|

My mate David from Blackthorn Focus is holding an Investor Event on Tuesday 26th June in Cambridge which you can see details of below and I asked him if he could knock up some words on each of the Companies as they look quite interesting. He has done exactly this and I have added some thoughts underneath.

I have also repeated the bit about the Duxford Aerodrome Event on the day before - Monday 25th June - everyone is invited and it will be a fun day out I am sure. Full disclosure, I am taking no commission or anything from David. He is a mate and we regularly chat about Stocks (he is an excellent Investor) and I am merely helping get the word around about the Event he is organising. It is up to Readers if they want to go or not and it could be a decent chance to talk to the Directors of some interesting quality companies. Cheers, WD.

“Big Yellow Group BYG is the big daddy of the UK's self-storage sector. In the last 20 years, this industry has quickly established itself as a thriving consumer niche. Co-Founder and CEO Jim Gibson will be speaking about the company and its industry at ALPHA Investor Forum and with the kind of returns that Big Yellow has delivered in recent years, this looks an excellent opportunity to hear from a top entrepreneur in a successful and fast-growing industry (Big Yellow has a £1.5bn market cap). Don't just take my word for it, look at the numbers. Revenues at Big Yellow have been growing every year for the last five years. The average rate of sales growth in that time is 10.7% a year. The annual dividend growth in that time has averaged nearly 18%. When you think about what it would take for a company like this to report a cash loss you can see why the market has long demonstrated a willingness to pay up for the shares.

West country manufacturer Gooch & Housego GHH are also going to be at ALPHA Investor Forum. This is one of AIM's most successful companies. The company has a £330m market capitalisation and enjoys a net cash position. Sales have increased every year for the last five years and the dividend has been increasing since 2011. Stockopedia awards the shares a Quality Rank of 95. Gooch & Housego shares are a longstanding favourite of famed private investor John Lee and it is not difficult to see why. Legal firm NAHL (NAH) has had a mixed time on the markets since its 2014 IPO on AIM. The company has been forced to adjust its business model in response to regulatory changes around personal injury claims. However, the company has always been profitable and dividend paying. Even though a dividend cut is forecast for 2018, as the business shifts to a new 'Alternative Business Structure', a legal business that may be owned by outsiders (such as NAHL shareholders) rather than a group of lawyers in partnership. According to the consensus forecasts, NAHL stock looks very cheap. The 2018 forecast P/E is 6.9 with the expected yield being a chunky 7.4% (even after that dividend cut). Both CEO and FD are going to be at ALPHA Investor Forum in June so this is an excellent chance to get the inside track on what looks like a real bargain share. The fourth company presenting is Learning Technologies Group LTG. There has been a lot of excitement around this company in recent years. The shares have approximately four-bagged in the last three years. The company is, as you would expect, a provider of online learning and testing software. Andrew Brode is Chairman of the company. Mr Brode is one of Britain's most successful business people, famed for his stake in RWS. CEO Jonathan Satchell will be representing the company on the day. Mr Satchell owns 17% of Learning Technologies Group. The most recent results from the company saw a 74% increase in adjusted diluted EPS and a 43% dividend hike.” Duxford Meet-up For the last couple of Years we have been holding the ‘Wheelie Bash’ in the vicinity of Windsor and it tends to be later in the Summer around September time for various logistical reasons. This has been a huge success and a really fun Day for all concerned and it looks set to become a regular feature of the UK Social Calendar (up with things like Trooping of the Colour, Wimbledon and the Boat Race), but the drawback is that we have plenty of Summer Months before to exploit and for more Northern based Readers it is not so easy to get to. With that in mind, I have been thinking about arranging some sort of other informal event in the Summer and those of you with extra pinsharp memories may recall that last year during the Summer I met up with a couple of mates Steve and David (same chap !!) (@LairdElmski and @aimprospector on the Tweet machine) at Duxford Aerodrome (or is it an Airfield?) just off the M11 outside Cambridge and it struck me as a very cool place to meet people who are based up around there and at the same time the Museum bits are superb (especially the American Hanger with the stunning SR71 Blackbird). Therefore, we will be doing a ‘Meet-up’ at Duxford Airfield/Dromey thing on Monday 25th June and I am expecting to get there myself around 12 Noon ish but because it is a proper full on Museum, anyone who is coming to join us can just turn up when they like and if you are early then take the chance to have a browse around the Planes etc. There is an Admission Price (not much) to get in but it stays open to about 6pm I think and there is a huge Car Park if you are driving there. Once I get through the Turnstile I will head for the Canteen/Restaurant bit and hopefully if the weather is nice we will be able to sit outside. Here is a link to the place: https://www.iwm.org.uk/visits/iwm-duxford As always everyone is invited and it would be brilliant to see you there - the more the merrier and all that !! Don’t worry if you have only been doing Shares for a short time - everyone is welcome and these kind of events are just a great chance to meet other like minded lunatics and to build relationships which can help you hugely. This date was not chosen entirely at random - it happens to be the day before David is arranging an Investor Event in Cambridge with several Companies presenting including:

