|

Unlike last year after a pretty strong performance, this year I have to write the ‘Scores on the Doors’ with a heavy heart…..

2016 was awful for me - as I have written a lot over recent months, I have not really enjoyed my Investing over the last year and it became an absolute chore - the simple reason being that I never seemed to get ahead of the game and my Accounts were negative almost from the off and never turned into Positive territory. In normal years, my Portfolio soon gets into the Money and tends to build on that with various fluctuations throughout the year.

As a result, this Blog will probably be short and sweet (bitter?) because I really don’t want to be dwelling too much on it - I have done so much thinking and reflection about where I went wrong and I don’t want to cover that too much here. In essence, I got hit by so many Profit Warnings that I seemed to have a reverse Midas touch and I compounded this difficulty by getting hugely caught out by trying to hedge my Long Portfolio by using Index Shorts - particularly on the FTSE100.

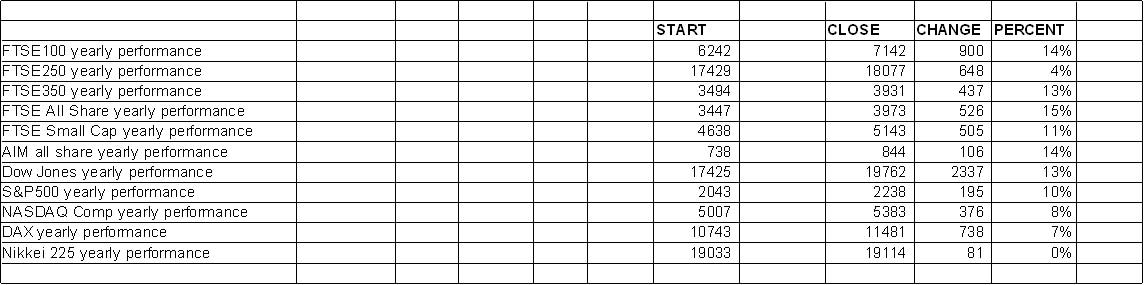

Being a sneaky git, I have copied some text from last year’s ‘Scores on the Doors’ and amended it accordingly to make things easier for me and so I can wrap this irritating chore up rapidly !! Indexes To set the scene, here is a Screenshot of how the Major Indexes turned out for 2016 - these are not including Dividends (i.e. they are not ‘Total Return’) and I calculated these myself from ShareScope numbers put in a Spreadsheet. They may not be Total Return but I guess in some ways they are fair Benchmarks as of course our Portfolios get hit by Dealing Costs, so in reality we could never really match the Benchmarks even if we bought exactly the same Stocks in the same Weightings. Roughly speaking, you can add on about 4% for FTSE100 Divvys and about 2.5% for the FTSE250. Big surprise for me here is how flat the Nikkei was. I include this Table for completeness because in all honesty I don’t get too fixated on ‘Beating the Market’ or anything like that - simply put I enjoy what I do and the idea that I would sell everything and buy an Index Tracker has no appeal for me whatsoever (although of course I could spend more time in the PUB……)

