|

This Blog has come into being after a long string of Tweets I sent out recently which were essentially about my Approach and how I intend to go forwards with ensuring that I can exploit how I do things to maximum effect but with minimal Risk and Effort.

I have actually captured the Tweets and put them into another Blog Draft and hopefully that will come out soon as well. I have added some other thoughts to those Tweets so it should make a decent read and in combination with a recent Blog about my Approach, Readers should have lots of detail on how I have evolved my methods and they can mull over any aspects they wish to copy etc. I will include a link to that Approach Blog at the bottom of this one. One of the concepts that I mentioned in the string of Tweets was that I see 3 key parts to my Approach which I have classified as System, Execution and Optimisation.

I have explained my System in considerable detail before and in many places, but the Approach Blog probably is the best repository of it. In terms of Execution it is really as it says on the tin and is ‘merely’ a case of going through the day to day motions of actually running my System.

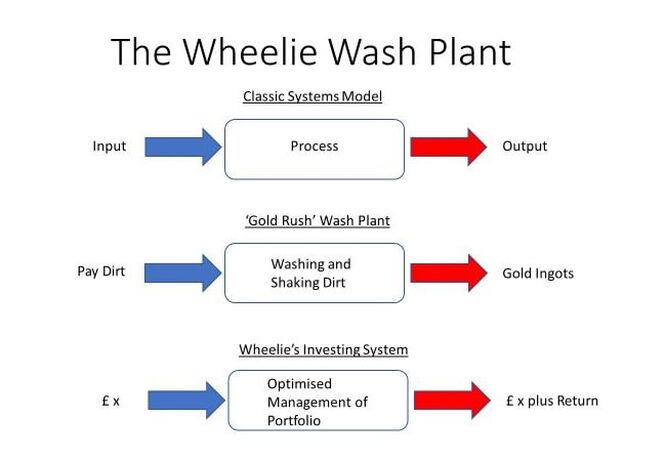

The final element is Optimisation and of course that is what this Blog is supposed to be about (I said it like that because so far I have only written a few paragraphs as you can see – and despite all my good intentions to write a decent Blog explaining all about it, I might not actually succeed and the rest of this document could be utter bilge and of no use to Man, Woman or Aardvark). In essence, Optimisation is about focusing in a detailed way upon the Execution of my System to ensure that I do it in the most effective and efficient way possible so as to maximise the Returns I can make in a given year. A ‘Real’ World Example of Optimisation I am pretty sure many Readers have seen the sublime ‘Gold Rush’ on Discovery Channel and will be very aware of what a Wash Plant is. For those of you who are silly enough not to have watched one of the best TV Shows ever made, a Wash Plant is in effect a Processing Facility through which the Gold Miners shovel in JCB Buckets of dirt which is then shaken and sprayed with high power water jets to separate the heavier Gold from the dirt and rocks and general crud that makes up ground. After all this shaking and water etc., the remaining material ends up in a thing called the Sluice Box which is like a gently sloping Slide at a kid’s adventure playground and within this there are sort of slanting strips of metal called Riffles that are to catch the Gold as the dirty water and remaining crud run out of the bottom of the Sluices. This mucky water runs back into a Pond where the material settles out to the bottom and the water can be recycled around several Settling Ponds before it then goes through the Wash Plant again as clean water. Bigger Rocks and stuff are taken out early in the Wash Plant processing and get chucked out to form piles of ‘Tailings’. Anyway, that’s the essence of a Wash Plant. You find an area of land that is tested to contain a high enough grade of Gold and then you dig it up and you shove it into the Wash Plant and after several processes, you get Gold appearing in the Sluice Box. Within the Sluice Box there is something called Miner’s Moss which are mats that contain more dirt and crud but also the Gold Nuggets and more usually loads of tiny flakes of Gold which then go into ‘The Gold Room’ where in effect more mini Wash Plants finally take out the Gold from the other material. The final stage is to melt it down and form Gold Ingots (little Bars). Then we come on to Optimisation. Anyone in theory could run a Wash Plant but unless there is considerable attention paid to the detailed processes involved, a large amount of the Gold that could be recoverable from the ‘Pay Dirt’ could end up running out of the end of the Sluices with the water, or being discarded into the Tailings pile. When the Miners set up a Wash Plant they put a lot of effort into getting the basics right such as making sure the Sluice Box slopes at the ideal angle to ensure that the Water runs through the Sluices nicely but at a speed which gives the heavier Gold enough time to drop behind the Riffles and to be captured. If the slope of the Sluice Box is too steep then the water runs too quickly and lots of Gold will just run out of the end of the Box. It can take a bit of experimentation to get the slope angle to the perfect setting and this kind of activity would count as an Optimisation task. So it is one thing to set up a Sluice Box so that you collect for example 80% of the Gold that you think is in the Pay Dirt, but the Optimisation is to try to raise this figure and get it up to perhaps 90%. Optimisation is the fine-tuning to do things in the best way possible, but of course always with constraints such as cost and time (throw enough money and time at it and you can probably get near to 100% of the Gold out but it won’t be worth the hassle as it could cost more than the additional Gold is worth). Another example that often comes up on the Show is when they try to