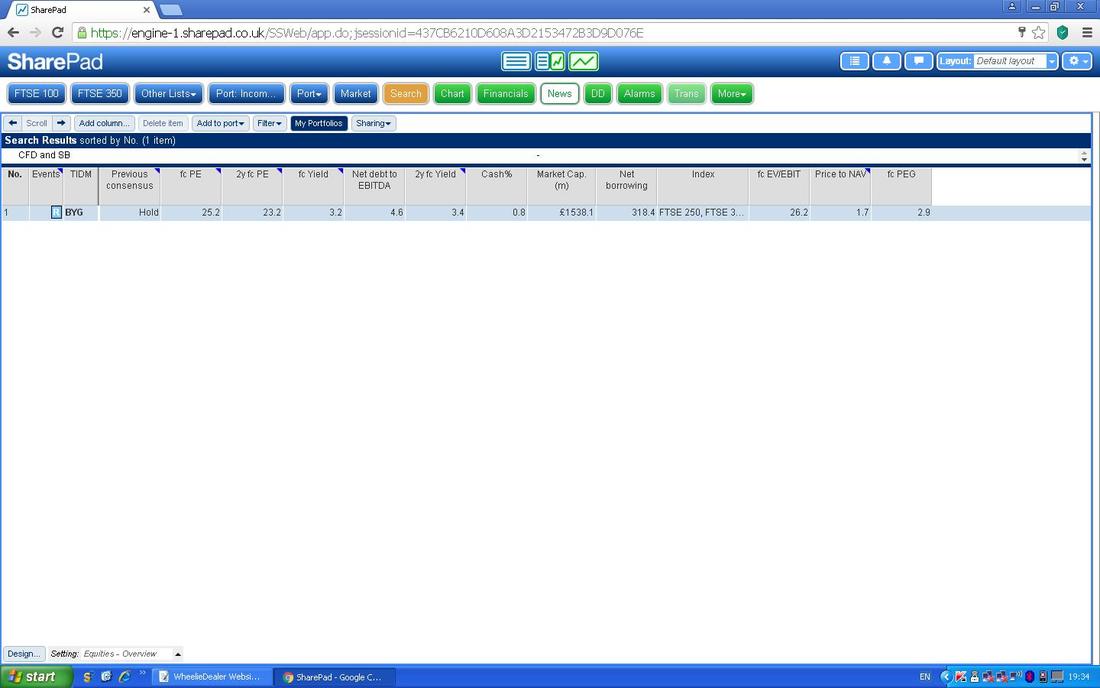

A few of these I know nothing about but I have to say that BYG, GHH, NAH and LTG are all decent businesses and could be worth knowing more about. Sadly I will not be at that Event myself because I cannot do 2 days on the trot due to Health complications !! You can see details of the Event here: http://blackthornfocus.com/events/alpha-investor-forum/june-2018/bf-pref The Charge for the Event is normally £159 but if you use this Link then you can attend for £124.99. Some thoughts from myself about the Companies at David’s Cambridge Forum thing Big Yellow Group BYG This is a sector I have been intrigued by for years (probably watching too much ‘Storage Wars’ on Discovery !!) and a while back I had Shares in Safestore SAFE but being really daft I sold them far too early. BYG is the ‘Big Daddy’ and extremely good at marketing itself simply by having huge Yellow Sheds which everyone sees as they drive around the UK. BYG is certainly a Quality Company but it is not ‘cheap’ as we will see in a mo - but if you want a ‘Bargain’ then perhaps the much smaller Lok ‘n Store LOK is the one to look at. One of the beauties of this Sector is that People tend to stick stuff into Storage “for a few months” and invariably they forget all about it and the stuff (for which read ‘Junk’) stays in the Shed for years and years and the Customer keeps paying by Direct Debit and either forgets to cancel the Direct Debit and/or simply has better things to do than go sorting the stuff out (which by now probably stinks to kingdom come). The trend to smaller Homes and no Garages has exacerbated this problem of nobody having room and this is driving demand for Space at Storage Centres. It is another classic example of the UK following the USA in everything but with just a 10 or 15 year time lag - sadly this applies to Gang Crime as well….. I have been a Subscriber to the superb ShareScope Software for millions of years (you should have seen it in the Stone Age - basic or what?!!) and a while back I started paying something like 50 squids extra to get access to SharePad as I can do that quickly on my Tablet and it saves me beaming up the Netbook (which I tend to delay until the Evening as a special treat). Anyway, the more I use SharePad the more I am impressed and they are constantly improving it and making changes - as they have always done with ShareScope. It is obvious that as time goes on they are moving SharePad to being the Platform for Long Term Investors and perhaps ShareScope is more focused on Short Term Traders - I am cool with that and I can see a future where I stop using ShareScope and totally switch to SharePad only - although that is a big psychological step !! So, what I am trying to say is that here are some SharePad ScreenScrapes which should give the info we want but also give Readers more visibility of SharePad and also doing this gets me more used to using it because I simply don’t use it enough at the moment to really get the hang of how to fully exploit it. As always, if you click on the Pics they should grow bigger so you can see some detail. The Screen below is one I always go to first when I look at a Stock because it is entirely configurable with millions of Columns and I have set these up because they are things that give me a very quick ‘Triage’ of some essential stuff for the way I invest. As you can see, BYG is on a Forward P/E 2 years out of 23.2 so I would not call it ‘cheap’ but of course you have to pay up for Quality. With a Forecast Dividend of 3.2% it is not a bad Divvy and the 2 Year Forecast is 3.4% - again, nice numbers. I would expect this to be a pretty reliable Dividend Payment although I do remember in the Credit Crunch that all Storage Stocks got hammered but then again every Stock got beat up !!