Trading ISA Portfolio

I managed a small gain of 6% over 2016, after all Costs and including Dividends and obviously some reinvestment over the year as I bought new Stocks or added to existing Holdings with the Divvy Cash - I distinctly remember a few times during the year tweeting about how I had amassed enough Divvy Cash very quickly to enable me to buy more Positions - I have a Minimum Position Size of 1%. Any Stocks that I sold had the money reinvested in something else. As with my Spreadbetting which we will come onto in a bit, I did some poor Hedging Trades in my Trading ISA and these probably amounted to a hit of about 1% on the Portfolio - so not too much impact. I suspect the largest detractor was the hits I took from countless Profits Warnings - in essence, during 2016, if there was a Profit Warning to catch, I would grab it greedily with both hands !! This is my biggest Portfolio so has a huge impact on my Wealth so I can at least be pleased it was up for the year. Areas for improvement are really around better Stockpicking and concentrating on timing issues of Entry and Exit. I need to get to the WD40 as I go on about continually, but I will not sell stuff just for the sake of it. As I will explore further down, this Portfolio is critical as it should drive the performance of my Spreadbetting Portfolio - sadly this has not happened well this year, but the fault does not lie with my Trading ISA. Unit Trusts My tiny collection of Overseas Unit Trusts was up 12% in 2016 - I am reasonably pleased with this although because of Decisions I made to reduce the size of this Portfolio and to focus my efforts more on my own Trading ISA and Spreadbet Account, the Performance probably suffered. I am pretty sure that if I had left the Unit Trusts as they were at the end of 2015, I would have done very well - however, that is totally hindsight bias and not really a particularly useful observation. I am sticking by my plan to reduce my Holdings here and I only hold a couple of Technology Unit Trusts and a Health Unit Trust now - all are mainly US based and this is perhaps a positive. However, my current thinking is that I want to build my Cash Reserves a bit and I will probably sell one of my Tech Funds in coming weeks - I will still keep the other Tech Fund and I have a lot of Technology Stocks anyway so there is duplication here really that I don’t think I need. If I feel a need for more Technology Funds exposure, I can always buy something like PCT or HRI in my Trading ISA anyway (Editor’s Note - since typing this paragraph I have sold my Henderson Global Growth Unit Trust - please see ‘Trades‘ page). I think a lot of the performance was driven by FOREX with US Dollar strength and Pound weakness being key factors - this is something I am unhappy with (I don’t want to be a FOREX Trader) and over time I have been reducing the Money I have invested in these Unit Trusts - this is also because I think I can make better Returns investing the money myself in my Trading ISA. On the flipside, this Portfolio adds to my overall Diversification (a rare ‘Free Lunch’ that should be taken advantage of and all Investors can do this easily) and this makes me keen to keep it going but I just feel a need to amend it a bit. It also adds some ‘Manager Diversification’ - this is the concept that if I screw up as the Fund Manager of my own Share Dealing Accounts, I have other Managers who might do better than I did. Income Portfolio The purpose of this Portfolio is to create a Dividend ‘Revenue’ Stream for myself so that in about 8 years when I hit 60 (yes, I am a shade off 52 - where did that year evaporate to?), if I want to, I can just take the Divvy Cash and spend it for a big part of my usual Living Costs (more on these further down). In the meantime I am reinvesting the Divvy Cash whenever I buy a new Position or top-up on an existing Holding - although I am not doing a DRIP (Dividend Reinvestment Programme) as I think they are a cr*p idea). On this basis, the Yearly Performance of the overall Portfolio is less important to me - what matters is the growth of the Dividend Stream. If you go to the ‘Portfolios’ page of the Website then you can see what Stocks I am holding. The Income Portfolio also has a benefit of diversification - more and more I find I am doing less stuff with FTSE100 type Stocks in my Trading ISA (mainly because I generally do much better on Smaller Cap Stocks) and this Income Portfolio therefore gives me added diversification across Stock Size (and is another reason why I am keen to reduce my Unit Trusts - none of those pay a Divvy and I would perhaps rather steer the Cash into my Income Portfolio). Here are some simple Numbers from the Portfolio for 2016:

Spreadbetting Account Right, now we get onto the Big Problems…….Due to my disasters with Hedging, the pain was felt in my Spreadbet Account and this got really hit hard - and wiped away any Gains from my other Long Portfolios of Stocks and the Long Spreadbet Positions I had open. If you need a refresher on what went wrong, the Blog below gives the full sorry saga and how I will avoid such a balls-up in future: http://wheeliedealer.weebly.com/blog/final-word-on-my-hedging-fiasco-hopefully-some-new-rules The Value of my igIndex Spreadbetting Account decreased by 46% against the Starting Capital on 1st Jan 2016. I have worded it this way because due to the Leverage and Margin situation, I had to put Cash into the Account to keep my Positions open and this in itself created more hassle and psychological stress which I didn’t need !! This issue was particularly exacerbated because the Gains on my Long Portfolios of Stocks were in ISA Accounts and mainly for ‘Mental Accounting’ psychological reasons I am reluctant to take money out of those ISA Wrappers unless there really is no other option. Consequently Cash that I would have liked to have put in my Income Portfolio ISA Account with iWeb perhaps got burnt to fund my Spreadbet Account - this really shows how Leverage can cause trouble. As it happens, I don’t think I missed out too much by not adding to my Income Portfolio but it was certainly not as I would have preferred. In terms of how bad the Hedging was, I did a very quick fag packet calculation and I suspect it cost me about 12% of my Total Portfolio Value - in other words had I not had this massive screw-up then I might have had an Overall Return from my Stockmarket Activities of as high as 10% (that’s made me really depressed typing that !!) In theory, I am supposed to ‘Mirror’ my Trading ISA by using Spreadbets in similar proportions. Let me explain this with an example:

I think a ‘Mirrored’ Spreadbet Portfolio will lag a Portfolio of Normal Shares due to Interest Charges (these are partly offset by Dividend Payments) but it seems that DFBs (Daily Funded Bets) have wider Spreads than Normal Shares and this is another drag on performance - although there is not much I can do about this (using CFDs would get around this problem but then you lose the Tax Free advantages of Spreadbets). If you click on the ‘Spreadbetting’ category on my Blog Page, then you can find loads of stuff on how to Spreadbet safely - but I do not recommend Spreadbets for beginners and it is best to start small and you must always understand fully the level of Exposure you are taking on. My Mate’s Unit Trust Portfolio If you go to the ‘Funds’ Page of my Website, you will see an Example Portfolio there which I run with a mate. This year that Portfolio was up 12% and we are very pleased with it. Much of this is due to Equities soaring globally and the effects of Pound Weakness. From memory there were no changes to the Portfolio during 2016 but I do feel there might be some rebalancing needed now. I keep trying to get my Friend to address this issue but she always has something more interesting to do !! This kind of nonchalant attitude sounds like a disadvantage (and it frustrates the hell out of me sometimes !!) but over time it has demonstrated practically how avoiding the temptation to tinker can actually have helpful impacts on your Returns. Another Mate’s SIPP Portfolio I have another friend who copies my Trades in her SIPP (obviously no Readers should copy my Trades - please see Disclaimer on the Homepage) and this year it is up 8%. This is in line with my Trading ISA and probably suffered a little less from my disastrous Hedging efforts using XUKS. It is worth noting how 2 people can have similar Stocks but different Results - in this case it is partly due to different Weightings and also because she holds some Stocks that I have in my Income Portfolio - so she has a bit of a hybrid Portfolio really in comparison to mine. There are obviously timing issues as well and small differences in Prices of Buy and Sell Trades along with small differences in Weightings can add up to a few % difference on the Portfolio over a Year. As with my own Long Portfolios I am fairly pleased with this Result (and my friend is) because I took a very Risk-averse stance and I am pretty sure that with a more aggressive approach I could have made a lot more Money. Prudential With Profits Bond I must just mention this Unsung Hero of my Overall Portfolio - this returned 3% on the Year which is not great but for the low Risk level it is acceptable. I have about 10% off all my Wealth in it and it really is a ‘Core Holding’. In other years recently it has done better than this - I suspect that next year it might be a bit better as the boom in Stockmarkets over 2016 will probably show up in 2017 numbers - I get my Statement in April so there is a timing mismatch with when I do the Numbers for the rest of my Portfolios. I am sure if I contacted Prudential they would give me the current figure - but it is not really worth the bother. I always record it this way every year, so it is consistent and understates the true Value now. Ah, good old Conservative Accounting……. It’s a funny old beast. These are the things that get linked to ‘Endowment Policies’ and they therefore have a bad name. However, mine is a standalone thing that I have had for about 17 years and it is pretty steady and solid. It came under some slight pressure during the Credit Crunch but it was nothing compared to what other Asset Classes suffered. I have been very pleased with this and it has some Tax Advantages. It is a ‘buy and Forget’ type of investment and I recommend it to anyone. I used to have one with Liverpool & Victoria (now LV= or some dopey name) but that one was rubbish - the Pru one is defo the best. When I started Investing seriously in 1999 or so, this was probably my only good decision !! Overall Wealth After my 7th year of Retirement and Freedom (try it, it‘s marvellous), I had a poor Year on my Investing but my Overall Wealth didn‘t take much of a hit - as you will see in the Section below, my Spending for the year was minimal and this means that my Capital was only depleted slightly. Across all my Stockmarket Activities, I was down 4% on the Year - but this does not include my Prudential With-Profits Bond which offset a large chunk of this. Spending Really surprised by this - over 2016 I only spent £14,731 on ‘Living Expenses’ which was down 15% on the £17,353 I spent in 2015. Not really sure why this is; I guess being an Old Git my Car Insurance has dropped a bit but seems like lots of other costs, like Rent, Car Tax, Broadband, SkyTV have increased. Weird. I suspect there is a psychological effect - when I am doing well on the Markets and making Dosh I am probably a bit more freer with my Spending and there is probably a sort of subliminal hesitation to spend when the Markets are not being my best mate. I guess I save on Petrol (because I never seem to drive anywhere much these days !!) and since doing WheelieDealer I am probably perched in front of a Screen a lot more and not out spending Money. I don’t have expensive Holidays (this is really down to the physical limitations of being Paraplegic - in all honesty going away just means hassle and health problems for me) and I don’t smoke or anything like that. On the flipside, I run 2 cars but I do such little mileage that they never seem to need much repair work and suchlike and indeed for the last year I don’t remember having any meaty Repair Bills on the Cars (oh, gawd, what have I just said !!) My Rent was £6511 this year, so if you strip this out for Reader Comparison purposes, my Living Expenses excluding Rent were £8,220 (I live in a purpose-built Housing Association Bungalow and the Rent is such a bargain and includes all House Repairs and stuff). I could probably reduce this figure a bit by only having one Car. Obviously I am no big spender, but it is amazing how little I live on - means more Cash to invest - hurrah !! Conclusion I am obviously very disappointed by the failure last year but on the positive side I feel that the events of the year have highlighted a big failing in my Approach which I have now corrected - it was possibly worth the pain and angst to bring to my attention this significant weakness - I now feel much better equipped to take on the Markets and to ensure I can make money whatever the Market chucks in our direction. Keeping things upbeat and optimistic - that is my nature thankfully and I don’t see how I could realistically take on the challenges of the Markets in 2017 unless I was moving forward with this mindset - there were some pockets of decent Performance among these Results and the big standout for me is the 9% gain on the Income Portfolio - when you consider that I did almost nothing to it all year (I am guessing I might have done one Buy transaction but that is probably it), it is not a Result to be sniffed at. In addition, in the latter weeks of 2016 the Income Portfolio got hit hard by a weak Update by KCOM and a huge slump in IGG due to Regulatory issues - this probably shaved 4% off the performance. Other than that, the Performance of the Portfolios I run with friends was really not too shabby and that gives me confidence that I can sort out my own Performance by not doing things that are merely hurting myself. No more masochism. It is fair to say that my ‘Long’ Portfolios did ok but nothing special over 2016 but my Hedging clearly was abysmal. Diversification across the Stocks and Portfolios clearly proved its worth again and it is also worth appreciating the part that Dividends played in my Returns. This game is all about Compounding Returns over years - for instance, if you can grow at 10% a year then your Money doubles in 7 years. If you can grow at 15% a year, then your Money doubles in just under 5 years. Most people do not get this - it is utterly vital to understand and it really is one of the rare Stockmarket ‘Free Lunches’ - anyone can grab it so make sure you do. Needless to say my dismal Returns for 2016 are a big blow to my Compounding but I am reasonably confident that I can recover the lost ground by ‘sticking to the knitting’ and using my Hedging Strategy properly. Having said that, one thing that I still have an issue with is the Volatility of my Yearly Returns - it would be nice if I could be much more consistent but in recent Years my Returns have swung around like a Banshee on Speed…… This Blog gives more insight on Compounding (I must say this is one of my favourite WheelieBlogs - the numbers in it are staggering): http://wheeliedealer.weebly.com/blog/why-bother-investing-the-power-of-compounding It is much easier to deal with such a major failing in my Yearly Performance when there is an obvious Single Problem which clearly explains 95% of the Losses and is something that is 100% fixable. In addition to this I had a lot of Profit Warnings over the course of 2016 and I need to put more focus on avoiding these (to the extent that any such avoidance is really possible) and improving the quality of my Stock Choices. There are always small improvements that I can make to the timing of Buys and Sells and I need to keep on top of the ‘Balance’ and Weightings across my Portfolio - this latter was an issue over 2015 as well but I think I did make some small progress during last year. Right, I can take no more 2016 - roll on the joys of 2017 !! Cheers, WD.