speed up the Wash Plant. The idea here is that there are loads of Conveyor Belts and a thing called a ‘Trommel’ usually which is an enormous metal cylinder with holes in it – a bit like the Drum of a Washing Machine. Dirt gets passed through the Trommel which is rotating fairly slowly and this shakes out bigger rocks and stuff and the remaining dirt carries on through the Wash Plant for further processing eventually ending up in a small Gold Bar. I am not totally sure but I think underneath the Trommel they have something called the ‘Shaker Deck’ which is a fairly flat surface with sides to it that has holes in through which the smaller stuff falls. The idea is that there is an optimal speed that you can push square yards of Dirt through the Wash Plant to maximise the amount of Gold you get out of it in a given time period. This really is not a simple thing to do. In theory the faster you run the Wash Plant, and the faster you can shove Dirt into it at the start of the process, the more Gold you are going to get in a given number of hours. Of course, this is where optimisation comes in because you need to run the Plant as fast as possible and this is really driven by the speed of the Conveyor Belts within it, but the faster you go, the more strain you put on the machinery. Something you soon learn from watching Gold Rush is that all the mining operations are dogged by equipment failures and downtime for repairs and of course this is dead time when they are not processing Gold. This is a particularly acute problem in the Yukon because they have a very short summer season in which to operate and as soon as it starts getting cold, the equipment can freeze up and they are forced to stop. The other problem with speeding up the Wash Plant is that it means the Digger Operators have to be able to keep up with the demands for Dirt to be chucked into the Hopper at the start of the process and you have things like the ‘Grizzly Bars’ which are big steel girders that sit across the top of the Hopper and ensure no huge Rocks get into the start of the processing (Rocks getting jammed in the Plant and tearing the Conveyor Belts is a regular problem). If you operate too fast then the humans struggle and it not only means they get tired, but they start making mistakes and it becomes a Health & Safety issue because they do silly things like crashing Rock Trucks and not watching the Wash Plant closely enough so that it gets damaged without anyone realising and it means yet more downtime. The Mining Authorities in the Yukon are also very powerful and if they find the Miners infringing Safety Rules then they can shut the Operation down. Optimisation in this example can in essence spread to every single detail of how the Mining Operation functions. Another example can be that a Driver does a particular series of turns to pick up Pay Dirt in the Digger Bucket and then tip it into a Rock Truck to be driven to the Wash Plant, from where it is originally dug up in a ‘Cut’. It could be that a Driver goes forwards and backwards and turns and stuff but could do it with one less turn by taking a particular course etc. Another example could be that the Rock Trucks have to drive 3 miles from the Cut to the Wash Plant, but if they were to drive a different route, then it might be cut to 2.5 miles – it doesn’t sound much but when you are doing 200 Truck Loads a day it means less Diesel cost and reduces time and operator tiredness. Often such changes can require moving a Settling Pond or building a new Road – but it can be worth doing because of the efficiency improvements. So in essence, Optimisation is about looking in detail at every single task and breaking it down to the most effective and efficient way of getting it done. It is good old-fashioned ‘Time & Motion’ studies and needs highly detailed analysis – which of course can be aided with Computer Programs these days. What Optimisation means with regards to my Approach I don’t think it is too much of a stretch to view my ‘System’ as similar to the Wash Plant in ‘Gold Rush’ and in effect it is the same concept of Inputs going in one end, and then some processing being done, and Outputs appearing at the other end. Obviously for the Wash Plant it is Pay Dirt in at the start and then loads of washing and shaking and stuff and then Gold pops out the other end – ok, that is rather simplistic but that is the essence of it. For my System the Inputs I guess can be seen as Money and Stocks and maybe Index Trades and then the Processing is done whilst the Stocks sit in my Portfolio or the Index Trades do their thing in my Spreadbet Account, and then in time Money is the end result that pops out the other end !! If only it were that simple, hey. My Diagram below sort of shows this in pictorial form but I have taken the extreme liberty of saying the Input for my Investing System is really an amount of Money and the Output is hopefully that initial amount of Money plus a nice Return on it. Previously I said that the Inputs were Shares and Spreadbets but really the selection of those Investments is part of the Process of operating my System as opposed to an actual Input.