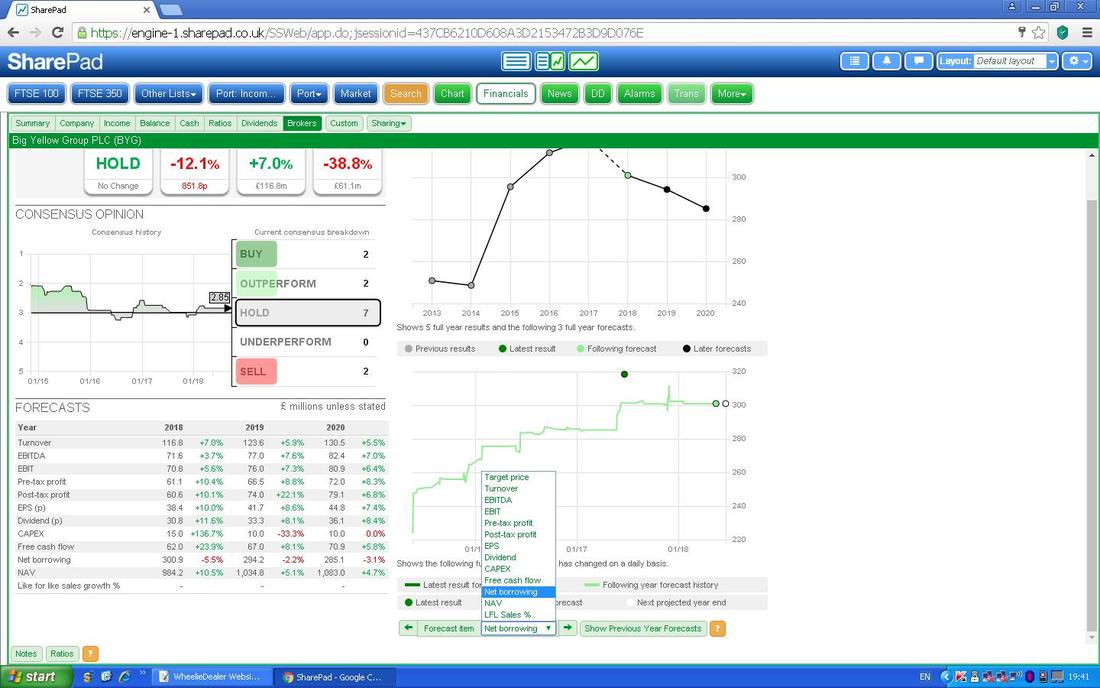

Next we have the Broker Forecasts Screen - this has been massively improved recently with the sweet little Table on the Bottom Left Hand Side and with the Graphs which are also a new thing. I have set it to show ‘Dividends’ but there are loads of other parameters to choose like I am showing in the little ‘Drop Down’ (ok, in this case it drops up !!) which you can see on the next Screen which appear right after in the middle at the bottom. Obviously the details on this Screen are about the Net Borrowing.

On the next Screen if you look at the Boxes on the Left and go to the ‘Valuation’ row, you should see ‘Price / NAV’ of 1.7. This is important for Property related businesses and this means the Share Price is a lot higher than the Net Asset Value (NAV).

I mentioned LOK earlier and if you look at this Screen then you can see the Price / NAV for this one is 1.4 which is a bit ‘cheaper’ (although of course LOK is much smaller than BYG which is the Market Leader). Note these Boxes are ‘Colour Coded’ so if the numbers are Green that is good and if they are Red that is bad.

Here is a fairly Long Term Chart for BYG going back about 7 years or so. As you can see there is a decent Uptrend although perhaps in the very short term it is a bit stretched.

