|

My mate Phil (@sloan_phil on the Tweets) has kindly provided this Guest Blog following the recent events regarding cuts to Dividends and his action in reviewing and rejigging his Income Portfolio. I have read it a couple of times for proofing and all that and it is really good and has some excellent insights into investing in US Stocks.

Many thanks to Phil for providing WD Readers with this and a personal thank you for saving me a load of work in writing a blog this week !! Cheers, WD.

“This time it’s different”

We hear the phrase trotted out a lot in financial markets, but this time, it probably IS different. We are after all dealing with a global pandemic; the scale of which we’ve not seen since the Spanish Flu outbreak over a century ago. Not surprisingly then, it’s a testing period for portfolios, but even more so it would seem, if you happen to run a dividend portfolio. My own portfolio, which I have run for over 20 years now, is typical of many dividend portfolios and is defensive by nature - usually outperforming on market falls, whilst lagging somewhat when markets are buoyant. This time however it has been noticeably different, and what I thought was a robust and conservative portfolio has shown defensive qualities more akin to Sheffield Wednesday’s back four. Consequently, by the end of March I found myself down by over 20%. So why is this time different for Dividend portfolios? The big factor that I’m sure you’re all aware of by now, has been the ‘trend’ (I’ll call it that, because that’s what it seems to have become) of companies cutting or suspending their dividends. Worse still, some even retrospectively cancelling already declared dividends (even after going ex-dividend!) – a dangerous precedent. According to a recent article by ‘Shares Magazine’, by the 9th April, 233 UK-listed companies had taken such action, entirely in response to issues arising out of COVID-19. For some sectors that have been ordered to close down their operations such as restaurants, retail and travel, it seems a prudent and understandable measure, albeit an unwelcome one from a dividend investor’s point of view. It has been necessary in order to strengthen the balance sheet, preserve cash and give a company the best possible chance of survival in the uncertain months ahead. But some companies have seemed a little too keen to jump on the bandwagon, house-builders for instance have huge surplus cash balances and no debt, yet have pulled previously declared dividends, including specials (such are their current cash surpluses!). Then there’s the interference from the regulators and authorities. The PRA (Bank of England – Prudential Regulation Authority) instructed the banks to cancel any previously declared dividends, and then suspend future payments, and it later transpired they’d also sent similar recommendations out to insurers. A final issue, that I believe won’t necessarily have been priced in (but in my opinion is a very real concern) is when these companies do eventually reinstate their dividend, be that 2021 or whenever, will they rebase to a lower, more comfortable payout ratio? Take Aviva AV., for instance, whose forward dividend yield on the day it announced its cancellation was 12%. Presuming they’re in for a difficult 6-12 months (and let’s face it they wouldn’t have cancelled the dividend if they didn’t think they were, would they?), the likelihood is that they’ll reset at about half that level. You have to question if you’re not getting a (good) dividend out of Aviva, why else would you hold their shares? So what should you do, if you’re an Income Investor? Despite the V-shaped bounce we’ve just experienced in April, more market turmoil could still come, so I think it’s a worthwhile exercise reviewing both the structure of your portfolio and the strength of the balance sheets on the individual companies you hold. How do you feel they’ll cope if the lockdown lasts for an extended period? How much surplus cash do they have to fall back on? How much debt? What is their interest cover like? How much dividend cover do they have and is a cut likely? These are some of questions you should ask yourself. My own Portfolio Review – what did I uncover and what action did I take? Hopefully, by discussing the structure of my own portfolio, it may give you food for thought on your stocks and shares. For those who aren’t particularly interested in hearing the ins and outs of my portfolio, feel free to jump to the next section, where I discuss a couple of leftfield suggestions for income investing in this ‘new world’. Firstly, I should say as far as dividends are concerned, I’m currently showing a 12% reduction in projected income for this year (better than I’d feared), but expect that figure may well rise before all this is done. I’m guilty of having an overly diverse portfolio of around 70 UK individual companies, Investment Trusts (IT’s), Real Estate Investment Trusts (REITS), and Unit Trusts (OEICS). I appreciate this is way too many to keep close track of effectively, but it was partly