|

***STOP PRESS - AS I GO TO PUBLISH THIS DAVID DAVIS HAS RESIGNED AS BREXIT SECRETARY - SO A LOT OF WHAT I HAVE WRITTEN ON THE BRINO STUFF MIGHT BE SHIFTING ALREADY. COULD THERE BE A TORY LEADERSHIP CHALLENGE VERY SOON?***

***STOP PRESS 2 - STEVE BAKER BREXIT MINISTER RESIGNED AS WELL - A LEADERSHIP CONTEST LOOKS EXTREMELY LIKELY*** As always I don’t know how much I can cover today mainly because I am typing this in between spurts of rushing outdoors and spraying Primer on the Front Bumper of my BMW - if you follow me on the Tweets you might have noticed that I have been exploiting this amazing Weather to do some dodgy Paintwork on my Z3 which I have been putting off for Years. The bit I am doing at the moment should be fairly straightforward (but seems to take an immense amount of time - it is all in the Preparation and you have to have each stage spot on before you can move onto the next stage - sounds like building a Portfolio of Quality Stocks !!), and I am really using it as a practice run because I have a really difficult bit to do just above the Boot Lid where some Oik dented it (my suspicion is that a Bike fell against it and a Lever or something jabbed into my Z3’s Rear End - it is a tiny dent but if just annoys me). Bear with - I just need to pop out for another Coat of Primer !!

OK, I’m back. Where was I?