Gooch & Housego GHH

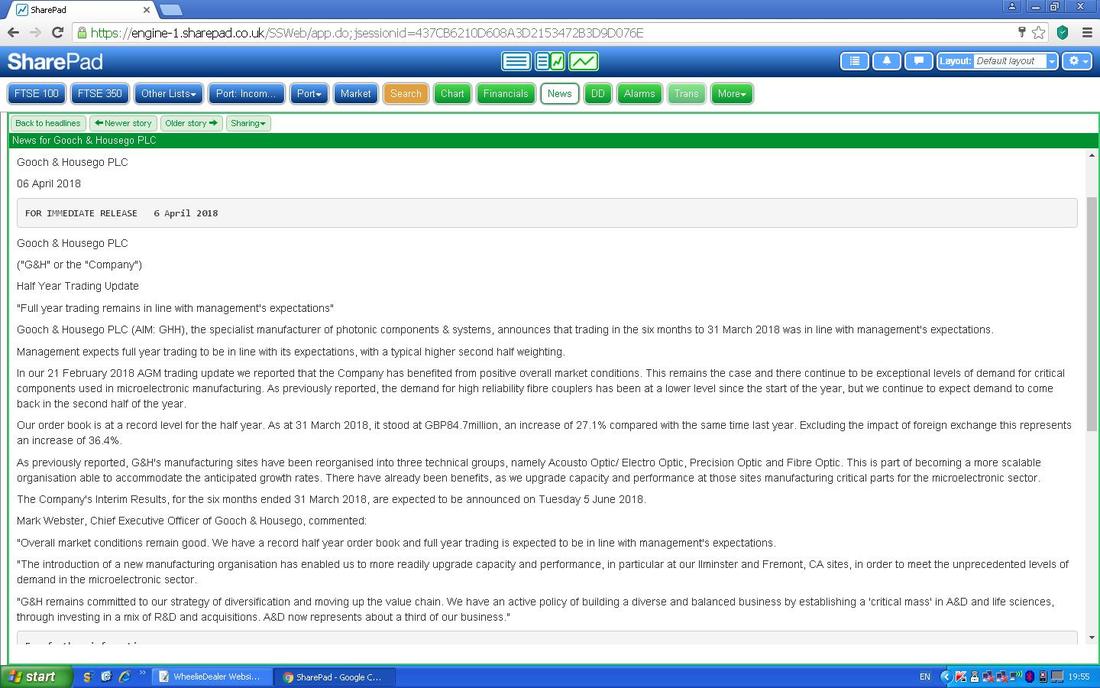

I couldn’t really remember what these guys do so I went over to the ‘News’ bit on SharePad and found this which is the most recent Trading Update.

Well, first thing to notice is that this is a really positive Update - they say “in line with expectations” but clearly things are going well. They seem to do some sort of Electronic Components stuff that has an Optical element to it but of course the first thing any potential Investor would need to do is to really figure out what they do and how sustainable it is etc. I know GHH have been around forever on the Stockmarket so they must be good at something !!