by design, rather than just a ‘monkey with a pin’ approach (honestly!). This extreme level of diversification provided my portfolio with a greater ability to absorb profit-warnings and had quite effectively helped my dividend income grow at around 10% p.a. over the past 5 or 6 years (which is my portfolio’s primary objective). It’s possibly also the reason for my income being relatively unscathed, with a large proportion made up of IT’s & REITs. IT’s have the ability to build up income reserves in good years, to call upon in leaner years (2020 step forward!) which help smooth out and maintain or grow dividends, regardless. This is a big advantage they have over OEICS (Unit Trusts). REITS on the other hand legally have to pay out at least 90% of their earnings as dividends, so as long as their ‘earnings’ hold up (i.e. as long as their tenants are able to pay them their rent) then they have to pay you the lion’s share. So a lot depends on the sectors in which they’re invested, the quality of their tenants and their Loan to Value Ratios( LTV’s) (the lower the better). Big-box warehousing, infrastructure, utilities, renewables, pharma/healthcare and consumer staples are all sectors of the economy that I’m invested in and these are holding up reasonably well. After initially falling with the rest of the market, the likes of Tritax Big Box REIT BBOX, Urban Logistics REIT SHED, Ecofin Global Utilities Infrastructure Trust EGL, Impax Asset Management IPX, Supermarket Income REIT SUPR, Assura AGR, Finsbury Growth and Income Trust FGT have bounced back quite strongly and my overall portfolio has subsequently gained more than 15% since the lows. I’ll be keeping all my IT’s and REIT’s, indeed I was fortunate enough to top-up on BBOX when it dropped approximately 40% in a matter of days. There’s worse places to be right now than logistical warehouses for internet shopping… I have significant holdings in the two Evenlode funds, plus smaller holdings in Fundsmith Equity and MS Global Brands, which are all OEICS and offer Global exposure and in all but Fundsmith, growing dividends. They’ve performed relatively well, so are long term holds for me (more on OEICS later). Clearly the biggest area of risk for me, therefore, are shares in individual companies. As we’ve seen in this past month, one RNS can wipe out 100% of what you might have already penciled in on your spreadsheet to receive from that company. The swathe of dividend cuts from individual companies in the UK has been a real eye opener and reality check for me. My memory isn’t what it used to be, but I can’t ever recall so many already-declared dividends being cancelled during my 20 years or so of investing. After a few sleepless nights therefore, I decided the time was nigh to have a little cull and reduce the number of individual stocks I hold in the process. Of the ‘dividend sinners’ I hit the sell button on a couple of housebuilders, alongside Lloyds LLOY, AV. and ITV. Whilst I’m a huge dog lover, I’ve no place for them in my portfolio! I was fortunate to sell out of Indoor Bowling operators, Hollywood Bowl BOWL & Ten Entertainment Group TEG, prior to them being ordered to shut down; and also cut Hotel Franchise business International Hotels Group IHG due to both the sector it operates in and the level of debt, which was also why DS Smith SMDS and WPP had to go (both later cancelled their dividends). Aircraft leasing company Avation AVAP was also one of my early sales. All businesses I liked, but in their specific circumstances, I felt it was prudent to sell and protect the capital. I’ve not been throwing the baby out with the bathwater though, and have kept some quality individual companies for the long term; Unilever ULVR, Diageo DGE, Games Workshop GAW, Strix KETL, Moneysupermarket MONY, AstraZeneca AZN & GlaxoSmithkline GSK all fall into this bracket. Not forgetting Legal & General LGEN, who got a big pat on the back from me (well, a 30% top-up!) for telling the Bank of England to “do one” and reaffirming their intention to pay shareholders their previously declared dividend. The net result of all this activity is a more slim-line portfolio of quality companies, many of whom have manageable debt and decent prospects going forward. This has resulted in my cash reserves growing to 16% (and in reality closer to 25% with funds raised from selling out of some other investments). So where will I be putting my newly raised cash? It might not feel like it right now, but if you’re a young investor, or someone with fresh cash to inject into the markets, the next 12 months or so, could be a fabulous time to be investing. Whilst there is undoubtedly more bad news ahead, it’s important to remember that markets are forward-thinking and will already be pricing in much of it, both economic and human. Consequently, over the next 12 months or so, I’ll be slowly adding cash into the markets, primarily towards 2 distinct areas, which as an income investor you might not necessarily have considered, but in my opinion are worthy of some thought:

Unit Trusts (or if you’re posh, OEICS) are often shunned by the private investor community, as having expensive ongoing charges and offering poor returns (especially actively managed funds), and I’ve been guilty myself of dismissing OEICS for such reasons in the past. However, it’s not always the case, and they do offer some appealing aspects too. Potentially they enable you to become a more nimble investor. In the event of a market shock like we’ve just experienced, you can sell up quickly and move into cash with very little, or in some cases no cost at all. Quite different to having an unwieldy portfolio of individual shares, which can prove hugely expensive and time consuming to convert into cash. Also, if you’re invested in smaller, AIM-listed shares, you might find that the option to sell just isn’t there, as the markets are too illiquid, or the Market Makers won’t allow Internet dealing. I also find it useful to have a few reliable ‘go to’ funds to hand on big move days. I like to average down/pound cost average, so when the markets are tumbling and everything looks ‘on sale’ and traditionally I’ve been stuck like a rabbit in headlights, I can now instead just put in a buy order for one of my funds, and get a nice basket of companies on the cheap. Timing the market shouldn’t really be an issue for long term investors, but if you’re a bit of a tight git like me, EQi (or selftrade as it was!) can be a good platform to use, as you can leave placing orders until 11:15am, for order execution 45 minutes later, so you know near as damn it what sort of level you’re buying in at. Table 1, below, shows a selection of actively managed funds, offering consistently market-beating total returns (FTSE All-Share Tracker is highlighted for reference):

Table 1: Courtesy of SharePad.

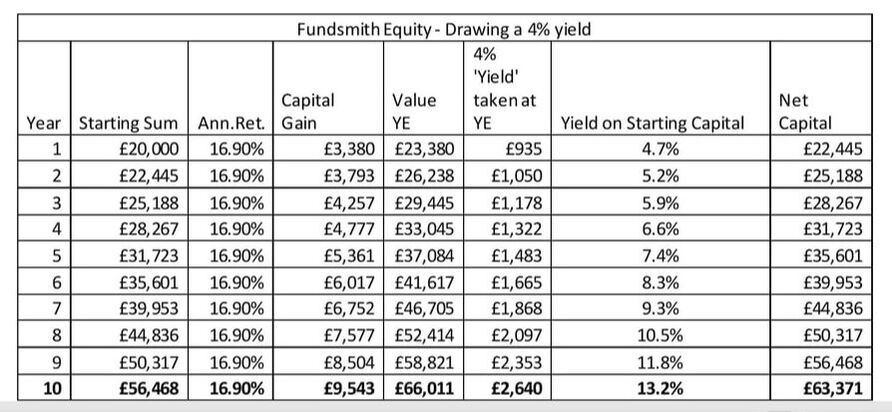

I’m looking to invest at least a third of my portfolio in OEICs, and the 2 main funds I’ll be buying into over the next 12 months or so are Terry Smith’s Fundsmith Equity & Blue Whale Growth, run by Stephen Hui. Both have excellent track records and crucially, have performed relatively well in the latest crash too. Now if you know anything about these funds, you might think they’re strange choices for a dividend investor, after all, they don’t pay dividends. No matter! Because like Baldrick, I have a cunning plan… My intention is to view things very much on a total return basis, buying accumulation units and then looking to sell 4% of these units each year, thus guaranteeing an initial 4% yield. Taking Fundsmith as an example, table 2 below demonstrates how things could pan out should I, for instance, invest my full ISA allocation with them this year:

