|

THIS IS NOT A TIP OR RECOMMENDATION. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITES.

I topped up my Holding in Avation (AVAP) on the morning of Wednesday 3rd June 2015, buying more Stock at 137p, to give me about 2% in total of my Portfolio Exposure in the Company. I find AVAP an intriguing Stock as it is involved in an Industry that I suspect the vast majority of Investors have no understanding of. The usual reaction I hear from people is “oooh, it’s got a lot of debt” and then they swiftly move on to the latest Hot Rocket Small Cap Mining Stock………….

The great thing about this is that as a consequence it looks to be hugely undervalued and I think there is huge upside here. I tend to find in such situations that over time Market Participants gradually start to understand and leap on the Bandwagon as it starts to make upward progress.

My aim in this Blog is to demonstrate to Readers why I think it is such a Great Opportunity and to make the mysteries of Aircraft Leasing rather more transparent. I am no expert on the Industry, but I have spent some time figuring out the relevant bits and I will try to cover all the Key Aspects with regard to the Risks and Potential Rewards of my Investment in AVAP. Here’s a taster from Richard Wolanski the CFO: “That’s what’s exciting about the company, we have locked in so much future growth and almost eliminated all the execution Risk associated with that growth.” Company Overview AVAP is a Fully Listed Stock (i.e. not AIM) based in Singapore which is involved in Commercial Passenger Aircraft Leasing and it is worth noting that it pays a small Dividend and the Board has announced a Progressive Dividend Policy (i.e. they intend to increase the size of the Divvy Payment over time). At a high level, the essence of the Business Model is that AVAP borrows money from Banks at a low rate of Interest and then Buys Planes with this borrowed money which it leases out to Airlines for a set Contract Period and Monthly Repayments with a Deposit paid upfront. AVAP is utterly tiny in the Aircraft Leasing world (although I understand there are about 50 Players and AVAP is in the Top 40) but it is focussed on a Very Specialist Niche of providing Small, Narrow Body, Single Aisle, twin engine (mainly turbo-prop) Planes to a growing number of Airlines around the World. The fleet includes Airbus A320 series Jets, German Fokker 100 jets and the French / Italian ATR 72 twin engine turbo-prop aircraft. The big players in the Aircraft Leasing Industry are enormous and lease Fleets of the common Jet Types (Boeing 777, 787, Airbus A350s, A330s etc.) to Major Global Airlines - this is a very different part of the Industry to the bit that AVAP serves. AVAP is more focused on Short-Haul flights. Major US players are Airlease, Aircastle, Avolon etc. To give you some idea of costs, an ATR 72-600 costs about $20m and an Airbus A320 is about $45m (oooh, I’ll have one of each please……) The text below comes from the 2014 Annual Report and explains the Aircraft type choice: “Avation aims to generate growth in its fleet and build shareholder value by focussing on 2 sectors being a) new turbo-prop regional aircraft, principally the popular fuel efficient ATR 72-600 model and b) second-hand narrow body jets in particular the popular Airbus A320/A321 family and Boeing 737NG aircraft. Owning different types of aircraft provides a benefit in terms of diversification of market and residual value Risk.” The current Plane Fleet can be seen here: http://www.avation.net/aircraft.html I first became aware of AVAP when it was a very small Business created by the Executive Chairman Jeff Chatfield in 2006 to be the Airline Leasing Company for Skywest which was an AIM Listed Airline Company run by Jeff Chatfield. I had Shares in Skywest for many years and I never bothered investing in AVAP as it seemed pointless as they were so inextricably linked. However, all that changed a few years back when Skywest was taken over by Virgin Australia and Jeff Chatfield stayed at AVAP. In the years since this, Jeff Chatfield and the Team at AVAP have fairly quickly grown the business from being a tiny sole supplier to one Airline in Australia (i.e. Skywest) to now Leasing 29 Planes to 7 different Airlines in a variety of Countries. This expansion in Customers and Locations has been nice to witness as a couple of years ago there was a clear Concentration Risk on just a couple of Airlines and it is welcome to see this problem steadily reducing. It is worth realising that even though this Major Risk has diminished, the Share Price has not really gone up much to reflect the huge reduction in Risk this diversification of the Customer Base represents. AVAP also has a Singapore based Subsidiary which supplies Aircraft Parts and Spares to a range of Operators Worldwide - from a look at the latest set of Accounts, this Business appears to be a tiny part and its contribution to Revenue and Profit is not reported. In other words, it can be ignored really. AVAP also own 95.1% of AIM Listed Capital Lease Aviation CLA. This stake is worth about £18m. In the last Financial Year, CLA underperformed expectations of the AVAP Board and they increased the AVAP holding in CLA with a view to also taking actions to improve the performance. Both Jeff Chatfield (Executive Chairman of AVAP) and Richard Wolanski (CFO of AVAP) are Directors of CLA. AVAP has its headquarters in Singapore where it is tax resident and since 17 April 2014 has benefited from the Singapore Aircraft Leasing Scheme tax incentive, which has lowered the Tax Bills. The Company is tiny and has just 16 People involved - and that includes 3 Directors. Richard mentioned to me at Master Investor this year (2015) that as they Lease out more Planes, the Overhead Costs of the business remain the same, so Revenues drop through to the Bottom Line. In other words, they can service a much higher number of Leases without having to increase Staffing Levels much if at all. The Corporate Broker is WH Ireland. Some Key Features of the Aircraft Leasing Industry There are a few points that I wish to emphasise with regard to the Aircraft Leasing Industry that make this probably far less Risky than people might think at first glance:

Website The Company Website is very basic and not really all that full of information. Some nice pictures of Planes though !! www.avation.net More Detail on the Leasing Model

“The Avation fleet of 25 aircraft has an average age of 9.0 years, which is likely to reduce as the Group adds new aircraft and disposes of old aircraft, and average remaining lease term of 6.1 years with a current customer base of airlines in Australia, Europe, North America and the Asia-Pacific region.” Customers

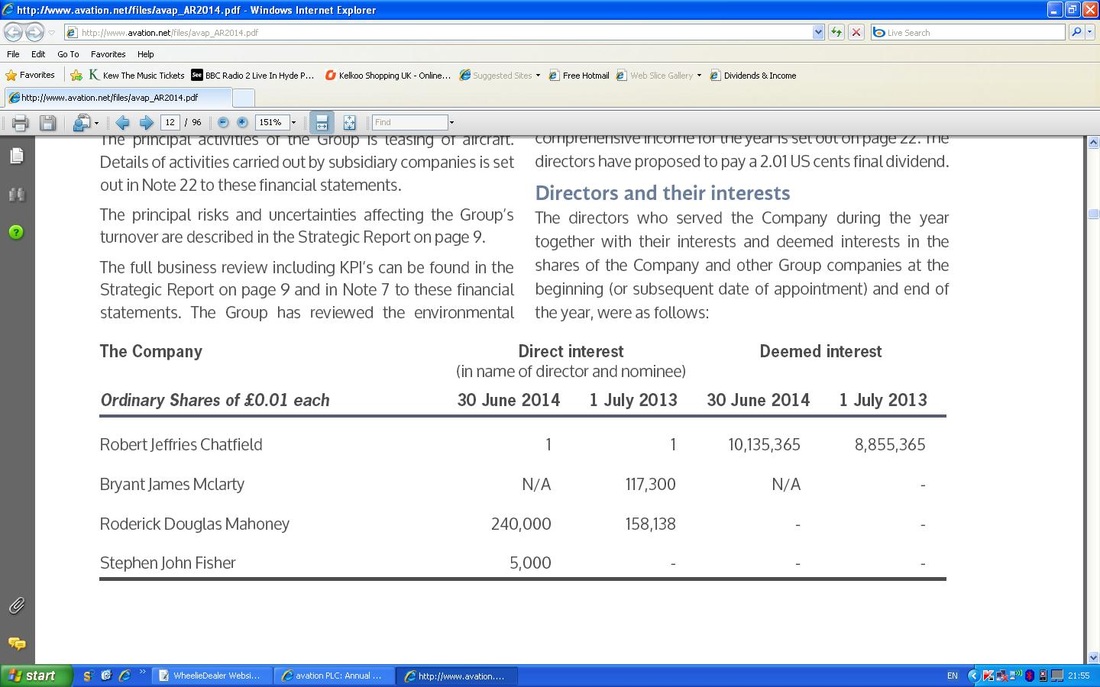

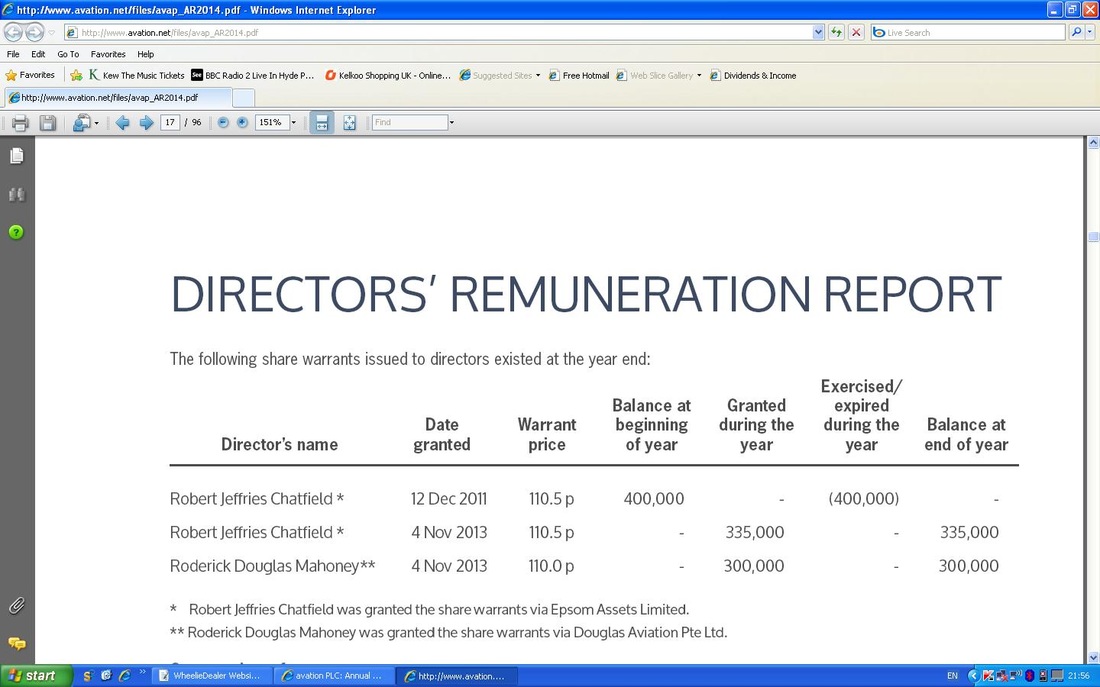

Directors The Key Directors can be found here: http://www.avation.net/directors.html Directors' Shareholdings I have struggled a bit to find details on this - the Screenshots from 2014’s Annual Report below give the best information I can find:

However, in an RNS issued on the 28th May 2015, it states that Richard Wolanski (CFO) purchased 25,000 Shares at 140p and this brings his holding to 162,500 Shares. It also says that Epsom Assets Ltd, a company in which Jeff Chatfield, Executive Chairman, is interested, settled the purchase of US$5 million in principal amount of Notes on 27 May 2015 at an issue price of 99% (these are the Bonds that are covered under ‘Noteworthy Recent Developments’ further down this Blog.)