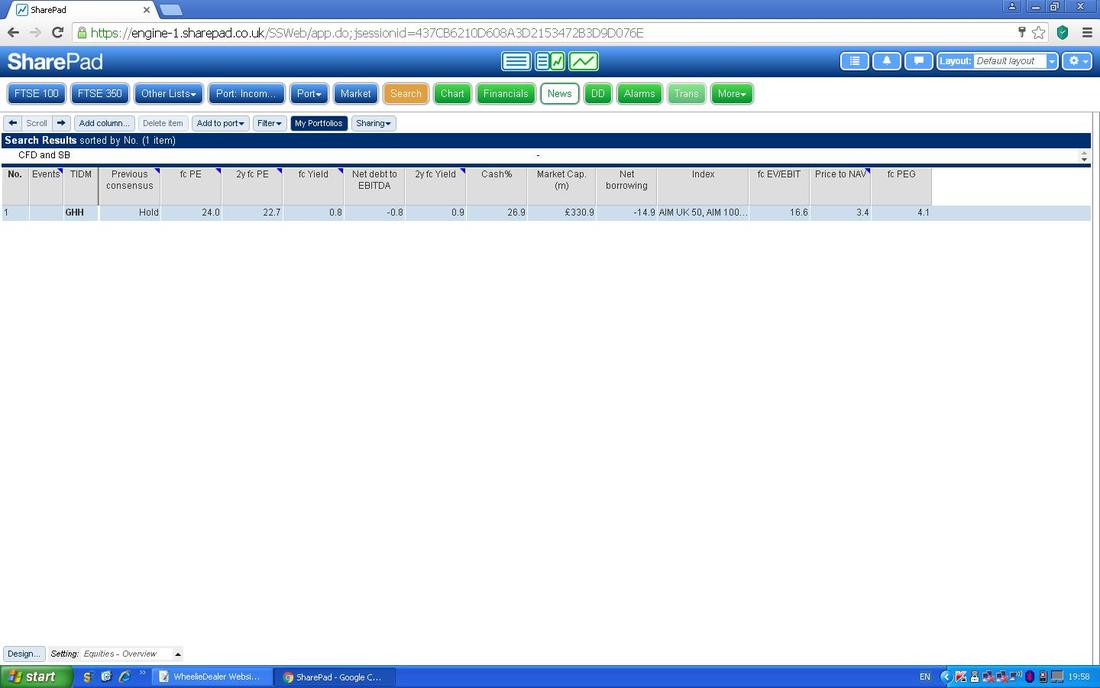

My ‘List’ Screen is below (note, if you are a ShareScope user then this is extremely similar to how the List Screen on ShareScope works - maybe that is why I like it !!) and you should be able to see a Forward P/E 2 Years out of 22.7 and a Forward Divvy for 2 Years out of 0.9. With numbers like that GHH is clearly being seen by the Market as a Growth Stock (not much Income here folks !!) but that is fine as long as it delivers and the Update we just saw was very impressive. It says ‘Net Borrowing’ of -14.9m which means that at the last Results GHH had Cash of 14.9m which in effect means the true Forward P/E Ratio is lower than it appears by a bit - and of course Cash means a decent Balance Sheet (usually !!) and increases and Investor’s ‘Margin of Safety’.

Here is the Broker Forecasts Screen and this time I am showing the EPS in the Graph.

…….and look how Borrowing has been tumbling on the next Screen.