Table 2. Fundsmith Equity – Drawing a notional 4% yield p.a

Now the table is for demonstration purposes only, but it does highlight how this strategy could work out very nicely in terms of both income and capital growth over a longer timeframe. I’ve used Fundsmith’s own annualised return rate over 10 years of 16.9% (a level which my own p/f can’t match!) which after this year will undoubtedly take a hit, but I believe many of the companies held in the fund will prove a lot more resilient than most in dealing with what lies ahead. Indeed, the performance of his fund during this difficult period (as seen in Table 1) has borne this out. To a lesser extent, I’ll be doing similar with Blue Whale Growth Fund, the young pretender to Fundsmith, run by Stephen Hui. This is the man that Peter Hargreaves (of Hargreaves Lansdown HL. fame) enlisted to look after his own fortune. If he’s good enough for him, he’s probably good enough for me too! Over the last 12 months I’ve also been impressed by and buying into MS Global Brands Equity Income, which has performed along similar lines as Fundsmith these last couple of years. It has the added of bonus of paying a growing dividend, currently over 4%, so I’ll continue with this fund alongside larger holdings in fellow dividend payers, Evenlode Income and Global Income funds. All good ‘go to’ funds on big down days. Legal and General Healthcare and Pharmaceuticals is the final fund I’m considering adding to my ISA (I already hold in my SIPP). It’s been a top performer over the years too, pays a smallish but growing divvy and in part is a nod to my previous employment in the Pharma industry.

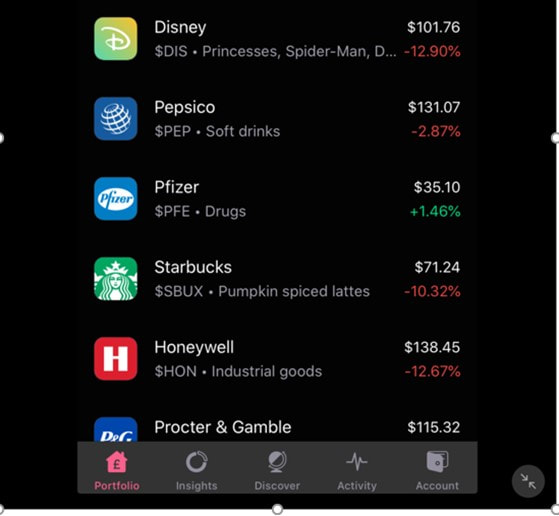

The second key area I intend to expand into, is a portfolio of US shares, which I would like to build up to 20% of my portfolio (I’ve already started this project about 6 months ago, and it currently accounts for about 10% of my total portfolio value). For some years now, after reading the excellent articles from US Dividend Growth investor and blogger, Jason Fieber, I’ve wanted to hold shares directly in top American companies, but broker fees (dealing charges, FX charges, admin fees, etc.) with traditional brokers (HL., AJ Bell AJB etc. step forward!) were just too prohibitive. As is often the case when companies are raking in high margins, others step in to exploit, and recently two new brokers have emerged in the UK, namely Trading 212 and Freetrade. They intend to disrupt the sector and make investing in US shares incredibly easy and cheap (well, free, actually!). The beauty of trades being free, means you don’t have to go ‘all in’ on day one with your purchases, like you possibly would do with traditional brokers, in order to keep dealing costs under control. With Freetrade and Trading 212, you can simply drip your way in, and slowly build a position, without the need to really nail down your timing. A ‘watchlist’ screenshot from the Freetrade App:

These apps are primarily targeting millennials, but the good news is, even if you’re an old fart like me, they’ll happily accept your custom. Fully regulated and covered by the FSCS (Financial Services Compensation Scheme), they both offer excellent, cheap ISA services, with one or two new features (e.g. Fractional shares) and could be quite a threat to mainstream UK brokers in the future. (*If the idea of opening an account with either appeals, please see the resources section at the end of this post, for sign-up links, where you’ll also be awarded a random free share up to £100 in value just for signing up!)