Oh, while I think of it, this is just between you and me but I am pulling a fast one and changing the convention I have been using for the Titles on my Weekend ’Charts’ Blogs. Keep it to yourself but in essence they will still be my Charts Blogs as usual but I am dropping the Charts bit from the Titles - in reality I cover a whole load more than just Charts in these Blogs and my worry is that many People to whom Charting is just ’Tea leaf, Mumbo Jumbo’, they see the Title and just don’t read them. Shame, cos maybe they are missing out. Anyway, this is our Secret and for all intents and purposes nothing is going to change !! So just view my Weekend Blogs as the Charts ones with Fake Spectacles, False Moustache and a Funny Nose !! Last Week We really are bang in the tedious Summer Months now and Last Week was typical of the sort of low Volume, low News, not much happening, kind of Markets that we might get for a while yet and of course Football is now the focus and there is some Tennis going on as well. The most interesting thing is that the US Markets had a strong Day on Friday and it looks like they could be turning up again. My Short Position on the S&P500 was Stopped Out (see the ‘Trades’ page for more details) and I took a tiny Loss equivalent to 0.2% of my Portfolio but this is the Price of Insurance in case of a Bigger Fall which thankfully looks less likely it is going to happen. The ‘Brino’ Brexit also makes it look like not much is going to change when the UK pretends to leave the EU, so Markets should be able to plod on for a while yet. My Portfolio was down 0.25% overall which is just Noise in the scheme of things. Strategy I’m sat here in my waistcoat in the style of Gareth Southgate deciding my Strategy for the coming Weeks…….. Nothing has changed from me - my 2018 Policy of not really doing much at all still applies (and it is likely to for a long time yet !!) and if anything I am looking to lower my Long Exposure by the odd bit of TopSlicing and this particularly applies to my Spreadbet Exposure which I would like to lower a bit. I had some good news on that - it turns out that these ESMA Rule Changes only apply to New Positions opened - Existing Positions will have the same Margin Deposit requirements as before. The upshot of this is that it will have very little effect on me immediately although I think it will mean that any Index Shorts or Longs I want to do will require far larger Margin Deposits - that is a bit annoying (more EU claptrap !!). So far I have heard this applies to igIndex which I use and also to CityIndex. It is very much in my mind that we have not had a Sharp Major Sell-off for a long time now - this makes me think that we could get some serious grief in the Autumn around the September/October Months - I am trying to lower my Long Exposure so I am prepared for this and I am in a position that I can buy on some Big Drops if I feel the need to. Hang on, I need to put another Coat of Primer on……… On the Tin it says “put at least 2 Coats on” - I must have done 12 and I can still see the blemishes underneath that I am trying to cover up…. Brino Brexit (Brexit in Name Only) T May seems to have got her Cabinet to line up behind the ‘softest’ of Brexits which of course will please nobody. Listening to the likes of Michael Gove making out that this is what Leave Voters wanted, it really strikes me that the simple fact is that the Clock has been ticking fast and they have all been mucking about like crazy and there is simply no time left to do anything else - especially if you lack Leadership and proper Courage which clearly all the Lilly-Livered Tory Cabinet do (I see Boris has been bleating again though so perhaps he will find some Testicles……..) I suspect T May has got a lot of this already agreed with the EU (remember she was talking to some Key Leaders last Week or so) and to be frank this version of Brexit is such a complete and utter capitulation on the UK’s behalf that the EU must be wetting themselves laughing at just how stupid and gullible we are as a Nation (in fact, I am embarrassed to type the word ‘Nation’ - it truly is pathetic). On the basis that the EU will except most of this (or perhaps with some tweaks where you can be 100% sure T May will give in yet again), because nothing will be changing this should be very good news for Big Business and the Markets should like it. The problem is that these things are never straightforward and it could be that the Pound recovers some ground and this then in turn hits the FTSE100 - although on the Flipside it could be that because the prospects for the UK are deemed to be better (remember, the Key Market participants like Fund Managers and suchlike would mostly have been ‘Remain’ Supporters), and this could mean some of the commonly believed ‘Brexit Discount’ on UK Stocks might reduce. However, there are many Risks around this. My particular fear is that this Comedy ‘Deal’ with the EU will disappoint the Majority of Tory Voters (something like 60%+ voted for Brexit and this nonsense trotted out by the Usual Suspects that Brexit Voters are thick as Pig Poo is clearly wrong and anyone with even a minor understanding of what Proper Brexit means will know they have been betrayed), and this has to increase the chances of a Corbyn Government which of course would be disastrous for the UK and disastrous for Stocks. This is because there were many Marginal Seats at the last General Election where the Tories only just took the Victory - if we see a Boycott by the Tory