Guest Blog from Justin Scarborough - Finance for Non-Finance People - Part 2 Company Valuation13/6/2018

This is the Second Part of an excellent Article on Accounting Basics produced by Justin (@justinscarboro2 ) and kindly offered for sharing on my Website. If you have not read Part 1 you can find it here:

http://wheeliedealer.weebly.com/blog/guest-blog-from-justin-scarborough-finance-for-non-finance-people-part-1-the-basics Oh, and while I think about it Part 1 had some excellent Reference Material in it so I have created a new Blog Category called ‘Accounting’ so if you click on that you should be able to find it quite fast in the future. This Second Bit covers Company Valuations in the main and I did some Blogs myself on this subject quite a while ago now and you can find those here: http://wheeliedealer.weebly.com/blog/valuation-valuation-valuation-bursting-for-a-pe-part-4-of-4 There are Links at the bottom of that one to the earlier 3 parts. Cheers, WD (P.S. - Thanks Justin, the feedback I have had from WD Readers has been really glowing on Part 1 and I expect we will get more such applause for this bit - Pete).

Company valuation – an art not a science

I spent 27 years in the City with the aim of coming out with a specific company valuation which drove a recommendation on a company which I then used to try to sell the idea to the investment community. While I got a lot of things right, I also got a lot of things wrong, not because of a lack of knowledge about a sector or a company but because either a) I used a wrong valuation methodology or b) I used what I perceived as the right methodology, but the majority of the investment community disagreed with my methods – hence the art not a science. There is a wide range of valuation tools, some really quite simple and some extremely complex:

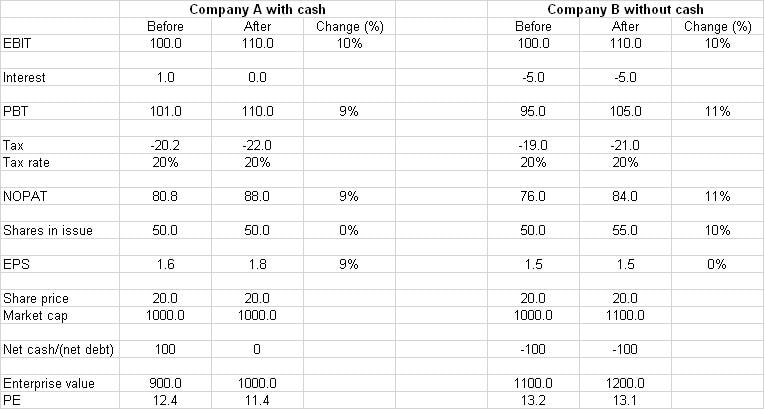

There are many other valuation methodologies, some of which are closely correlated to share price movements over long-term time frames. For example, if a company is generating a ROCE way above its WACC that should be reflected in a high PE. However, this is not always the case but what is normally the case is that the ‘excess’ returns pertaining to the capital invested are reflected in the EV of a company. One of my favoured methods used in my past life was plotting EV/IC (Enterprise Value divided by Invested Capital) versus ROCE-WACC or ROCE/WACC. Two companies may have the same IC, but one company may have generated a 20% return, the other a 15% return. This would, or well should, be reflected in a higher multiple of EV/IC for the 20% return. This metric held the best correlation co-efficient of any metric I used. The financial impact of acquisitions: EPS and ROCE This is another fun topic – often seen as complex but in reality rather simple if explained properly. When making an acquisition there should be 2 central questions, which have to be aligned (in the ideal world). Is the transaction Strategically sensible? and does it generate a positive Financial outcome? – Strategic and Financial – never separate the two. We could include Operational but often it is only the acquiring company that has the data to be informed about the operational benefits (synergies). The best way to explain the financial effects is to use an example. We will use 2 companies which are exactly the same bar one simple fact. One company has net cash on its balance sheet and one has net debt.

The EPS effects of Company A and B are very different only because they are financed differently. So,

Thus, when doing an acquisition, the EPS effect is all about how the deal is financed given that the ROCE is the same for both acquiring companies. Ideally, funding deals out of cash or lower cost debt is more beneficial to EPS than when issuing shares. The only issue though is when a company gears itself up too much (too much debt for the level of cash or EBITDA it is generating) and at times like this, issuing equity may have to form part of the funding equation. Finally, the relationship between a PE and ROCE can be seen when doing a deal.

A quick word on Acquisition Synergies A company which builds an acquisition case including significant cost or revenue synergies is dangerous, in my view. Often, they never materialise, or if they do, they get reinvested and shareholders never see them. Without synergies though, many acquisitions would not stack up financially despite the strategic attractions. Here in lies the rub – most acquisitions do not achieve the expected financial outcomes. So beware the serial acquirer.

1 Comment

25/6/2024 04:57:11 pm

I really like your post. Thanks for sharing such a informative blog. To register a company, choose a unique business name and structure (e.g., LLC, corporation). Prepare necessary documents, including articles of incorporation and an operating agreement. File these with your state's business registration office, pay the required fees, and obtain an Employer Identification Number (EIN) from the IRS. Ensure compliance with local, state, and federal regulations.

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|