This Chart goes back to 2009 and as you can see it has risen very nicely since that time.

And on the next Screen I have shortened the Timeframe to about 2 Years and there is a steeper Uptrend here and it looks like Support at 1229p is important and before that 1300p looks a good Support Level.

NAHL Group NAH

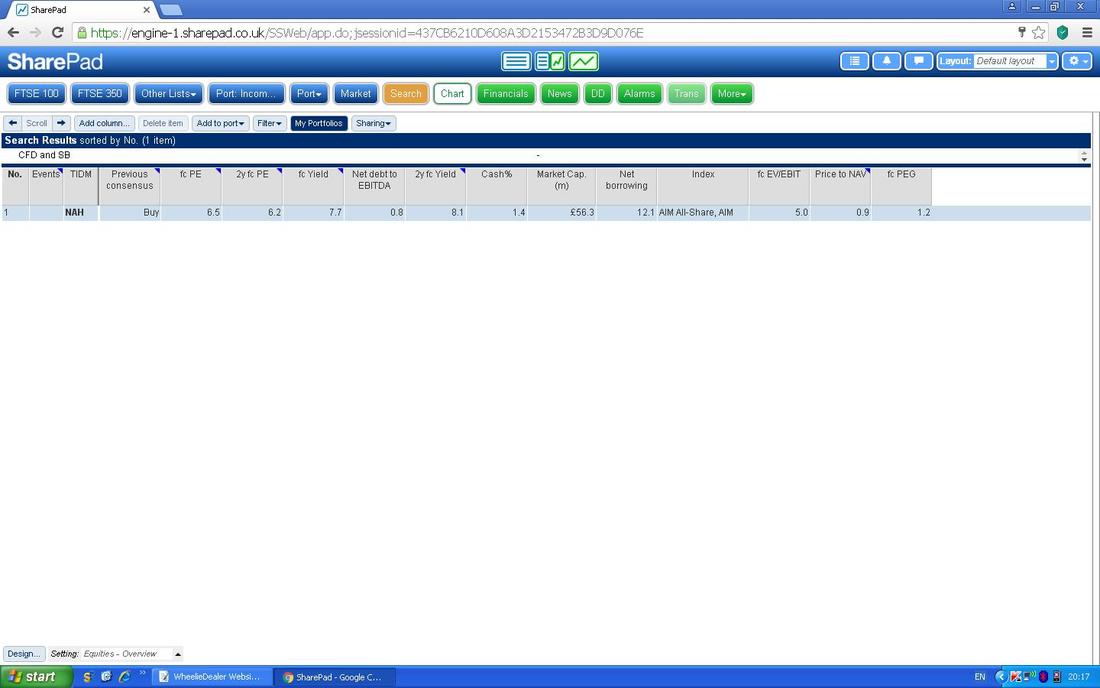

Of the Stocks we are looking at here this is perhaps the least interesting to me in business terms (although as we will see it could be the most appealing in terms of Valuation) and it is very connected to Personal Injury Claims and stuff like that - it used to be called National Accident Helpline and it still runs that business but it also does some Property Stuff as well like Conveyancing and some Marketing Services. First off we have the List Screen and you should be able to see a Forward P/E 2 years out of 6.2 and a Forward Divvy 2 years out of 8.1%. On the face of it, these are highly appealing numbers to a Value Investor. Note there is £12.1m of Debt shown here.