Brexit Voters (and they would be justified in doing so because this Brino Deal is a complete travesty), then that might be enough to mean Corbyn picks up these Marginal Seats. Hard Hats essential. There is also the issue of Trust in Politicians which is looking very shaky at the moment; the obvious implication of this is that we might get our own Donald Trump……… But of course Brino might actually be about to become Extinct. So far the Tory Troops have been fairly quiet (the odd Proper Brexiteer has made their thoughts clear) but the Key Bloke is Moggy and if he comes out and says in the next few Days that Brino is a joke then that might be enough to cause trouble for T May. It is very possible that this means the 48 Letters or whatever it needs to be that have to be sent to the 1922 Committee Head might get written. I think I heard that Monday Night is when the Brexiteers are going to discuss the Brino Deal (I think this is when the 1922 Committee meets anyway) and T May is due to present to them. There seems to be a lot of opposition to the Brino Deal from lots of Bodies etc. outside of the Tory Party - it could be that the EU rejects it and if so perhaps it makes a ‘WTO Rules’ Brexit more likely - that would be worrying for the Markets although of course a Weaker Pound as a result might help Stocks. It is just so opaque even after over 2 Years. In addition to all this Next Week Parliament moves on to the Customs and Trade Bills for Brexit - this is when the arguments in the Tory Partly will play out no doubt and there are countless ways in which T May will come under more pressure - one of them is around what Parliament votes for on Membership of the Single Market and of the Customs Union. Anyone for a piece of Brino Fudge? Yum. Down the Pub With so little going on at the moment (although I personally have loads of ‘Jobs’ and ‘Projects’ to do but it doesn’t take much for me to conveniently forget about those), I don’t need much excuse to get my Butt down the Pub and on Friday I had a lovely afternoon at some random Pub in Hatfield where I met up with a superb bunch of experienced Investors - @DianaEPatterson, @zygsuzin, @TreesieTT, @dosh100 which apart from being a really good relaxing laugh (although it was intensely hot !!), was very useful in terms of my Investing. If you have read the Blog Series on how my Investing Approach has evolved over many Years (I will include a link to them in this Week’s throwback to past Blogs bit), you might have noticed that I have gone through Phases in my Investing Career and this Meet-up in the Pub has made me think about one particular aspect. I mentioned in those Evolution Blogs how I felt that I had flatlined in my Learning and Advancement when I started doing the WheelieDealer thing and a big upside for me has been that the WD Stuff has enabled me to meet many really experienced and successful Investors that I would otherwise not have met. What strikes me about these Meets is that we rarely talk about specific Stocks - I think on Friday perhaps a handful got mentioned but often that was just ‘in passing’ and one of the Group might have mentioned a Particular Stock to highlight a point they were making with regards to how they do things to give a Real World example. So my point is that when I get to Meet like this we nearly always talk about how we manage our Portfolios and various Tools and Techniques that we employ to try to maximise our Returns and often this is to overcome our own Psychological Biases. This plays to the idea that actually selecting Stocks is in many ways the easy bit (as long as you choose from Quality Stocks and not the Junky AIM stuff) but what is more important is how you Manage your Portfolio in terms of things such as the Number of Holdings, Use of Stoplosses or not, TopChopping, Adding to Positions, methods of Entry etc. etc. I suspect that when we start off as Investors we are obsessed with finding Stocks to buy but it is as we mature that we start to realise that how we do things is really what makes the difference. Something for Readers to think on…… Ah, there is something else for Readers to think on. I have just come back indoors after yet another Molecule Thick Paint Layer, and I remembered I wanted to pick up on something else which was very much a Theme down the Pub. It was notable that I think all 5 of us seemed quite nervous about the near-term Future for the Markets - this was probably a bit around Brexit but also that the UK Economy is clearly very weak and that the Global Economy (apart from the US) seems to be slowing again. In addition, there was a feeling that after around 9 Years of the Strongest Bull Market in history, things are getting a bit ‘Long in the Tooth’. This caution was manifesting itself in high Cash Levels and it seemed like none of us were really doing much in terms of Buying. The other comment that kept coming up was that there are clearly a lot of fairly recent Investors who have only been around for the last few Years or so and they have been extremely fortunate to have started their Investing Careers when the Markets are really very favourable for Buying Stocks and holding them. The view around the Table was that many of these Newer Investors do not have Portfolios that are positioned for Tough Times and the common theme is that of very Concentrated Portfolios and a propensity to hold Small Cap Stocks. The trouble with this Approach is that Small Caps are extremely unwanted in Bear Markets and they get hit considerably more than Stocks