|

This Guest Blog has been kindly sent to me in order for Readers to see what Journal.Investments are providing in terms of a Website through which you can record information about particular Stocks in a structured way with various ways to analyse your performance and it is FREE to use. I first became aware of this perhaps a year ago and I have had various chats with the guys who run it with regards to how it can be shared with the wider community. It is now ready so feel free to take advantage. Having proof-read the text they sent me I have to say that it does sound a very useful tool.

I have no commercial relationship with Journal.Investments. Cheers, WD. PS. You can find a copy of ‘The Art of Execution’ in Wheelie’s Bookshop if you are desperate to spend money.

An Introduction to Journal.Investments

Journal.Investments is an investment journal and diary that helps you organise your research on companies and track your investment performance in more detail, including checklists, cloned portfolios, and performance breakdown. It is completely free to use and you can sign up at https://journal.investments/ and follow us on twitter @journal_invest. Introduction We decided to build Journal.Investments for several reasons, most notably:

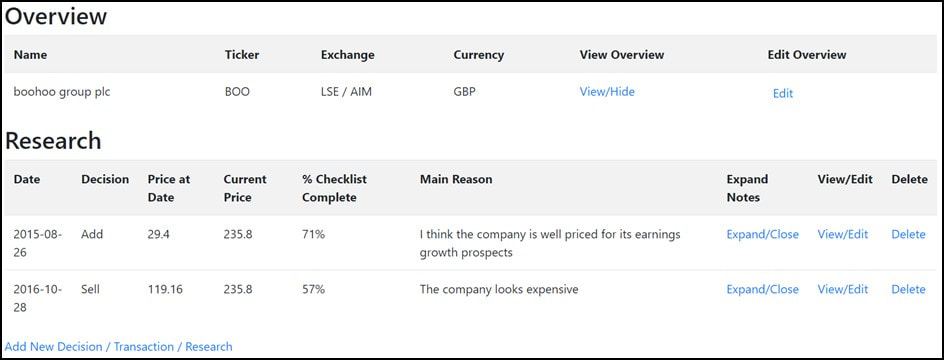

This started out as a personal project, mainly to help us with the above issues, however we realised that it may be useful for a wider audience and decided to make it available to everyone to use. The basic premise of the website is that every time you research a company you type up your notes and reasons for buying, selling or doing nothing and score the company against your checklist. If you buy or sell, this is tracked and your portfolio is calculated and your performance tracked. Many websites allow you to build a portfolio, but we think there are elements of Journal.Investments that make it a much more useful tool for all investors. Getting Started We have tried to make it as quick and easy to use as possible. Signing up takes less than a minute and then you can bulk upload your history of transactions to get started. You will immediately be able to see analysis of your performance (more on that below). Organisation of Company Research There are generally two types of research you do when you are looking at companies: understanding what the company does (the overview) and deciding whether to buy or sell (transaction research). These tend to have different characteristics; the former involves looking at the products and services offered, the markets it plays in, and other factors that won’t change within a few years. The latter is more about whether now is the right time to purchase, so looks at additional factors including valuation, outlook and so on. We have split these into two as you can see in the screenshot below. Each company you look at will have its own dashboard, where you can see any decisions you made, the price at which you made them, the % of checklist complete and so on. You can also expand the overview or the transaction research to see your more detailed notes and comments. From this screen you can also edit your existing research or add new research.

Checklists

Having a checklist is an extremely important part of being a successful investor, as Charlie Munger says “No wise pilot, no matter how great his talent and experience, fails to use his checklist.” Stock Screens are great, but usually are only the start of the research process. Most investors look for things that it is generally impossible to screen for such as recurring revenue, high quality management etc. and this is where checklists come in. With Journal.Investments you can build your own custom checklist that you fill out every time you add a new piece of research. You can then quickly and easily review your decisions against your checklist and quickly see what has changed as well. We are also working on some analysis where you will be able to see your performance by the % of your checklist that was complete, to give you an idea of how effective your checklist is. Checklists also help you to be much more disciplined – they should make you think twice about buying that ‘AIM story stock’. Consequently, we think the best way to use Journal.Investments is to fill out the research page before you hit the buy or sell button. Analysis of Performance One of the reasons for building the site was to better understand our investing performance, and we have built several different analyses that help with that and have more planned. Overall Performance The overall performance view looks at your overall and annualised returns, and breaks that down by capital gains, dividends, and the impact of fees. This way you can see performance over time, what drove that performance and whether fees are taking up a significant proportion of your gains. Company Performance A key message in ‘The Art of Execution’ is that even the best investors buy the right company’s only slightly more than half the time (there are some exceptions), but it is how they deal with their winners and losers that makes the difference. This view splits out the companies into winners and losers, let’s you see your % winners and % losers, and also how much you made on average on winners, and lost on losers. This helps you to understand whether you are ‘running your winners and cutting your losers’ successfully. It’s also interesting to recap on what your best and worst investments have been, and to try to understand what went right or wrong. Cloned Portfolios Cloned Portfolios take a snapshot of your historical portfolios and roll it forward to today to understand whether decisions you made in between improved performance or not. There is often a tendency to ‘overtrade’ which can diminish your returns and increase your fees – these cloned portfolios will give an indication of whether that is something you are doing. More to Come We have more analyses in the pipeline including performance based on % of checklist completed; performance based on holding period; and performance based on ‘averaging down’ or ‘topping up’. Keep in Touch We hope you find Journal.Investments useful and easy to use. We are very keen to receive feedback on how we can improve it – whether adding new features or improving existing ones. So please feel free to email us on [email protected] or use the feedback form at the bottom right corner of the website. Thanks for reading, regards Henry and Ben.

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|