but it was a lovely surprise. If you look at my ‘Scores on the Doors 2019’ blog then you can read more about this Fund and there is also some text on my ‘Portfolios’ page. Spending I always make the claim that I cost less to keep than a well-trained sparrow, and that I live off thin air, but this year I totally excelled myself and only spent £15,266 on my Living Expenses, which is totally nuts. Of course, this is an artificially low figure because of the Coronavirus crisis and I was in essence unable to spend much in The White Hart or the Boatman, and of course I didn’t have too many trips to concerts and suchlike (er, none at all in fact). Without doubt this is the lowest amount I have spent in about 11 years of being ‘retired’ and I would usually budget for about £1500 a month (these are all ‘after tax’ figures) and that would mean about £18,000 a year. To help Readers get a sense of what this Spending figure includes, please note the following:

If you look at the ‘Scores on the Doors 2019’ blog this tells you more about my pretty frugal lifestyle and without doubt if I wanted to, I could reduce my Living Expenses to probably £14,000 and perhaps a little more if I ditched a car. This supports what I said in the blog from last year that if I did not have Rent to pay, then I could probably get my Living Expenses down to as little as £8,000 – although obviously I would far rather spend more and be down the Pub as much as possible. OK, that’s it, I hope you enjoyed the read and found it informative and a help with your own retirement plans, Happy New Non-Virus Year !! WD.

7 Comments

Kevin S

22/1/2021 08:12:29 am

Great result Pete and interesting to hear about your structured assets.

Reply

WheelieDealer

7/2/2021 09:59:55 pm

Hi Kevin,

Reply

8/4/2021 01:36:17 pm

This blog very informative and give me some positive way, how to move for next level. I really thank full to author for this latest blog.

Reply

Awesome content. Loved this post and I’m definitely pinning it to share! You might like to visit couponplusdeals.com for amazing coupons and promotion, especially for health supplements, jewelry, gadgets, home and office supplies, apparels, and many more, with thousands of brands all over the world. Thanks for the great read. Kudos!

Reply

20/11/2022 10:26:23 am

Great article! Thank you for sharing this informative post, and looking forward to the latest one.

Reply

25/1/2023 04:39:42 pm

Hello there, as a newbie to crypto currency trading, I lost a lot of money trying to navigate the market on my own. In my search for a genuine and trusted trader, i came across Mr Bernie Doran who guided and helped me make so much profit up to the tune of $40,000. I made my first investment with $1,000 and got a ROI of $9,400 in less than 8 days. You can contact this expert trader via Gmail [email protected] or on WhatsApp +1(424)285-0682 and be ready to share your own

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|