|

THIS IS NOT A TIP OR RECOMMENDATION. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITE. IF YOU COPY MY TRADES, YOU WILL PROBABLY LOSE MONEY. I HAVE A LARGE PORTFOLIO AND I USE DIVERSIFICATION TO SPREAD RISK ALONG WITH TRICKS LIKE HEDGING AND OCCASIONALLY BY THE USE OF STOPLOSSES - IF YOU BUY ANY STOCK YOU REALLY SHOULD FOCUS ON HOW IT FITS IN YOUR PORTFOLIO AND KEEP RISK MANAGEMENT AT THE FOREFRONT OF EVERYTHING YOU DO. BE AWARE THAT ALL INVESTORS/TRADERS GET THINGS WRONG AND MANY STOCK SELECTIONS WILL WORK OUT BADLY.

If you have been keeping on top of my rare and infrequent Trades this year, then you might have spotted that I recently sold out entirely of my Holding in Sainsburys SBRY which I had held primarily in my Income Portfolio but I also had a Long Spreadbet on it which I sold earlier (you can see all details of my Trades on the ‘Trades’ page, funnily enough). The idea behind my Income Portfolio is that it is really intended to be Low Risk, Low Activity and Low Return - but what I mean by that is by targeting a Blended Dividend Yield for the Portfolio of 5% and with a little bit of Capital Gain each Year I hope to get about 7% CAGR (Compound Annual Growth Rate). If you skip over to my ‘Portfolios’ page you will see at the top a full list of the Stocks in my Income Portfolio at the moment.

So having booted out the miscreant SBRY (to be fair, it actually did its job in the Income Portfolio over the 4 Years or so that I held it), I now need to replace it with a Stock which has a fairly high degree of ‘Defensiveness’ and which I think has the potential to pay a sizeable Dividend Yield from Day 1 but also for that to grow over time and hopefully for some Capital Gain to come alongside this growth. Not only that, the Stock must fit in with the rest of the Portfolio and it needs to be of a decent size so that it is liquid and it is highly likely that from time to time I might try to do Long Spreadbets on it to juice up the Returns.