But if we assume that the Theoretical Model is along those lines, then the efficiency and effectiveness of my System depends on how well I do the Execution which means things such as:

Which leads us on to Optimisation which is really about taking the Execution Tasks and doing them in the most Efficient and Effective way. This means a laser-like focus on how I do things and putting in considerable effort to make sure I exploit every single thing I do in the day-to-day running of my System. Just like with the Wash Plant, I need to look in great detail at every single aspect of how I Execute things and to aim to do them as best I possibly can in order to maximise my Returns which pop out the other end of the System. Here are some examples of things I can do to Optimise my System but of course I am likely to keep discovering new tweaks as the years go by:

Finally, I was inspired earlier today from a rather obvious point (so obvious I should have realised myself !!) that Peter C3 made to me on the Fone. He hit the nail on the head when he said that everything I have been doing with my Website, Tweets, Podcasts and Blogs etc. has been very much about fine tuning how I do things and adding to my knowledge and skills and very much along the lines of the Japanese concept of Kaizen – Continuous Improvement. No doubt much of what I do has been about finalising my Approach, Execution and System but a huge aspect of it has been about Optimising how I do things and how I can squeeze out more and more Returns from running the Wheelie Wash Plant. Hopefully this Blog will get you thinking about how you do things and how well the concepts discussed here of System, Execution and Optimisation relate to your way of doing things. As you have probably seen me say before, I like to write material that is unusual and that you will not see anywhere else but is highly applicable to what you do – with luck I have achieved that with this one and it should get you thinking. Regards, WD. Related Blogs This is the one that outlines my Approach. This one includes loads of relevant links at the end of it to other related blogs as well: https://wheeliedealer.weebly.com/educational-blogs/the-pungent-essence-of-my-approach

3 Comments

17/6/2020 06:15:27 am

Great article Pete!

Reply

WheelieDealer

25/6/2020 10:38:35 pm

Hi Michael,

Reply

25/1/2023 04:51:39 pm

I lost my Job few months ago,my wife left me ,could not get income for my family, things was so tough and I couldn't get anything for my children, not until a met a recommendation on a page writing how Mr Bernie Wilfred helped a lady in getting a huge amount of profit every 6 working days on trading with his management on the cryptocurrency Market, to be honest I never believe it but I took the risk to take a loan of $2000. and I contacted him unbelievable and I was so happy I earn $22,500 in 6 working days, the most joy is that I can now take care of my family I don't know how to appreciate your good work Mr. Bernie Doran God will continue to bless you for being a life saver I have no way to appreciate you than to tell people about your good trade management system. For a perfect investment and good strategies contact Mr Bernie Doran via WhatsApp :+1(424)285-0682 or Telegram : @Bernie_fx or Gmail : [email protected]

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|