Here is the Brokers Forecasts Screen. I wanted some context for that £12.1m of Debt and the first thing to notice is that the Debt on the Chart has been going up for a few Years - this concerns me really and I would want to dig into why this is happening. It’s a bit much paying out high Dividends if you are really just piling up Debt. They are forecast to do £13.3m of Pretax Profit in 2018 so in this context Debt of £12.1m doesn’t look a problem (obviously at this stage of a quick look at the Stocks this is superficial and more digging would be needed into things like Cashflow etc. but they can be addressed in a more detailed Investigation if the Stock gets through initial screening.

I noticed a Director Buy on the News for NAH and as a result I lobbed this Screen in - I have not looked at it - it is purely for your sheer enjoyment….

I guess this is no shock as the Valuation suggests NAH has been finding life tough for a while -anyway, there is a clear Downtrend Line here and my Arrow is pointing to where it might Pop Out and if this happens then it would be a Bullish development - before this Line is breached it might be wise to only Buy NAH in a small way. You can add when it breaks out.

200p looks a difficult Resistance Level to get over - once it cracks that, it would suggest more gains to come.

Learning Technologies Group LTG

This time we are starting with the LTG Chart because I am so peed off I missed this !! I even wrote it in my ‘Little Black Book’ a while back and put it on the ‘WheelieBin’ page as usual but I didn’t buy it myself. Gutted I tell you. Anyway, it is still extremely bullish from a Chart viewpoint.

