|

THIS IS NOT A TIP OR RECOMMENDATION. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITE. IF YOU COPY MY TRADES, YOU WILL PROBABLY LOSE MONEY.

This morning I bought more GoCompare.com GOCO because I totally adore that Opera Singer on the TV Ads. Actually, you might be surprised to hear that is not why I bought more GOCO - the truth is I am far more besotted by the Meerkats. I paid the princely sum of 76.5p per Share and picked up roughly another 1% of my Portfolio Value - I already had a ridiculously small amount after they were ‘spun-out’ from my Esure ESUR Share Holding - but I reckon I only had perhaps 0.5% of my Portfolio Value in them. Yesterday GOCO put out a nicely positive Trading Update (which you can read at the link further down below) and following this they jumped 12% on the day which is obviously a sizeable move. As ever, I dislike making snap decisions about Buying or Selling during the Trading Day and I kept patient and waited until after the Markets were closed to coldly look at the situation and decide whether or not to buy more.

If you listened to the Podcast I recorded with Justin on Tuesday 10th January, you may have heard me mention that I had intended to top-up on GOCO before the Trading Update but with everything that was going on I totally got distracted and failed to buy some - this was partly because I never got a nice hint from the Chart that it was ‘Buy time’ (there is a link to the Podcast on the Homepage of the WD Website - you want Podcast number 680). Due to the large move up yesterday, I decided to only buy another 1% at this stage and I will be looking to buy more and build a proper Stake over time. My thinking was that after such strong moves it is quite likely that Profit Taking can set in and we might see GOCO drop in coming days - this would give me a chance to buy more.

The Joy of Divvys Something I just want to throw in here which is almost totally unconnected but I like to mention it (I have certainly talked about this on the Tweet machine), is that the Cash I used in my Trading ISA to buy more GOCO was actually Dosh that had ‘grown’ by the magical power of Divvys. It is truly glorious when the Divvys keep miraculously appearing in my Account and steadily build up over time to give me enough for a ‘Full Position’ so I can get buying something I fancy. The Power of Dividends should not be underestimated (it nearly always is !!) and the Compounded effects of Divvys around 3% of a Portfolio’s Value can add up over a period of Years to give a huge boost to your Total Returns. If you don’t believe me (or even if you do !!) check out this Blog I scribbled years back about Compounding: http://wheeliedealer.weebly.com/blog/why-bother-investing-the-power-of-compounding While on this, many people use DRIP Schemes (Dividend Re-Investment Schemes) which are when a Company lets Shareholders take their Divvys as extra Shares but personally I am not keen on these. From a ‘passive’ and ‘easy’ point of view I can understand why people do this, but my concern is that you can end up buying Shares when they are very expensive and there is a danger that your Position can grow far too big and put your Portfolio seriously out of balance - I prefer to be in control and I decide what my Cash goes on and when I buy it. Besides that, if you do DRIP you miss out on the joy of watching that Divvy Cash steadily build up in your Account !! OK, so what does GOCO actually do mister? I won’t spend hours on this (in fact, I might not even spend minutes on it) because I’m pretty sure the vast majority of WD Readers will have felt the pain of watching one of the GoCompare.com ‘Opera Singer’ TV Adverts (Gio Compario is his real name by the way and the moustache is equally real) and in essence GOCO is very much in the same game as ‘Compare the Meerkats’, Confused.com and MoneySupermarket.com etc. etc. In other words, they are all Comparison Websites. I am sure there are many variations on their business models but the essence is that they are a quick and easy way for Punters to compare various Products (mainly in the Financial Services space) by sticking in various parameters and eventually the hope is that the Punter selects one of the Product Providers and buys whatever it is. The Product Provider then pays GOCO or whichever Website it was a small Commission. From what I can tell GOCO has steadily widened its Offer from being mainly around Insurance (especially Motor Insurance) to many more Product types - I noticed the other day that the latest Adverts have got good old Gio stood on the Wing of a Biplane ‘singing’ about Flight Deals or something. From the Website, I see they now are doing the following stuff:

In fact, if you look at the ‘Drop-down’ Menus on the Website they do a huge range of various things now. You can see the Customer-facing Comparison Website here: www.gocompare.com The ‘Investors’ Website can be found here: http://www.gocomparegroup.com/ Very recent History GOCO has been around as a business for years now and was one of the first Comparison Websites to launch. As I understand it, things went pretty well in the early days but after some time the then management (it was Privately owned) made a pretty radical decision to ditch the Opera Singer (there was a bit of ’folklore’ going around that everyone detested him because he was so, so irritating) and to base their Advertising on some sort of weird Welsh Tourism theme - it was a terrible decision in hindsight (to be fair, it might have seemed very sensible at the time because he really is horrifically annoying) and it meant that Traffic to the GOCO Website pretty much dried up and the business got itself in a lot of trouble and was eventually bought out by the super-shrewd chaps at ESUR. An essential bit about the Comparison Site model is that they spend massive amounts on Marketing and driving Customers to the website - if you have a memorable ‘Brand’ that is burnt onto Customers' brains then it gives a huge advantage when that Customer goes to their Google Search Engine (think ‘Brian the Robot‘, 118118, etc.). When GOCO ditched the Opera Singer they were falling into the trap that ‘Confused.com’ were firmly stuck in where they had TV Advertising that was far from memorable and it had no emotional appeal. Funnily enough, as I am typing this there is a ‘Compare the Meerkats’ advert playing in the background and they are doing the ‘Frozen’ ‘Let it go’ song and giving away free ‘Frozen’ themed Baby Meerkats if you buy via their Website - this is the kind of Emotional Marketing (Meerkating?) that sucks the Punters in (especially with their kids nagging them). Anyway, ESUR bought the mess that was GOCO and the first thing they did was bring back Gio Compario and very quickly things were on the mend - ESUR multiplied their Investment massively and spun out GOCO just a few weeks ago. From a Risk point of view, this episode highlights what can happen if the current Management of GOCO make a similarly daft Marketing decision. Fit with the Wheelie Portfolio Following the Spin-out I ended up with an absurdly small GOCO Position and I had to decide whether to buy more or sell to help in my quest to get down to the El Dorado-like ‘WD40‘. I have a bit of a thing about ‘Internet’ stuff with mainly an emphasis on the Online Shopping side of things (BOO is obviously in this theme and also MOSB, SGP, SBRY play it to an extent) but also I hold ePayments businesses like PAYS and PYPL which are sort of linked. My contention is that The Interweb is the Future……..yes, I know, this is radical thinking as you would expect from WD. However, up until now I did not really have any proper Exposure to Comparison Websites which are obviously a major part of the new kinds of Businesses that the Internet has allowed to flourish. I have felt for a while that I was missing out but the Stocks available to put my Dosh in were on the whole very expensive and I couldn’t get excited enough to buy them - MoneySupermarket MONY particularly springs to mind along with Zoopla ZPLA which is a lot newer to the Market and was more focussed around Estate Agency - a Sector I have no love for (I note ZPLA is starting to offer a wider range of Comparison Products these days). Due to this desire for Exposure to this space, I was pretty interested in getting more GOCO when it arrived on the Market and I have been waiting for confirmation that there was Value and it was worth buying. Before yesterday’s Update I had pretty much convinced myself that I was happy with it but after the Update I now have a lot more confidence that GOCO is a quality play and I am happy to get more heavily involved. Obviously I could have bought more at a lower Price some weeks ago but at that time the Risk would have been far higher - as ever Risk/Reward is a vital consideration at all times and I like to keep my Risk low. The company that owns the Meerkats is due to do an IPO at some point this year - the publicity around that might help GOCO Shares especially if the Meerkats floats on a very high rating and makes GOCO look very cheap in comparison (Compare the Stocks !!) Talking of Risks……….. At a fairly high level, I see these as the Key Risks for GOCO:

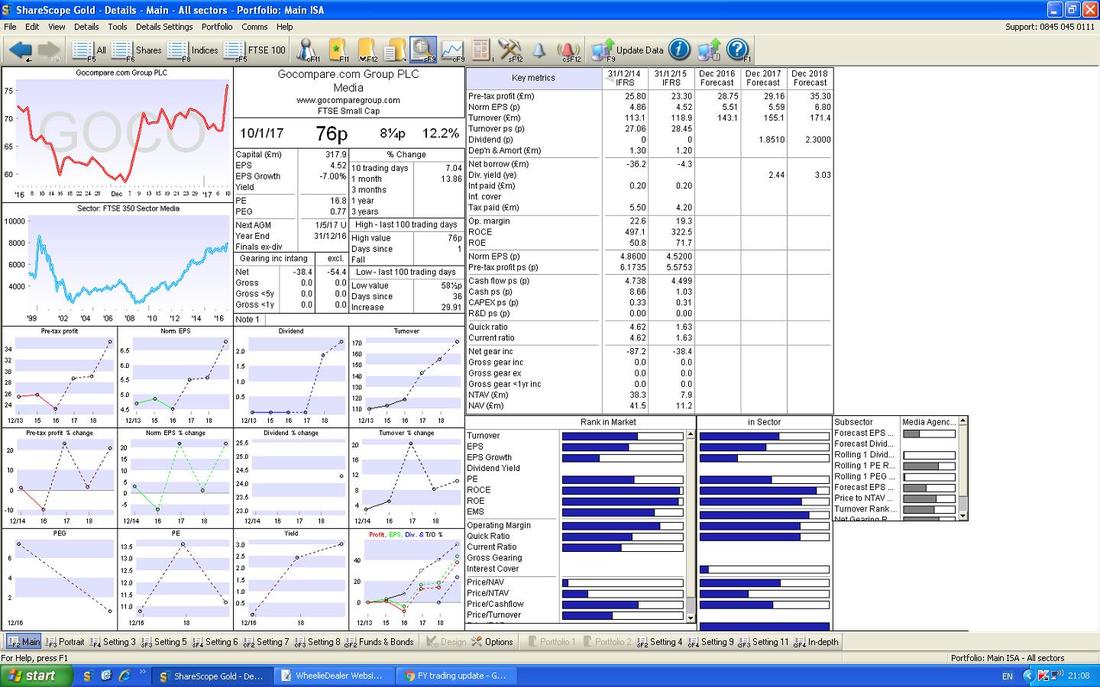

The Trading Update It was very short and sweet, the key bit being: “The Group has made good progress in 2016 with revenue of approximately £142.0m, which is 19% up on 2015 and in line with guidance. Adjusted operating profit1 is expected to be approximately £30m, which represents growth of 30% over 2015 and is at the top end of the guidance provided at the time of the publication of the demerger prospectus in October 2016.” And: “We start 2017 from a position of confidence and look forward to delivering another year of strong growth.” I like the growth rates here and I think it is quite possible that we will see more growth but perhaps not as fast as this. You can read the latest Trading Update from Tuesday 10th January 2017 here: http://otp.investis.com/clients/uk/gocompare.com_group_plc/rns/regulatory-story.aspx?newsid=834130&cid=2019 Valuation As usual, the ShareScope screen below is as it confronted me on the Night of Tuesday 10th January 2017 when I made my decision to Buy some more GOCO. If you look in the Top Right Hand Corner for the line ‘Norm EPS(p)’ for ‘Dec 2017 Forecast’ you should see a figure of 5.59. On my Buy Price of 76.5p, this gives a Forward P/E Ratio of 13.7 (76.5 divided by 5.59p). If you look at the line called ‘Dividend (p)’ for ‘Dec 2017 Forecast’ there is a figure of 1.8510 - on my Buy Price of 76.5p this gives a Forward Dividend Yield of 2.4%. Note these Forecasts are expected to improve the following year and from what I am seeing the numbers don’t look unreasonable - but of course any Forecast is guesswork (and usually done by a 12 year old Analyst). I think these numbers are quite attractive - especially when you consider that MONY is on a Forward P/E of 18 and ZPLA is on a Forward P/E of 20.8 (I won’t show these, you can check them yourself or simply “Trust me I’m a Doctor” I’m not, which means you can make your own conclusions and perhaps you better check those P/E Ratios !!) In line with this I hope to see 100p for GOCO in time and with a lot of patience maybe it will go higher than this. To help the Price on its way, I am hoping we will get the usual mags like Shares and Investors Chronicle giving GOCO positive write-ups and some Broker Upgrades would also go down a treat.

The Charts

Again these are the Charts as I saw them last night. As you can see on the Chart below, GOCO has not been around long and there is little chart history - this can be a really good thing though - if it can Breakout over my Black Line (marked with the Black Arrow) where the Price Opened on the First Day on the Market, there are no natural levels of Resistance where Holders would Sell - it is ‘Blue Sky’ up above. Note on Tuesday 10th January 2017 we got a huge White Up Candle after the Trading Update - this is marked with my Blue Arrow and is clearly a Bullish development.

The Chart below in the Bottom Window has the MACD for GOCO (Moving Average Convergence Divergence) - we have a ‘Bullish MACD Cross’ here - this is shown by my Blue Arrow in the ‘Signal Lines’ format or with my Black Arrow as the ‘Histogram Bars’ format.

Right, that’s enough. Fingers Crossed, cheers, WD.

0 Comments

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|