from the FTSE100 etc. and those of a more Defensive Nature (they still get hit, but by much less - I am thinking here of Utilities, Big Pharma, Fags, etc.). The real essence of the problem is the Lack of Liquidity when we go into a Bear Market - there are simply no Buyers around at almost any Price on some of these Small Stocks and you just can’t offload them without taking a big hit - Daily Drops of 10% are not uncommon and this can be for several Days on the trot. This could merely be the bleating of old hardened Investors and perhaps our own Baises are tainting our thinking - but of course we might be right…… Anyway, the simple fact is that all Investors should be thinking through various Scenarios - What would you do if the Markets fell 20%? What would you do if the Markets fell 40%? etc. etc. You need to think about your own Psychological and Financial ability to sustain big hits to your Portfolio and it is important to realise that your ability to cope with big drops is MUCH LOWER THAN YOU THINK IT IS !!! A Trip down Short Term Memory Lane As I mentioned earlier here are the Blogs about my Evolution as an Investor: http://wheeliedealer.weebly.com/blog/evolution-of-an-investor-part-5-of-5 There are links at the start of that one to the other Parts of the Series. It has just struck me whilst grabbing this link that in a few Years maybe I should write a follow-up Blog to these which outlines how I will have changed in the intervening Period - that’s something to look forward to then !! On the subject of how important the way we manage our Portfolios is, here are some Blogs which address this matter: http://wheeliedealer.weebly.com/blog/pin-the-tail-on-the-monkey-musings-on-portfolio-management-part-1-of-2 http://wheeliedealer.weebly.com/blog/pin-the-tail-on-the-monkey-musings-on-portfolio-management-part-2-of-2 The Blog Slate Last Week I published the last bit of the Patience Blogs which seem to have gone down well with Readers and now my focus is moving on to my sort of Review of Robbie Burn’s ‘Trade Like a Shark’ where I am taking loads and loads of Quotes from the Book that I think are really key bits and then I am putting my views on what Robbie has said. I think Readers are going to find this extremely useful. The Blog is in good shape already and I should be able to get Part 1 out this coming Week - I suspect it will be 3 Parts in total and is actually much longer than I expected - but the Book really is top notch and you will get a flavour of this when you read my Blog. I know I also need to update the Weekly Performance chunk on the Homepage for June and I will try to get this done - but I have loads on at the moment and now I even have to spend time watching Football because up until now I have watched none of the England Games (I must be the only person in the Country !!) because I simply cannot be doing with all the Emotion and Disappointment which I have endured so many time in the past. I said all along that I would not watch any unless England got to the Semi-Final and lo and behold I now have to watch Football !! Actually I cheated a bit because I caught the last few minutes of the Russia vs. Croatia Game when it was 2-1 to the Croats and then in the dying Seconds the Ruskies drew Level - I couldn’t believe it !! Luckily the Penalties sorted it all out and it is probably best that England are facing Croatia because there seems to often be a Home Advantage of being the Host Nation. Besides that, if England were to beat Russia then Vlad would probably not let our Team back out and send them to a Gulag. I’ve been forced to stop spraying Primer on now - it has gone 10 o’clock and I can’t actually see where the Car is anymore !! Might as well sling some Charts in then. S&P500 As always the Charts I will show are from the excellent ShareScope Software that I subscribe to, and if you Click on the Charts then they should grow larger so you can see more detail. The Chart below is my actual ‘Working’ Screen which I use for monitoring Shorts and Longs on the S&P500 and the Narrow Yellow Box is highlighting a Big White Up Candle from Friday and this Triggered my Stoploss at 2752 where the Pink Horizontal Line is (marked by the Pink Arrow). Note also how the Up Candle from Friday actually Broke-out of the Green Downtrend Line marked by my Green Arrow - this is Bullish. It is interesting as well that the Candle on Friday turned up from the Blue Wiggly Line which is the 50 Day Moving Average - I have pointed at this with my Black Arrow. This Break higher is clearly a Bullish Phenomenon. My Blue Arrow is pointing to where I Opened my Short Position. I am quite happy with how this played out despite taking a Loss equivalent to 0.2% of my Long Portfolio Value. This is the Price of Insurance - had the Markets dropped and my Short was needed the Insurance would have Paid out but as it was not needed, I have taken a small Hit and my Portfolio is now pretty much 95% Long again. Think of it like this - opening a Short is like Selling a load of my Shares and moving to Cash - but using a Short in this way to ‘Hedge’ is much faster to turn ‘On’ and ‘Off’ and it is a lot cheaper. The other good thing about this Trade was the small size of the Position I put on. Had the Markets fallen then I could have increased the Position to give me even more Protection - but because they soon turned up again, I was able to Close out this Protection with a Small Loss (and remember I was nearly 85% Long as my Short was about 10%, so I gain on my Stocks anyway).