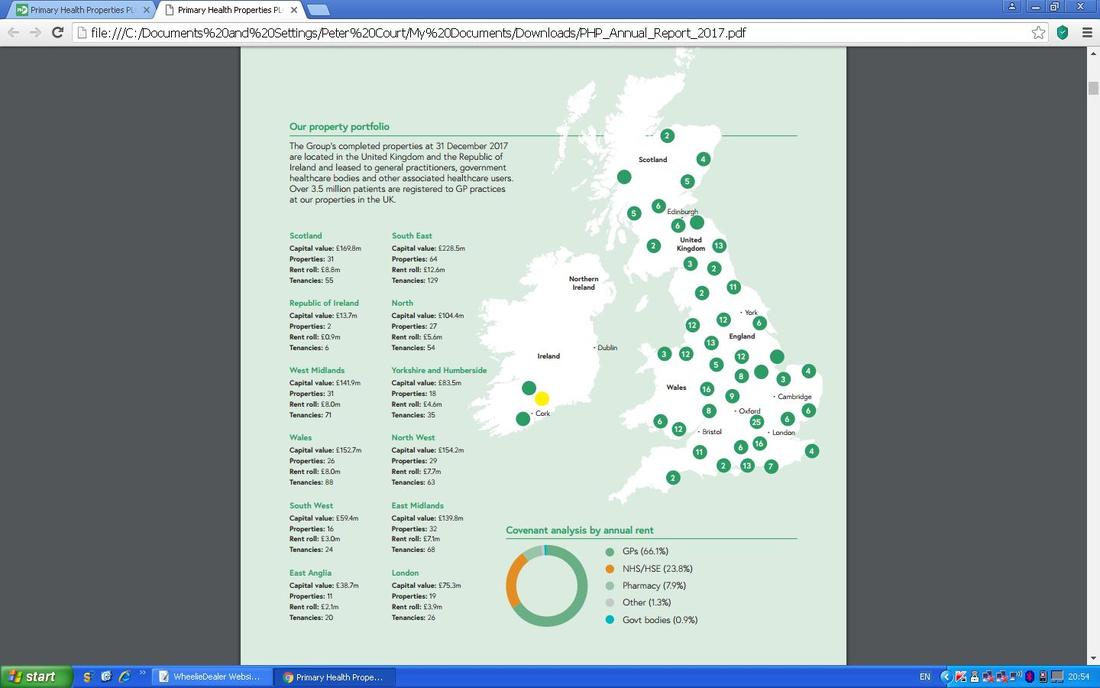

With those requirements in mind and having been thinking of ultimately increasing the size of my Income Portfolio from a quite focused 12 Stocks to slightly more at 15, I have been looking out for potential candidates and to be honest I have ruled out almost everything I trip over. However, there are 2 that keep cropping up - Primary Health Properties PHP and good old Vodafone VOD. For no particular reason (it is probably just some sort of silly WheelieMental bias), my attention has been glued to PHP for a while and I have had many Chats on Twitter about it and apart from a few minor points (which I will no doubt cover somewhere in this Blog) it seems to be pretty much what I am after and is my Prime Target. To that end, I have decided to do a full and detailed Buy Rationale Blog on it because it has been a while since I have done a ‘Stock WheelieBlog’ and I know Readers appreciate them and of course the selfish reason is that it forces me to do a thorough and structured Investigation of what I am buying. Since writing the above Text I have actually got around to buying a chunk of PHP and if you look on the ‘Trades’ page of this Website you should see that on Wednesday 23rd May I bought just under £4000 worth of PHP at 112p for my Income Portfolio. I fully expect to be buying more over time but I do not expect much ‘excitement’ from PHP - its role in my Income Portfolio is very much one of ballast and defensive stability and I expect it to fulfil this role admirably. Company Overview PHP is a Property REIT (Real Estate Investment Trust) which specialises in acquiring Primary Healthcare Centres which it then leases to the NHS usually with an Inflation Link to the Lease Payments. In the old days, GPs (General Practitioners - your ‘Doctor’ !!) used to often group together with perhaps 3 or 4 of them and they would all work out of a ‘Practice’ which in my experience often seemed to be a converted 1930s House or something. In the modern world, GPs and other services like District Nurses, Physios, Dentists, Occupational Therapists, Midwives, Chemists etc. are being based in far larger Primary Healthcare Centres which in large part can do many of the functions and treatments that Hospitals have usually done. Obviously this has Economies of Scale for the NHS and takes some pressure away from the Hospitals. They will acquire Freehold or Long Leasehold Purpose-built Healthcare Properties and use a Debt and Equity mix to make Shareholder Returns efficient. At the moment they claim to have over 300 Healthcare Facilities. This trend has been established for a while now and PHP has been exploiting this to grow a large Portfolio of Properties and one of the most ‘exciting’ aspects of an Investment in PHP is that it has recently started a serious move into the Republic of Ireland which is following a similar trend of large Primary Healthcare Centres. So really PHP is a fairly simple business to understand and with an aging Population and ever more complex treatments etc. as well as a driver to lower Costs, it seems like the background Demand Drivers for PHP’s buildings is very buoyant and likely to grow - especially with the move into Eire. Note also that there are rumours around that the UK Government is soon to announce a new Funding Settlement for the NHS which will involve a 10 Year Commitment and 3%-4% Real Terms increases per year - this is obviously positive for PHP. The map below is from Page 5 of the 2017 Annual Report - certainly shows a very wide geographic coverage of the UK !! (if you click on the picture it should grow bigger so you can see it better):

I quite like this statement from their ‘About us’ bit on their Website:

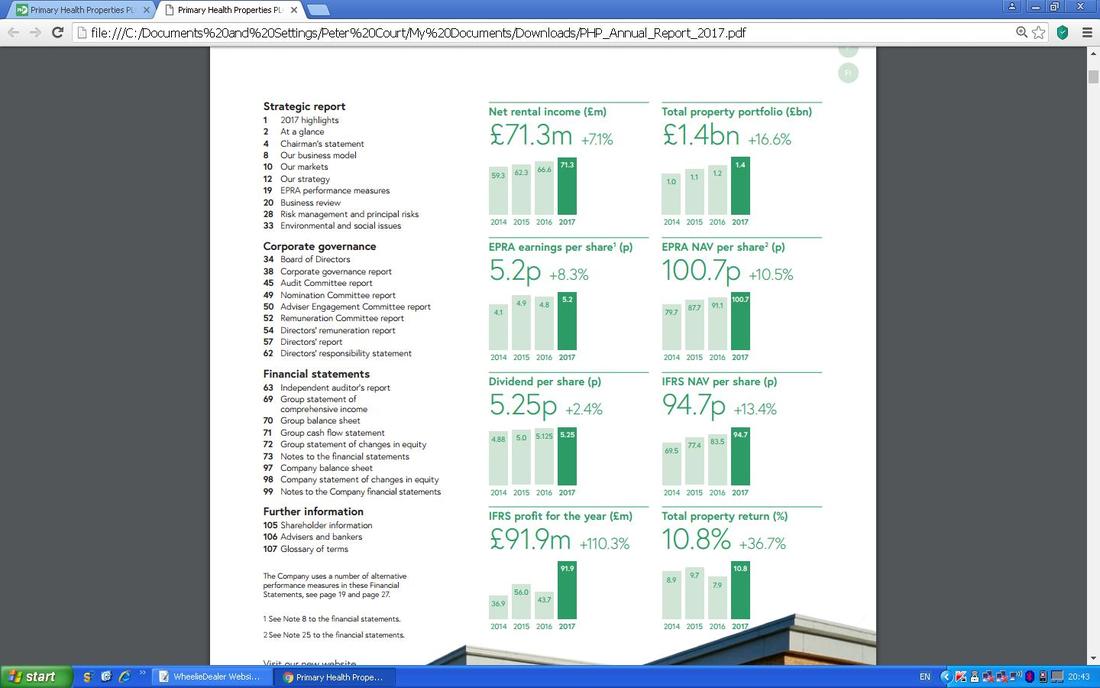

“The objective of the Group is to create progressive returns to shareholders through a combination of earnings growth and capital appreciation.” Of course ‘they all say that’ but in the context of an Income Portfolio this is exactly the right sort of philosophy (of course achieving it is another thing entirely !!). The List of Properties can be seen here - there are loads !!!: https://www.phpgroup.co.uk/portfolio This page is from the start of the 2017 Annual Report but has some nice little Charts to give an overview of the progress made by PHP in recent years - of course the Dividend one is particularly interesting to me as this is for my Income Portfolio:

Key Risks:

Key Attractions:

Company History I’m being super lazy here and simply copied this bit from their Website but it seems to give enough Info for our needs (Harry is the Managing Director): “The idea of purchasing primary healthcare premises and leasing back to NHS GPs through indirect property investment was put forward by Harry Hyman in 1994. Following the purchase of a small portfolio of primary care premises, Primary Health Properties PLC (“PHP”) was incorporated in 1995 and floated on the Alternative Investment Market in 1996. On 5 November 1998, PHP achieved full market listing on the London Stock Exchange. On 1 January 2007, PHP became the UK's first dedicated healthcare Real Estate Investment Trust.” Strategy You can see some pretty pictures regarding Strategy here - it is all pretty simple really (as I have already mentioned this is not an overly ‘complex‘ business: https://www.phpgroup.co.uk/about-us/our-business-model-and-strategy Something worth noting is that PHP is not a direct developer of real estate, which means that the Group is not exposed to risks that are inherent in property development which is much higher risk than simply being a REIT which manages existing buildings, collecting Rent and repairing them and stuff. PHP Business Environment Page 12 of the 2017 Annual Report is very good on this - I have plucked out the following key bits of text from that page: “Primary healthcare provides a critical function, forming a key part of the NHS’s Five Year Forward View (“FYFV”), operating as most patients’ first point of call when unwell. The primary care estate has faced underinvestment over the last decade, with approximately 50% of the 8,000 GP surgeries in England and Wales now considered by medical professionals to be unfit for purpose. Building on the FYFV, the follow-up “Next Steps on the Five Year Forward View”, published in March 2017, reiterated that shift, setting out targets for growth in the primary care workforce, expansion of access to general practice and the need for improved primary care premises. In March 2017, the independent report on NHS Property and Estates by Sir Robert Naylor was published, highlighting the importance of primary care premises and making a number of recommendations. In January 2018, the Government published a response to the Naylor Review which acknowledged the importance of land and property to the transformation of the health system and how the NHS will be able to supplement public capital with other sources of finance from the private sector. PHP continues to actively engage with GPs, key stakeholders and influencers within the NHS, HSE in Ireland and Governments in both countries, on a cross-party basis, demonstrating the benefits of PHP’s third-party development (“3PD”) model and the key differences with Private Finance Initiatives (“PFI”).“ Website Address The Company Website can be found here: https://www.phpgroup.co.uk/ Lease Terms I found this text in the 2017 Annual Report and it is quite relevant I think: “Initial lease terms in the UK are typically of 20 years or more, at effectively upward-only rentals. With the large majority of income received either from the NHS or from NHS funded GPs, this provides a secure, transparent income stream. The HSE in Ireland typically enters into 25-year leases with CPI linked rent reviews, providing similar long term income streams to those of the NHS in the UK.” Risks