The attraction for me of a US portfolio, over individual UK companies, primarily comes down to quality. The US holds many of the top companies in the world, both in terms of size and quality of earnings. Many have long histories of dividend growth and enjoy elevated status amongst investors as Dividend Aristocrats (25+ years consecutive dividend growth) or even Dividend Kings (50+ years of unbroken dividend growth). One such ‘King’, Procter and Gamble PG, raised its dividend by 6% just recently on the 14th April, continuing a 64 year consecutive run of dividend growth, whilst my biggest holding Johnson & Johnson JNJ also announced a 5% hike on the same day, and both beat earnings estimates. A stark contrast to what we’re seeing in the UK right now. Generally, the dividends paid by US companies do tend to be a little lower than UK companies, but they’re dividend growth rates are higher, and their resolve to continue to pay their shareholders dividends during testing times is proving to be much greater than their UK counterparts. So far, none of the US shares I hold has cut, or even reduced their dividends as a result of the pandemic. I intend this to be my ‘Hold forever’ portfolio requiring little in the way of maintenance or monitoring, hence I’m going for the cream of the crop, world leading companies, the majority of which will provide decent, reliable, capital and dividend growth for years to come. The likes of JNJ, Microsoft MSFT, Visa V, IBM, Pepsi PEP, Coca-Cola KO, Kimberly-Clark KMB, McDonalds MCD, 3M MMM, Pfizer PFE, and one non divvy payer, Facebook FB, are some of the household names I’m investing in. And the beautiful thing about this all is, the recent crash provides a great entry point for many of these top companies. Despite a strong recent rally, I suspect there’ll be more opportunities in the weeks and months ahead to buy into some of the world’s top companies at reasonable valuations. Final Thoughts I’m hoping that with the retention of my Investment Trust and REITS, combined with a greater allocation to OEICS, and reduced number of UK individual companies, I can shelter myself better from future market storms and be more nimble if required. In addition, I hope to establish a more reliable dividend stream from my US portfolio of ‘sleep-easy’ investments. If you’ve read this far, I’d like to thank you for your time and congratulate you on your stamina. Hopefully, it’s giving you one or two things to ponder on, and maybe spark a review of your own portfolio if you haven’t already done so. Please check out the resources below, for further reading/watching. Please note I’m not a financial advisor, and none of what I’ve written should be taken as financial advice. Regards, Phil @sloan_phil Resources: • First port of call for research into Investment Trusts: https://www.theaic.co.uk/ • Excellent resource for OEICS : https://www.trustnet.com/ • Fundsmith Shareholders Annual Shareholders Meeting 2020 – if you want to watch something other than Disney+ or SkySports re-runs of The 2016 Masters: https://youtu.be/PZy9-4Z_4i8 • Blue Whale Growth fund – recent interview with the Manager about the impact of Covid-19 on his fund: https://youtu.be/_OLHwr4obro • *Trading 212 Use this link here to sign up and get awarded a free share worth up to £100 : www.trading212.com/invite/FMACYT9Y (please note, I will also get a free share also) • *Freetrade : if you wish to sign up to their app and get a free share, please contact me on Twitter: @sloan_phil • Some knowledgeable US dividend investors / bloggers and youtubers:

4 Comments

Phil Sloan

1/5/2020 07:11:35 pm

Many thanks, weenie!

Reply

Jeff

1/5/2020 09:36:18 am

Hi Phil,

Reply

Philip Sloan

2/5/2020 12:03:45 pm

Thank you very much for taking the time to read my post, Jeff, and for your useful feedback..

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|