In the Bottom Window on the Chart below we have the RSI (Relative Strength Index) for the S&P500 Daily. On a Reading of RSI 55 it can go loads higher and the most important thing is that it has turned up now.

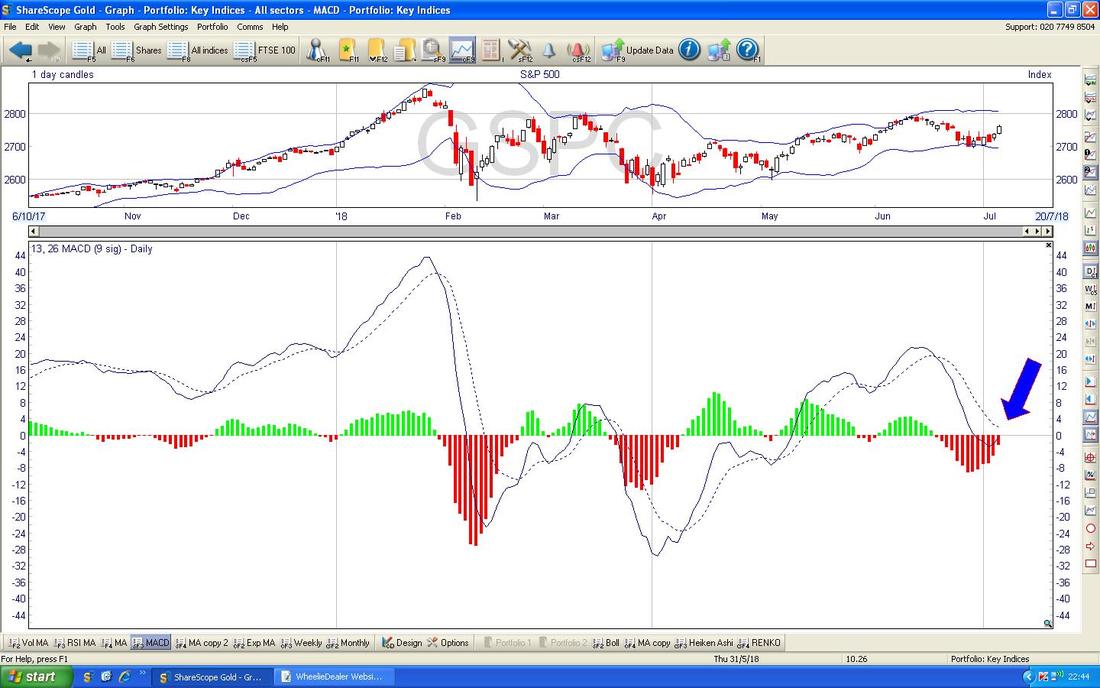

In the Bottom Window on the Screen below we have the MACD (Moving Average Convergence Divergence) for the S&P500 Daily. My Blue Arrow is pointing to where we are very near a Bullish MACD Cross on both the Histogram ‘Humps’ format and the Signal Lines format.

On the Chart below my Black Arrow is pointing to where we nearly have a 13/22 Day EMA (Exponential Moving Average) Golden Cross and if we get this in the next couple of Days, then this is very Bullish in the Short Term. My next Chart will show this more clearly.

After all these Years of using ShareScope, my mate showed me now to zoom in to very short Periods using the Mouse - so here is a Chart which shows how near we are to a 13/21 Day EMA Golden Cross.

On the next Chart please ignore most of it but focus on that Huge Blue Arrow and the Blue Downtrend Resistance Line. We need the S&P500 to get over this Line and this really means a breakout over the High where my Yellow Circle is - that is around 2792. If it cannot escape this Blue Line - then that is Bad News.

Now we have the Weekly Candles for the S&P500. My Blue Arrow is pointing to a rather lush ‘Bullish Engulfing Candle’ and after 3 soggy Weeks this looks a Bullish Event. Note also how the Blue Moving Average Lines (the Darker one is the 50 Day and the Lighter Blue one is the 200 Day MA) are both rising.