The 2017 Annual Report covers ‘Risk management and principal risks’ on Pages 28 to 32 and you can find it here: https://www.phpgroup.co.uk/investors/results-centre Competition As always this is a very difficult section to write. From what I can tell PHP appear to be able to buy the sort of Health Properties they are after and I can only assume that they are sticking by their Parameters with regards to the attributes of those Properties - for example the Rental yield and the Lease term etc. There are a couple of obvious Listed alternatives such as Medicx Fund MXF and Assura Group AGR but I think PHP is the largest of the three and was the first one to List. The issue around Competition really is that if too many Companies/Funds are chasing a limited supply of Health Property Assets then Prices can get bid up too high and the Rental Yields will fall short of the level needed to enable solid Returns to Shareholders. Following the Financial Collapse in 2008 and the subsequent very low Interest Rates, there has been a pronounced ‘Hunt for Yield’ where Investors have been chasing Assets that are perceived to be at the lower end of the Risk Spectrum and which provide Income Streams that are higher than what is available on Government Bonds and suchlike. In line with this, the demand for Property Assets has clearly increased and my assumption is that PHP is facing challenges from such other buyers when it comes to obtaining new Assets. This text from Page 13 of the 2017 Annual Report gives PHP’s view of the situation: “The market fundamentals supporting the primary healthcare sector have translated into continued investor demand and limited supply resulting in further yield compression during 2017. Given the continued lack of new supply in the short to medium term and continued demand, we believe yields may continue to compress further in 2018. However, PHP will continue to remain disciplined in its approach to investment by maintaining strict selection criteria and a carefully evaluated pricing approach to ensure additions are high quality, accretive to net earnings and offer the opportunity for future growth.” From looking through recent Trading Updates and Results etc. for PHP I don’t see much mention of them struggling to buy Properties at the kind of Investment Criteria they have. The recent Capital Raising (see below) suggests they are not having too many problems with regards to Competition for Properties. Research Notes This is not something I see on every (or many for that matter) Company Websites - a whole page dedicated to Broker/Analyst Research Notes and I see one from Edison dated 14th May 2018: https://www.phpgroup.co.uk/news-and-media/research-notes Listing Details Index FTSE250 Country of Incorporation United Kingdom. Company Secretary and Registered Office Nexus Management Services Limited Fifth Floor Greener House 66–68 Haymarket London SW1Y 4RF Tel: 020 7451 7057 Fax: 020 7451 7051 (I’ve no idea what a ‘Fax’ is). Advisers This role seems to be undertaken by Nexus again: Nexus TradeCo Limited Main Office Fifth floor Greener House 66–68 Haymarket London SW1Y 4RF Tel: 0207 451 7050 Fax: 0207 451 7051 (and I still don’t know what a ‘Fax’ is). Regional Office First Floor Unit 6, The Courtyard Timothy's Bridge Road Stratford-upon-Avon CV37 9NP Tel: 01789 263000 Fax: 01789 404018 Stockbrokers Numis Securities Limited The London Stock Exchange Building 10 Paternoster Square London EC4M 7LT Peel Hunt Limited Moor House 120 London Wall London EC2Y 5ET Solicitors CMS Cameron McKenna Nabarro Olswang LLP 1 South Quay Victoria Quays Sheffield S2 5SY Shepherd and Wedderburn LLP 191 West George Street Glasgow G2 2LB Gowling WLG (UK) LLP 4 More London Riverside London SE1 2AU Auditors Deloitte LLP 2 New Street Square London EC4A 3BZ Registrars Equiniti Aspect House Spencer Road Lancing West Sussex BN99 6DA General helpline enquiries: 0371 384 2030 SCIRP/DRIP enquiries: 0371 384 2268 Bankers The Royal Bank of Scotland plc 280 Bishopsgate London EC2M 3UR Aviva Commercial Finance Limited Surrey Street Norwich NR1 3NJ Barclays Bank PLC 1 Churchill Place London E14 5HP HSBC 8 Canada Square London E14 5HQ Annual Reports PHP has a bit on their Website called ‘Results Centre’ and that seems to have everything in it: https://www.phpgroup.co.uk/investors/results-centre You can see the most recent Annual Report (2017) here. Management Company PHP uses Nexus Tradeco Limited to provide property advisory, management, accounting and company secretarial services. Note several of the PHP Board are also key Directors in Nexus. The Nexus team can be seen here: https://www.phpgroup.co.uk/about-us/management-team Directors The Board of Directors can be seen at this Link: https://www.phpgroup.co.uk/about-us/board-directors The key chaps are as follows:

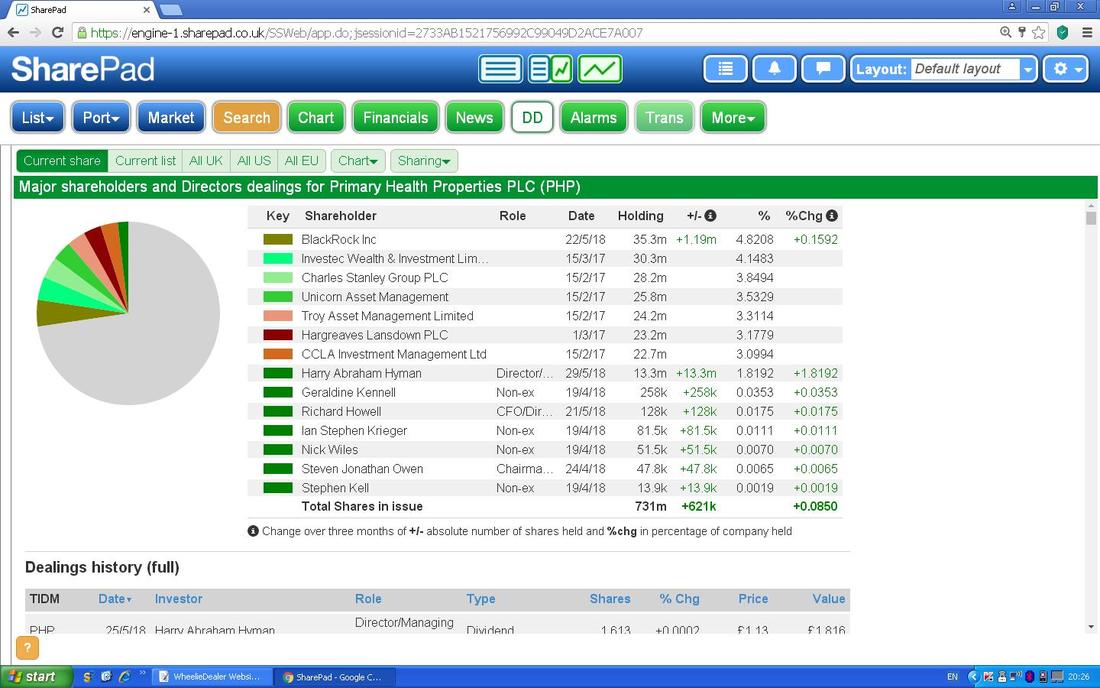

As I read through those short ‘Resumes’, it struck me that they all have Finance backgrounds (perhaps the numbers might add up then !!). It is also interesting that Harry Hyman is the Non-Exec Chairman of Summit Germany SMTG. Directors’ Shareholdings and Major Shareholders The image below comes from the excellent SharePad Software that I subscribe to and I just discovered that when using it on my Netbook I can use the ‘Ctrl+’ function and it gets bigger on my Screen. As usual, if you click on the image it should get even larger if you still struggle to read it. This image is from Wednesday 30th May 2018 and it might have changed a bit when you read this. Not much to say really, the Directors seem to hold a bit and there are some Funds involved !!