12 Comments

samenic

20/1/2017 09:50:56 am

Well considering you had more than just your foot out of the door for nearly all the year l think you deserve a pat on the back ! Tis exhausting playing catch-up when everyone seems to be eating cake on the other side of the room.A maxim to keep it simple is something l fail at every year but its nonetheless maybe the way forward.Good hunting..

Reply

WheelieDealer

25/1/2017 08:42:03 pm

Hi samenic - hope you are well and all that. Thanks for all your support - last year was as tough as anything for me and your comments about watching other people stuffing their faces with cake is so true. It just goes to show how important it is to say calm and appreciate that there are many ups and downs in this game and continually obsessing about what other people are doing will drive you bonkers. Your dead right about simplicity - it applies to everything and along with 'Cutting out Noise' it has to be the way forward.

Reply

WheelieDealer

25/1/2017 08:45:08 pm

Hi James, thanks for the feedback - as you know I am very committed to 'Keeping it Real' and I make sure I tell it how it is - I am sure Readers will agree that anything other than that is of far less value. It does me immense good to come clean about what I get wrong and it is a great way of helping me improve - which of course is a key thing we need to do as you never stop learning.

Reply

catflap

21/1/2017 02:46:15 pm

Brutally honest. Reading your blog posts this last year have certainly deterred me from opening a spread betting account. Others too perhaps?

Reply

WheelieDealer

25/1/2017 08:47:21 pm

Hi catflap - thanks for the feedback and all your support. People think IGG shares collapsed due to the Regulation of CFDs but I suspect the real reason is because I have put off all the potential customers with my stories of pain and angst on the spreadbets !!!

Reply

David

22/1/2017 09:34:27 am

Very insightful and honest. Good luck for 2017!

Reply

WheelieDealer

25/1/2017 08:49:23 pm

Hi David, many thanks for leaving the comments - hopefully the blog will help Readers think about how they do things and give them some good lessons to avoid the huge screw-ups I managed to perform last year. I hope things went well for you and best of luck for 2017 !!!

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|