On the 2nd June 2015, the Company issued an RNS saying that Richard Wolanski had bought a further 10,000 Shares at 137.5p and Epsom Assets bought 30,000 Shares at 137.5p and 50,000 Shares at 140p. I think it is safe to say that the Directors have a large personal interest in the Business succeeding and it is nice to see they were buying not far from my Topup Buy Price of 147p. Major Shareholdings I found the following list in a Presentation I picked up somewhere and I think it is pretty close to the current position:

The following list comes from the 2014 Annual Report but I think it is now probably out of date: Vidacos Nominees Limited 10,635,732 Ordinary Shares 21.64% Chase Nominees Limited 9,331,140 Ordinary Shares 18.98% Fitel Nominees Limited 4,707,702 Ordinary Shares 9.58% HSBC Global Custody Nominee 3,569,916 Ordinary Shares 7.26% Chase Nominees Limited 2,870,000 Ordinary Shares 5.84% HSBC Global Custody Nominee (UK) 2,055,000 Ordinary Shares 4.18% (I have no idea why these guys appear twice !!) Latest Results Update AVAP released its First Half Results back on Thursday 19th February 2015 and they caused a bit of a stir. The Results Statement read ok but there was a big miss against Expectations for EPS (Earnings Per Share), and as you would expect, the Shares tanked - down around 12% at one point I think. Anyway, due to some great work by Paul Scott (of the Stockopedia Small Cap Value Report fame) speaking with Richard Wolanski, it later became clear that it was a presentational issue because the Company had failed to explain the true reason for the fall in EPS - and in fact it was no problem at all. In essence, the problem arose because AVAP had entered into 5 New Leases at the end of the 6 month Period - so the benefit of them from Lease Payments and consequent Profits will not come through until the Second Half of the Year. This will repeat when all New Leases are created - the Numbers come through in the next Full 6 Month Period. Noteworthy Recent Developments

“The intention of this Programme is to provide further funding options to the Company in its quest to provide high quality returns on equity for shareholders. The flexible nature of the programme allows the issue of various tranches of notes in the capital markets, when desirable, to match the funding required for the growth in the Company’s Aircraft Fleet. The Up-front cost of these programs in terms of advisers, legal and marketing are not insubstantial, however, the benefits over the coming years may be significantly accretive to shareholder value.”

Jeff Chatfield said: “These Notes form a part of the strategy to create an optimal capital structure for funding the growth of the Company. The Company has previously announced the purchase of twelve new modern commercial aircraft, a mixture of Airbus A321 and ATR72 types. When combined with appropriate amounts of asset backed senior bank debt, the deployment of the proceeds of these Notes allow the Company to strive to maximise its return on equity for its shareholders.”

“The completion of the Notes issue has provided the Company with the funding for additional growth beyond these contracted aircraft. The Company is assessing various narrow body aircraft for purchase. Avation may acquire aircraft if established investment criteria and airline credit risk profiles are met. In the event that this occurs, it is expected that the aircraft will be financed through a combination of senior secured financing at a senior debt loan to value ratio typical for the Company along with some funds provided by the Notes. The combination of secured and unsecured financing is planned to be established at a blended cost of capital similar to the Company’s current debt costs. The remainder of the funds provided by the Notes will be used to fund, in combination with senior secured financing, the 12 Contracted Aircraft. This will enable the Company to grow revenue in the near term.” Jeff Chatfield, Executive Chairman, said: “The first tranche of US$100 million in Notes has been successfully listed on the SGX-ST. This Programme is intended to provide flexible funding options to the Company in its quest to provide high quality returns on equity for shareholders. The up-front cost for the first tranche of Notes will be around US$3 million, however, the benefits over the coming years may be significantly accretive to shareholder value. The Company is planning to sell two older aircraft in the near term. As a lessor, every aircraft that is purchased by the Company must, at some future time, eventually be sold. The Company is seeking to have a young fleet, which we calculate at May 2015 to have a weighted average age of 4.8 years. The Company is seeking to take advantage of good aircraft market conditions to exit these old aircraft and improve the average age of the owned fleet.” Risks The Key Risks that I see are as follows:

The Following Text I have copied from the Company’s Annual Report - this is a comprehensive List: “The Company believes that it can obtain access to the necessary debt for the future purchase of aircraft. Access to funding nevertheless remains a risk, which is common to all businesses that are capital intensive. Specific aviation industry risks are also present and include the creditworthiness of client airlines. Other risks remain typical for an aircraft leasing industry that typically uses leverage to build the fleet, along with the finance risks and more particularly the residual value risk and impairment in aircraft assets. The Company has significant balance sheet exposure to Australian based aircraft. The Company is seeking to actively diversify away from Australian economic and geographic risk going forward by marketing to new airline customers.” Market related risks: Exposure to the airline industry:

Operational risks:

Growth Strategy AVAP leases out 29 Planes at the moment and plans to have 100 Planes leased out over the next few years. The plan is to add 12 planes over the next 2 years and to double the Fleet size within 3 years. Richard told me at Master Investor that they have 29 Planes now in Operation and 22 Options - which I understand as a ‘Right to Buy’ the Planes but they have not actually taken up the Options yet. These Options have a Tradeable Value and can be sold to other Plane Purchasers - according to Paul Scott the Options are worth another $30.8m on top (22 Options at $1.4m each apparently). I understand that the Value of these Options is not shown on the Company’s Balance Sheet - so there is some ‘Hidden’ value here possibly. AVAP is scheduled to deliver eight new ATR 72-600 aircraft before the end of FY2015 and an additional three ATR 72-600 aircraft in the second half of calendar year 2015. AVAP is actively evaluating additional aircraft acquisition opportunities. Asia / Pacific and Europe are the Hottest Growth areas with regard to Aircraft demand, particularly as the Asian Middle Classes expand. Having a Singapore Base is helpful in this regard. I copied this text from the 2014 Annual Report because it neatly summarises the Growth Case: “Coinciding with the expected future delivery of additional ATR 72s ordered from the manufacturer and potential acquisitions of other aircraft, Avation will continue to grow in terms of the size and quality of its managed fleet and the financial returns it generates.” The text below is from the Annual Report 2014 and highlights the Plane Leasing trends - this chimes with stuff I have read elsewhere: “Aircraft leasing is a growth industry with a growing market share of the world’s total commercial passenger aircraft fleet. Avation expects that the percentage of leased aircraft in the world fleet will continue to grow over the coming years due to the flexibility that the leasing model provides for airlines and also due to increased access to financial capital for leasing Companies.” Barriers to Entry Richard Wolanski said in one of the Videos on AVAP’s website that the main Entry Barriers to competitors were as follows:

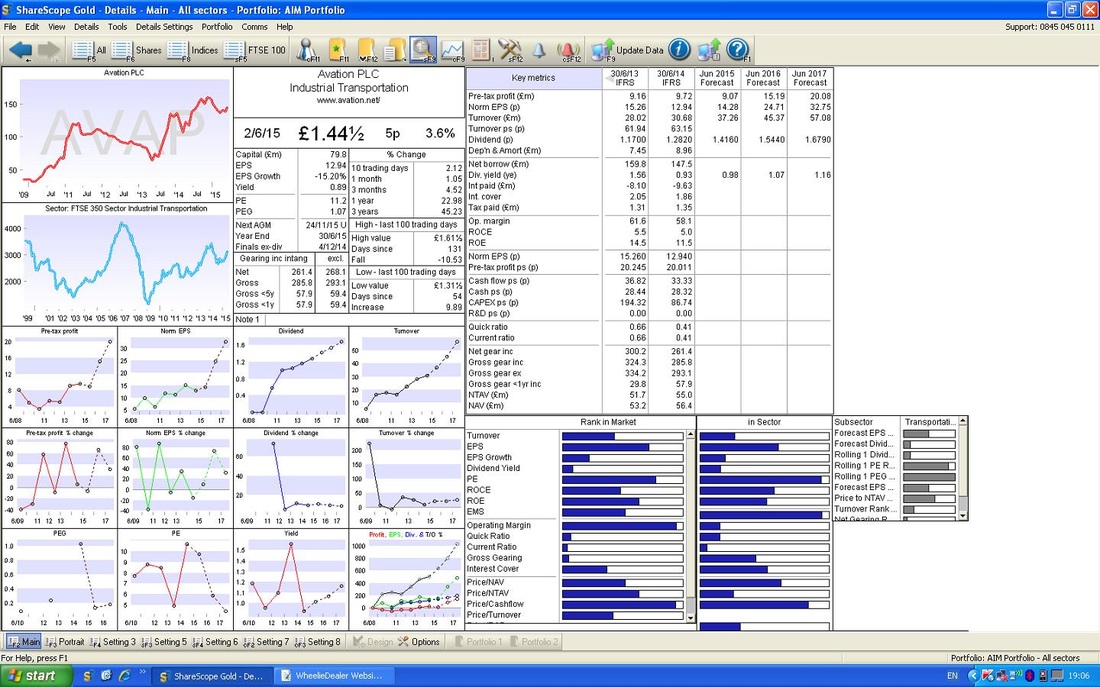

These seem like plausible Economic Moats to me, and it is obvious from the Global Notes Announcement that AVAP now have the Capital to back up their Plans. My simple test is, if you gave me £100m could I do this? Well, no, obviously I couldn’t…….. Valuation All of the Screenshots in this Blog are from the Night of Thursday 2nd June 2015, which was the situation pertaining (wow, cool word Wheelie !!) when I finally made my Decision to Topup my Holding of AVAP. If you look at the ShareScope ‘Details’ screenshot below, you should see in the Top Right Hand Corner, ‘Norm EPS (p)’ for ‘Jun 2016 Forecast’ of 24.71p (EPS means Earnings Per Share). At my Buy Price on Wednesday 3rd June of 147p, this gives a Forward P/E Ratio (Price Earnings Ratio - think of it as the number of years for the Stock to earn back the money invested) of 5.9 (147p divided by 24.71p). This is extremely low - you will rarely see a Stock with such a low P/E - usually you are lucky to find one on P/E of 8 and anything around 10 is usually considered as Good Value. If we go forward another year (remember, 2016 is Next Year and will be on us before we know it !!) and look at ‘Jun 2017 Forecast’ we get EPS of 32.75, which on my Buy Price of 147p gives a Forward P/E of 4.5 !!

In terms of Dividend, I won’t be getting much - to be fair, AVAP is clearly putting the Cash into the Business to help fuel growth - I have no problem with this and at this stage of Life it is probably better that they focus on Growth and the Divvys can come later. The Divvy is around 1% but slowly creep up in coming years.

At the 147p I paid for my Topup Shares, they are pretty much on TNAV (Total Net Asset Value) of £75.8m (figure according to Paul Scott from his excellent Stockopedia page) and the Options are worth another $30.8m on top (22 Options at $1.4m each apparently - these are not shown in the Balance Sheet). Target Rivals are valued on around 12 to 15 times Earnings and 1.5 Times NAV (Net Asset Value). If I was to put a P/E on AVAP of 12 times Next Year’s Forecast Earnings of 24.71p, I get a Target of 296p (12 x 24.71p). If I was generous and went for a P/E of 15 (bear in mind this might not be utterly daft if there is a Takeover Bid or AVAP can grow as fast as it intends to), then I get a Target of 370p. It is possible that AVAP could exceed Forecasts as the recent Bond Issue gives them a lot more scope to grow - in such a scenario, a Target of 400p would not be idiotic. In terms of NAV, simply using 1.5 times as the Metric, a Target of 220p is generated. Technicals As ever, let’s start with the Long Term. The Chart Below shows the Full History that I can see in ShareScope and covers about 5 years. As you should see, the Bottom Black Line and the Upper Red Line mark a wide Uptrend Channel that has been going on - please ignore the other lines etc. at this stage.

On the Chart below, I have zoomed in a bit so we are looking at about 1.5 years because I want to point out a ‘Triangle’ Pattern that is the Key Factor here. The Blue Line at the bottom and the sort of Purpely Line in the Top Right denote the Point of the Triangle. The important point here is that the Price has ‘Broken Out’ from the Purpely Top Line and this is very significant because with these kind of Breakouts, the Price can run up very fast (I hope so anyway !!).