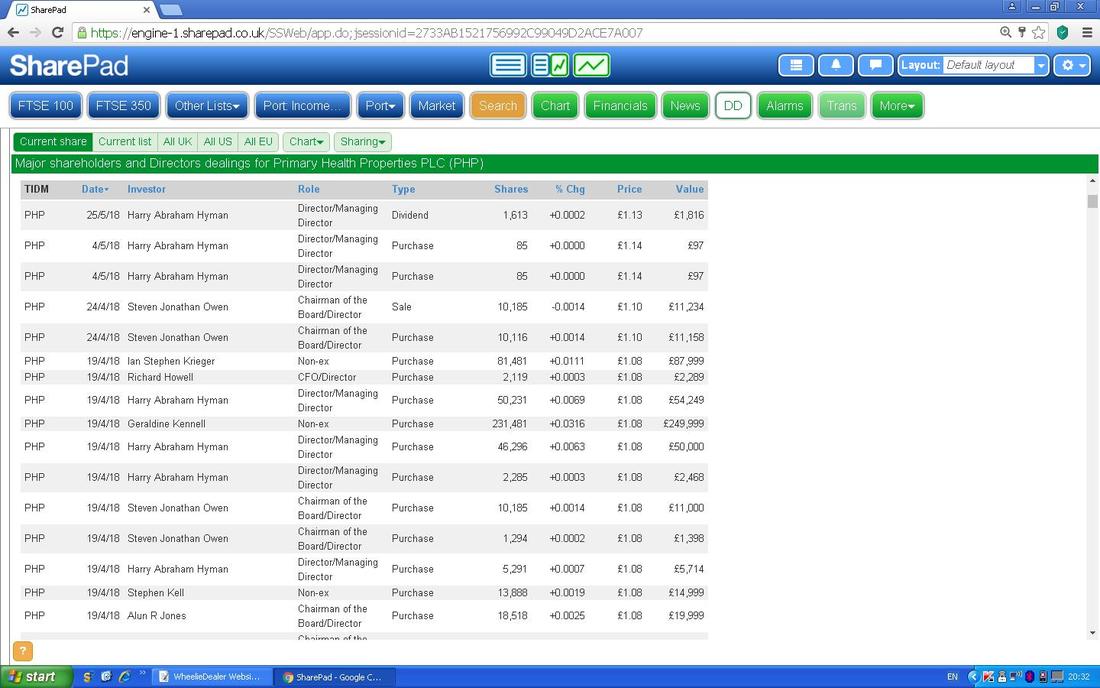

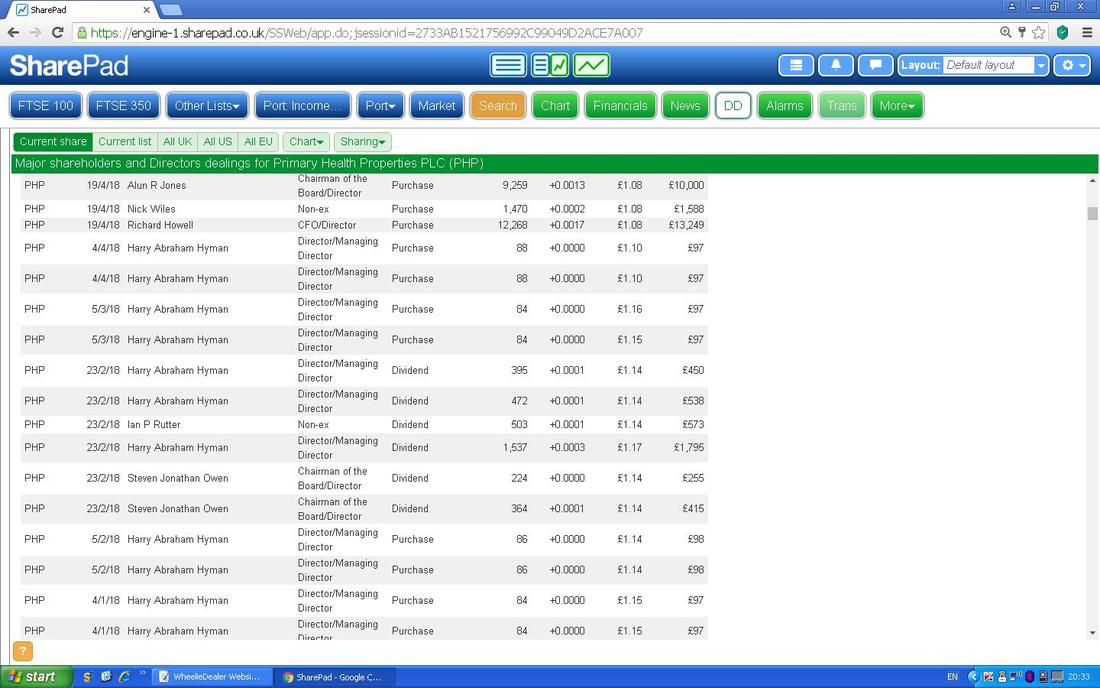

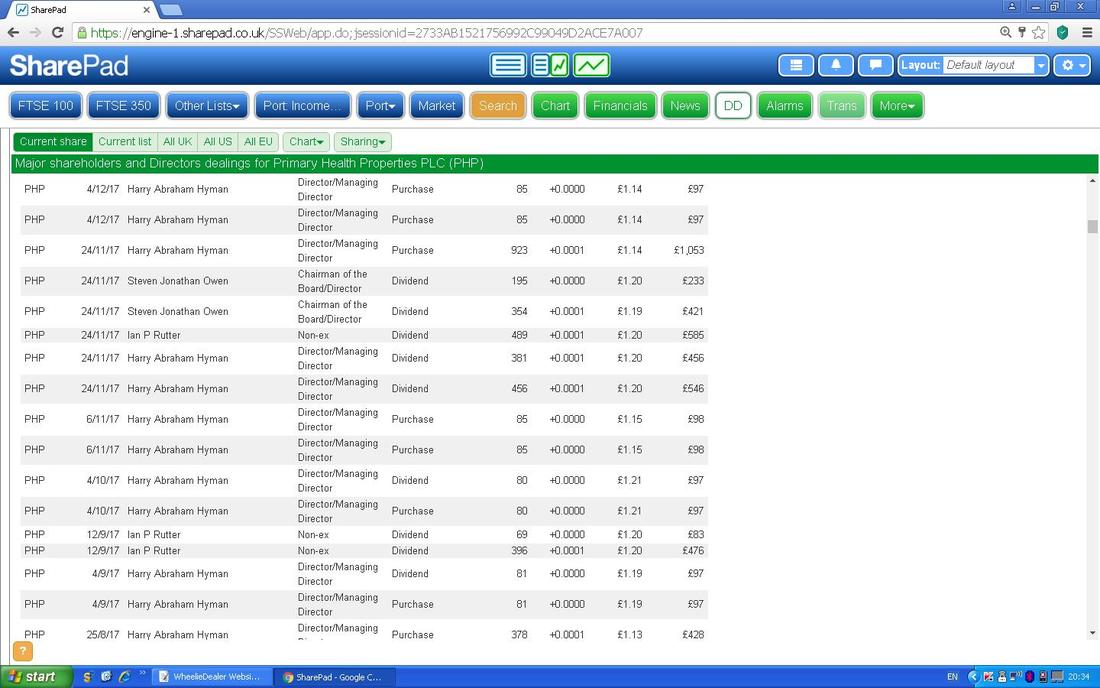

Recent Director Dealings

These Screens are also from SharePad and taken on Wednesday 30th May 2018 - I have gone back a fair way and there are loads of Buys but of course many are little bits and Dividend Reinvestment but note not many Sells:

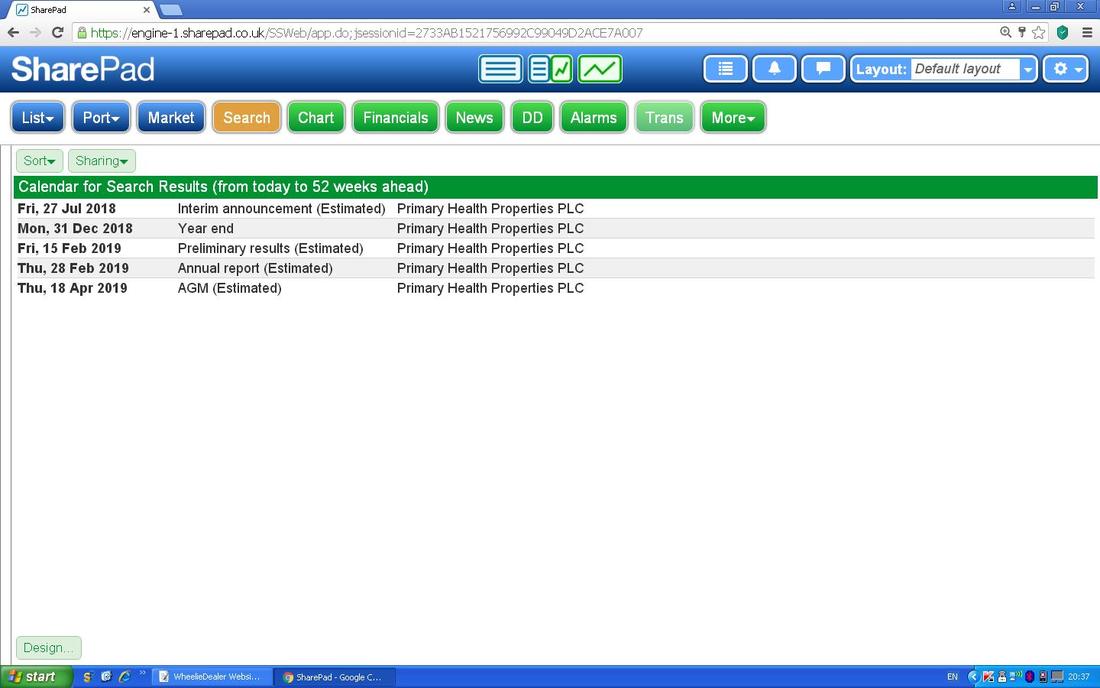

Calendar

I have taken the attached ScreenShot from SharePad. Note on the PHP Website (which seems pretty good otherwise) they have a ‘Calendar’ bit but it has nothing for the next 12 months !! This SharePad Screen unfortunately mainly says ‘Estimated’ so it is probably not overly useful at this point in time but of course the Screen will update as SharePad gets the information.

Recent Trading

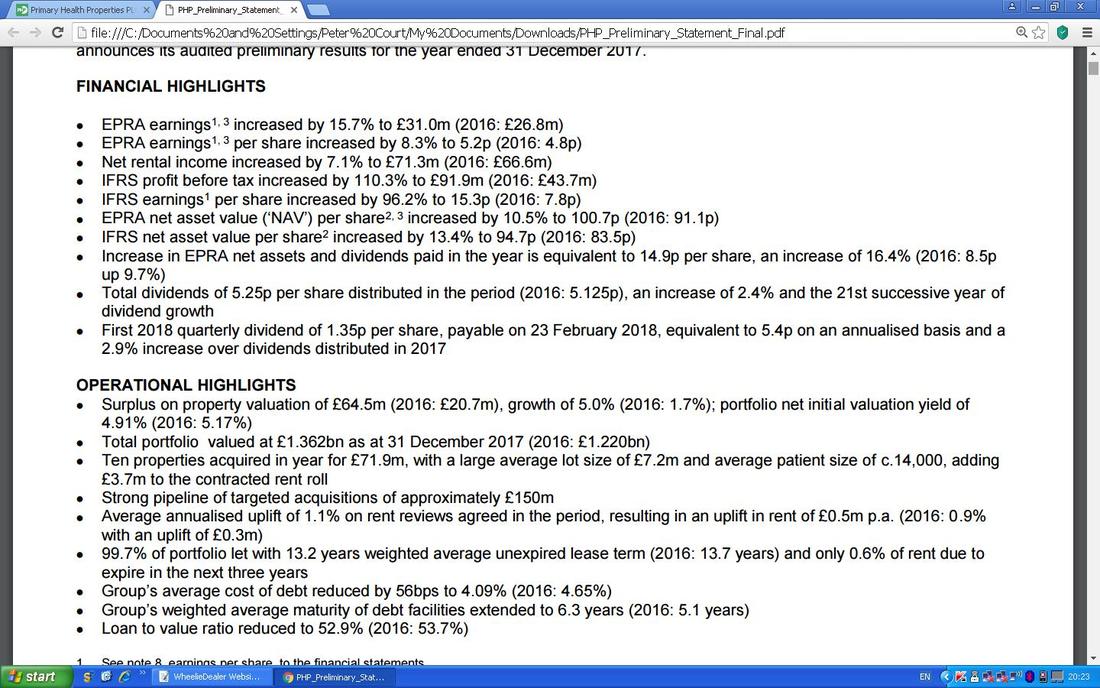

PHP issued its Preliminary Results for the year ended 31 December 2017 on 15th February 2018 and you can see them here: https://ir.euroinvestor.com/Solutions/phpgroup/3754/newsArticle.aspx?storyid=13814907 I have taken the image below from the first page and it does look pretty impressive (but of course these Bullets are very much in isolation):

Just below that the Managing Director Harry Hyman added some comments and these bits in particular appeal to me (21 Years of Dividend Growth especially):