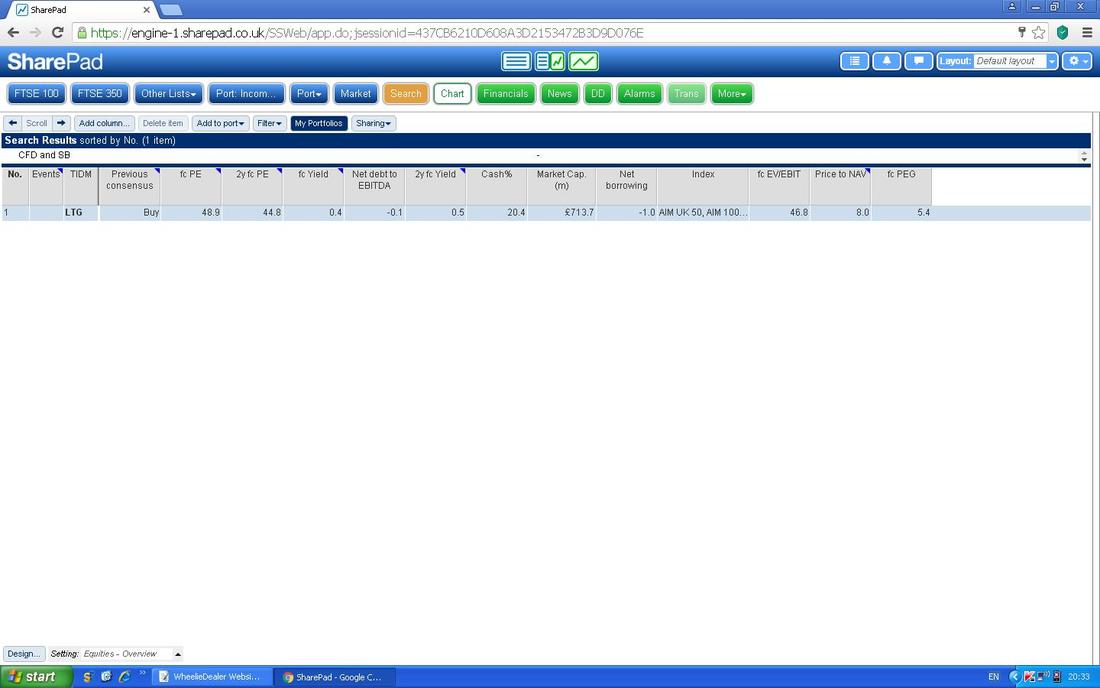

You certainly have to pay up for it now though - as you can see it is on a Forward P/E 2 years out of 44.8 which is really high and probably too high for me - but if the Company can keep up a super fast Growth Rate then it might be justifiable. Digital Learning stuff is obviously a growth area.

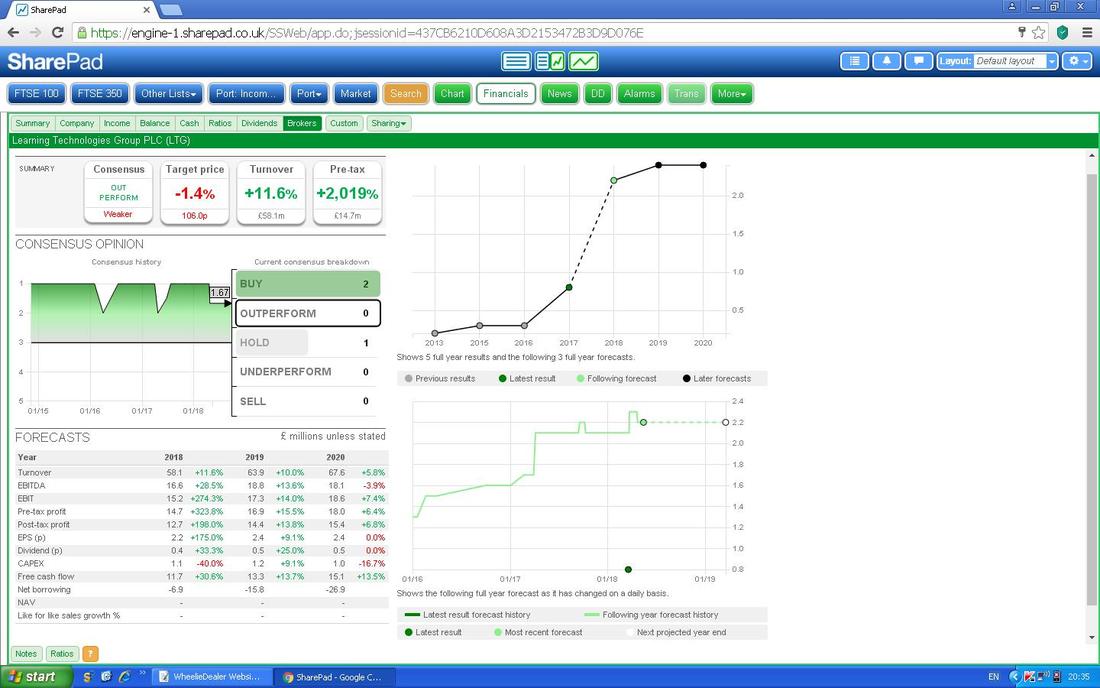

Next we have the Broker Forecasts. This is interesting because the Forward P/E we just talked about suggests extremely fast growth but looking at the Chart here for EPS and looking at the EPS Growth Numbers in the Table, there is a clear anomaly with the Valuation. The Chart is flatlining in 2019 to 2020 and clearly something is wrong here. If I was looking at Investing in this Stock now I would be paying close attention to the likely Growth Rate and the drivers for Growth. I know LTG have been very acquisitive in the recent past and presumably the Strategy is for more of the same.

OK, I will leave it there. I hope this gives some insights into 4 potentially interesting Companies (or ones you already hold !!). Cheers, WD.

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|