On the Chart below, I have scrunched up the Upper Chart to show the RSI (Relative Strength Index). I love this Indicator as it is really clear and unambiguous. The Lower Black Line shows where a Stock has got ‘Oversold’ at RSI 30 and it might be time to Buy, and the Upper Red Line shows where it has got ‘Overbought’ on RSI 70 where it might be time to Sell.

In this case, the Price is at about RSI 56 so there is a bit of room to move up and it is good that the RSI line is moving up. Looking back through AVAP’s history, I note that on many occasions the RSI reading has gone as high as 90 ish - this means it could go up quite a lot in the move I hope is about to happen. You tend to find that with Smaller and more Illiquid Stocks, the RSI readings can get quite high. With larger and more Liquid Stocks (like FTSE100 stuff), you tend to get them Selling off before or around RSI 70.

On the Chart below, please look in the Top Window where you should see the Bollinger Bands (the Blue Wiggly lines) and note my Red Arrow which points out that the Price is currently up at the Top Line - which can mean it is not a good time to buy. However, quite often the Price can bang up against the Upper Bollinger Band and sort of ‘hug’ it on the way up. I suspect this will happen in this case as the Triangle Breakout I mentioned earlier is the Key Factor here. In other words I am pretty much ignoring the Signals from the Bollinger Bands !!

The Blue Arrow in the Bottom Window above points out where the MACD (Moving Average Convergence Divergence) has just turned Bullish - this is great.

On the Chart below, I have gone to a very Short timescale to point out the poor ‘Quality’ of the Candle that was produced on the Breakout. If you look at my Black Arrow - this is pointing to the offending Candle - you should be able to see that it has a very long ‘Wick’ (the line that is going up vertically out of the top of the ‘Body’). This means that during the Day, the Price was unable to stay up at the High of the Day - this is a shame, because I would have liked the Bulls to have kept charging hard throughout the Day. It’s another example where you often don’t get perfection with Technical Indicators and you have to work with what you’ve got and make decisions based on the most dominant factors.

Conclusion

There is a lot to like about this Company - hey, that’s why I have a chunk of their Shares. The risk is around Economic Growth really - if we get a Downturn, then this could cause AVAP a lot of problems - this is the key Risk Investors need to be comfortable with. The following key points make the Buy Case for me:

I expect to hold this for years and years - I think it has huge potential and I really would like to see it hit my higher Targets around 400p. skrzyzowane palce wd

5 Comments

catsick

8/6/2015 08:10:31 pm

Very nice writeup, I am long a chunk of these too after meeting the management team in Singapore pretty much for the same reasons as you outline, I have been buying more on dips ( which this company seems to get a lot of ) the company is very solid and good to see the management all are used to operating at a higher level and have a lot of skin in the game.

Reply

WheelieD

9/6/2015 04:30:09 pm

Hi Catsick, thanks for the comments - like you I am impressed by the Management and like the commitment. As I mentioned in my Blog, I feel a lot of the hesitancy is because people don't really understand the Company and hopefully my Blog can help unravel the mysteries !!

Reply

claudereins

9/6/2015 12:40:59 am

I have met Wolanski too - at Mello Derby Nov last year. He has been in Europe for quite a lot of time recently, in my view seeking institutional investor support. He said as much to me in a conversation with him after his presentation at Mello. He clearly hasn't got it yet, and that no doubt is holding down the SP. He also was obviously here to sort out the Flybe deals, though that wasn't obvious at the time.

Reply

WheelieD

9/6/2015 04:34:51 pm

Hi Claudereins - thank you for your info - nice to see it all chimes with what I have heard. It certainly looks like one where patience is needed but the progress in the Business will most probably get reflected in the Share Price over time.

Reply

23/12/2015 07:41:05 am

I find AVAP an intriguing Stock as it is involved in an Industry that I suspect the vast majority of Investors have no understanding of. The usual reaction I hear from people is “oooh, it’s got a lot of debt” and then they swiftly move on to the latest Hot Rocket Small Cap Mining Stock………….

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|