“I am delighted to report that PHP once again increased its total dividend, its 21st successive year of dividend growth. Increasing our income and dividends is key to our strategy as a modern healthcare REIT. Importantly, we have continued our progressive dividend policy into 2018 by increasing the first quarterly payment….” “PHP is very active in its marketplace and has a strong targeted pipeline that meets our criteria. This bodes well for 2018 and beyond. We look forward to the future with confidence.” This bit in the Results regarding Cladding is worth knowing as well because it is clearly a topical issue after the Grenfell Tower tragedy: “Cladding Following the tragic fire at Grenfell Tower in London, a detailed review of the Group’s entire portfolio has been undertaken and there are no properties that have cladding considered to be a significant safety risk. Nevertheless, we are committed to ensuring that there is no potential safety risk and we have written to tenants reminding them of their health and safety responsibilities, especially in regard to fire risk. The portfolio is insured for full reinstatement, loss of rent and property owner’s liability.” I also noticed this bit under the ‘Risk Management and Principal Risks’ Section: “Investment focuses on the primary heath real estate sector which is traditionally much less cyclical than other real estate sectors;…..” My hope is that PHP will be a bit of a diversifier in my Income Portfolio and hold up better than some of the other more cyclical Stocks when we get Market sell-offs. The chances are that PHP will not do much on the Upside though and it is more about the steadily rising Dividend Yield and its Defensive and Diversifying nature that appeal to me. Recent Capital Raising On 23rd March 2018 PHP announced a ‘Proposed Firm Placing and Placing, Open Offer and Offer for Subscription and Notice of General Meeting’ which you can see here: http://ir1.euroinvestor.com/IR/Files/RNSNews/2564/phpgroup_13857646.pdf The new Shares were issued at 108p which was a Discount of 5.3% to the Closing Price of 114p just before the Announcement was made. The Key Reasons for the Raising were as follows: “The Capital Raising will enable the Company to continue delivering its long-term strategy of growing the portfolio through selected property acquisitions in line with its prudent acquisition policies whilst maintaining gearing at a conservative level and supporting its progressive dividend policy.” This next bit is important because it shows PHP are very conscious of their ‘Capital Structure’ and as much as they use Debt, they clearly understand the dangers of letting it get out of control: “The Board's medium to long term target is to operate with leverage in the range of 45 per cent to 65 per cent of gross property value and in the short to medium term no higher than 60 per cent.” “The Group has taken its first steps into healthcare real estate in the Republic of Ireland and now owns three completed properties with 16 tenants, comprising nearly 118,500 square feet of lettable space, and is working to acquire or develop additional premises in the Republic of Ireland.” “to fund transactions from PHP's current acquisition and development pipeline totalling some £81.8 million in the UK and some €79.0 million in the Republic of Ireland” PHP updated the Market on 18th April 2018 with Results of the Capital Raising which you can read here: http://ir1.euroinvestor.com/IR/Files/RNSNews/2564/phpgroup_13887381.pdf Note they actually raised £115m against their initial Target of £100m. I see nothing to be concerned about with this Capital Raising. It is good that Existing Shareholders were given the chance to participate and buy more at the slightly discounted Price and it makes sense for PHP to be careful with their Leverage levels. Expansion into the Republic of Ireland seems a very sensible strategy and perhaps in the future they will move more into Europe as well - but that is probably a way off as yet. Debt Considerations These Bullets Points were taken from the ‘Preliminary Results Announcement’ from 15th February 2018 (there is a Link in the Section above marked ‘Recent Trading’):

I also noticed they had “Total undrawn loan facilities” of £101m at 31st December 2017 which was up from £90.5m at the end of 31st December 2016. On Page 11 of the ‘Preliminary Results’ PHP have a good piece on ‘New long-term financing’ which is worth reading - it essentially says that they have several sources of Funding and have been able to borrow at lower Rates over 2017. Of course this may not continue into the future. Debt Providers include Aviva, Lloyds Bank, Santander, The Royal Bank of Scotland, and “a range of Insurance Companies”. That’s it for Part 1 - I have started on Part 2 which is more about the Valuation and Chart side of things but it will be some time before it is fit for publishing. Cheers, WD.

4 Comments

Dave Royle

30/5/2018 11:42:01 pm

Pete,

Reply

WheelieDealer

31/5/2018 09:47:00 pm

Hi Dave, thanks for the comments - pleased you liked the Blog. I'm sure the Lord will cope even if he does go a touch green !!

Reply

Mohsin

31/5/2018 01:23:32 am

Nice one... BTW I already have VOD . now need to add PHP

Reply

WheelieDealer

31/5/2018 09:49:32 pm

Hi Mohsin, thanks for the feedback. As you can probably tell I am quite taken with PHP and really like it for an Income Portfolio - I particularly like the 'Defensive' aspects of it and reckon it brings more stability to my overall Collection of Stocks. It won't be exciting but it should deliver good Returns over many years with no stress on the way.

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|