Finally we have the Heiken Ashi Daily Candles for the S&P500. My Blue Arrow is pointing to a nice Big White HA Candle and this is Bullish.

Dow Jones Industrials DOW

This is interesting because it does not look anywhere near as Bullish as the S&P500. My Yellow Circle is highlighting the Up Candle from Friday but note it is still below the 50 Day Moving Average Line which my Blue Arrow is pointing at. This is around 24600 and the DOW needs to get above that Level if it is going to get serious about being a proper Bull again. Like with the S&P500 that Green Downtrend Resistance Line is important (Green Arrow) and the really important Level to Breakout over is 25402. Note however that the 50 and 200 Day MA Lines are both rising which is good for Bulls.

The other ‘things’ on the DOW Charts are quite similar to the S&P500 but a bit behind in terms of time. It looks to me that yet again the Tech Nasdaq Index is driving things and this is why the S&P500 is so spunky with the less Tech heavy DOW lagging.

Nasdaq Composite Time is short so I won’t show much here but the Chart below has the Daily Candles for the Nasdaq and my Green Circle is pointing out the Big White Up Candle from Friday and this looks very Bullish. Next Stop is the All Time High just above 7800 and it must be very likely the Nasdaq breaks-out above this - 8000 would then be in the Sights. Note how it turned up off the 50 Day MA where my Blue Arrow is. All the ‘Experts’ and ‘Gurus’ say that Tech is overvalued. It might be, but that doesn’t seem to stop it charging on up.

The Chart below has an extremely rare but extremely Bullish Technical Event on it. Where my Blue Arrow is note that the Black 13 Day EMA Line was heading down towards the Green 21 Day EMA Line and it looked like a Bearish ‘Death Cross’ was on the cards. Note though, that we did not get the DX and instead we got a ‘Skim-off’ or ‘Glance-off’ and these kinds of things are really Bullish in the Short Term.

Just to clarify, I said “in the Short Term” because that is the nature of a 13/21 Day EMA Crossover - they are Short Term things. However, if we had a ‘Skim-off’ or ‘Glance-off’ on Longer Term Lines, like the 50 and 200 Day MAs, then this would be a Longer Term thing.

To keep the Bullish theme going, here we have the Weekly Candles for the Nasdaq Comp and my Black Arrow is pointing to a Bullish Engulfing Candle - nice.

FTSE100

There’s really not a lot happening here. My Chart below will be largely familiar to Regular Readers (don’t worry, I won’t trot out that tired All Bran quip this time or substitute it with Prunes…….) and the Downtrend Channel I concocted with my Parallel ish Green Lines is still in force. The FTSE100 must get above my Top Green Line (similar to the US then !!) if it is to properly go higher and this means getting over the crucial 7700 ish Level then. My Pink Arrow is pointing to a Small Up Candle from Friday but it clearly isn’t doing much. My Yellow Circle is showing a Bullish Golden Cross between the 50 and 200 Day MAs and this suggests Weeks and Months of Gains - clearly it would be nice if the FTSE100 actually got on with that !!

There is some hope here for the Bulls. In the Bottom Window on the Screen below we have the MACD for the FTSE100 Daily. My Blue Arrow is pointing to where we are very near a Bullish MACD Cross on the Histogram Bars format and the Signal Lines format.

My Green Arrow on the Chart below is pointing to a Bearish 13/21 Day EMA ‘Death Cross’ which is still in force. For the FTSE100 to get properly Bullish, we need to have the opposite, a ‘Golden Cross’.

I need to finish this off here. I have just heard that David Davis has resigned as the Brexit Secretary - oh dear……and now Steve Baker, the Brexit Minister…..T May is toast. Anyway, looks like plenty of fun to come next Week - Good Luck everyone !! Cheers, WD.

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|