|

THIS IS NOT A TIP. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITES. PLEASE BE AWARE THAT THIS STOCK IS EXTREMELY HIGH RISK AND IF YOU COPY MY BUY YOU MAY LOSE ALL YOUR MONEY. IT IS NOT SOMETHING I WOULD NORMALLY BUY AND IT MIGHT TURN OUT TO BE A RIGHT DISASTER. This is a Buy Rationale following my small Nibble of some Accsys Technologies AXS Shares on Thursday 29th January at 58.84p. To a large extent this Blog is digging into the Products in order to understand if AXS really could be a truly great investment - because at this stage of development, it really is a Very High Risk, Speculative, ‘Blue-Sky‘ Buy. Regular Readers will be aware that this is not normally something I would buy, but in this case I have a very good source of Information and it is a Share that I have been watching for years - and for most of the time it never seemed to be getting anywhere. That may have now changed. AXS is a small AIM listed stock that is now on a Share Price of 57p (mid price) with a Market Capitalisation of £50.6m. This is a very small company and really too speculative for me to normally buy - but I think there could be something really very special here. I discovered a couple of slightly weird and surprising things about AXS recently - firstly, the CEO is Paul Clegg - yes, you guessed it, the brother of the Deputy Prime Minister, Nick Clegg - I am not sure if this is a good or bad thing, but clearly AXS have the Ear of Government. Secondly, their Head Office is in Windsor (my Local Town) - maybe they will take me out to Lunch at the Green Olive, Greek Restaurant, (hint, hint - just email me at [email protected]). Maybe the fact that they are in Windsor should put me off it. I read something recently that seemed to be saying that Investors who bought into companies in their Local Area often lost money - I think it is called ‘Familiarity Bias’, breeding Overconfidence. Well, in this case, hopefully this is not influencing me too much - because the truth is that I only realised this about AXS in recent weeks - for years I have been unaware. Although of course it could have been a classic bit of ‘Confirmation Bias’ which finally tipped me over the edge to buy them !! Valuation This Blog is not really intended to be about Valuations - to be honest, it is hard to value as they are loss making at this stage, and I suspect there is a huge risk of dilution for any Shareholders as new Shares will probably need to be issued in the future. They had in the region of 13.5m Euros of cash at the end of September 2014 (as per their Interim Results which were issued on an RNS dated 24th November 2014) - I have no idea what the current position is, but it will obviously have gone down. I note from the Interims that their Cash Pile had dropped by 11% in that 6 months period. In addition, the Euro has been weak lately and when translated back into Quids, this would be lower than previously. With the new Far-Left government ruling Greece, we may see even more pressure on the Euro. The Underlying Loss from the Interim 6 month period was 3.1m Euros (I think the ‘Underlying’ figure is appropriate as the removed ‘Exceptional’ is a properly One-Off payment for the Diamond Wood situation which I address further down this spiel), so if we were to assume a Cash Burn of 6m Euros a year (Revenues are growing fast and the Loss seems to be dropping so this feels about right), then they would have about 2 years of Cash. I will not be surprised if there is a Fund Raising and Dilution for Shareholders in future - but I do not expect this to be big - and it may be avoided if Revenues can keep up the strong growth rate. I understand they are at the moment. The single Valuation Metric that leaps out at me is the Price to Sales Ratio (PSR). The Turnover (sales, revenue, really) from the 2014 Full Year results was £27.69m (I am getting these figures from ShareScope). For next year (2015) the Turnover forecast is £33.26m and for 2016 the Turnover forecast is £38.46m and then in 2017 it is £43.57m. In other words, on a Market Cap of £50.6m, it doesn’t look wildly overvalued on this metric (PSR) - especially if the growth comes through. If anything, these numbers may be on the light side - if the New Factory which is coming on line in 2016 works out, then there must be Upside Potential. Unfortunately even by 2017 it is not expected to make a Profit - this is not so good, although the trend of Losses is expected to reduce nicely. The Pre Tax profit figures are as follows:

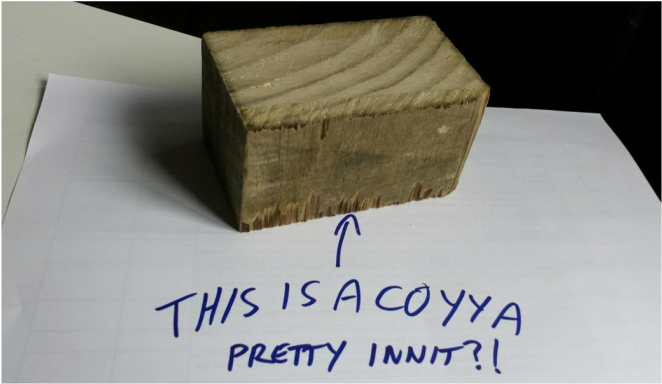

Pre Tax Profit is obviously appropriate because with all these Losses, and a huge amount from previous years I imagine, they won’t have to pay any Tax for a long time. Products Right, I am basically saying I know sod all about the valuation (or rather, how to value something this speculative and High Risk) but I am gonna tell you about the amazing products…….. On Sunday night 14th Dec, I had the great fortune of going to see Chrissie Hynde live in some pokey little church in Bristol - it was superb. Amazing to think she is a Rock-Chick-Granny. Where was I, yeah, the point is I went with my Brother. He works for James Latham, the timber people, (EPIC LTHM) and is really a Buyer of timber but I understand he gets involved on the Sales side a bit and clearly understands what Wood is selling. He made me aware of Accoya (AXS main product) some years ago - it might have been in response to me reading about AXS and asking him - I cannot remember. I have been looking at progress at AXS recently so while we troffed a Pizza, we had a deep discussion on Accoya and what was potentially good about it. We also discussed their other product, Tricoya. By the way, Pizza Hut, if you are reading this (yeah, right, Wheelie) please make sure you have Cheese Crust at your Bristol Restaurant next time. Having no Cheese is not really a valid excuse at a Pizza Restaurant !! Accoya The basic product is a Pine which has been soaked (treated) in an Oil Industry by-product which changes the structural properties of the softwood. My Brother gave me a chunk of Accoya which you can see in the picture below - ok, it’s not that exciting I will admit, but you need to understand what is going on here. So, as you can see, it is a block of Pine (shame I can‘t spell !!). However, when you look closely (you probably can’t see in the picture, so you will have to trust me on this), it has a sort of greyish colouration on the outside surfaces and if you sniff it, it has a definite whiff which is none too pleasant really. Quite chemically. Lucky no one has yet invented ‘SmelliVision’. One really key point is that if you look at the Cross Section of the tree (where you get the ‘Rings’ - at the Top of the Block in the Picture) then you see the ‘Rings’ are extremely wide apart - this means that the growth rate of the tree is very fast - most unusual and you would not see this in Hardwoods, which take a long time to grow. As I understood our conversation, the Pine is shipped from New Zealand (this is potentially a negative from an Environmental viewpoint as obviously the Ship is turfing out fumes etc. but Accoya does have other Environmental benefits which should be obvious from the text which is going to follow), to Arnhem in The Netherlands where it is dipped in the chemicals to change it into Accoya. The Pine presumably grows fast out in New Zealand but I am sure they could source good wood elsewhere - my Brother suggests this is the case and says Chile would be a possible source among others. I used to be under the mistaken belief that Accoya was amazing because the soaking turned Softwood (cheap, fast growing, Pine) into Hardwood (like Teak, Mahogany, Sapele, Oak etc.), but that is totally untrue. I suspect most Investors totally misunderstand this also. In fact, Accoya seems to me to be very much like Pine in its ‘strength’ properties - i.e. you smack it with a hammer and it dents a lot and probably breaks up. If you give a piece of Teak a good bashing, it holds up pretty well. If you had a ‘beam’ of Accoya and jumped up and down on it, it would probably break - it does not have ‘strength’ as such. No, it is not about strength, the key here is ‘Durability’. When the Pine gets soaked, the internal structure of the wood changes. In untreated Pine, there are sort of lots of little tiny tube shapes in it (I guess they are Cells or something) but they have open ends - so this means that water can just pass through the wood and it will expand and warp. The amazing thing with Accoya is that the ends of these tiny tubes get sort of filled in - so Water will not pass into the wood. My brother gave the example that if you threw 2 blocks into a bucket of water - with one being Pine and the other being Accoya, you would find that the Pine one grows hugely but the Accoya one grows a tiny bit and then stays at the same size - so there is an initial expansion, and then that is the size it stays - a very useful property as I will get on to in a bit (you are gonna have to wait, god you lot are so impatient !!). When you take the Pine Block out of the bucket, it will then shrink back to its smaller size as it dries out, and it will probably warp and stuff as well. Accoya will not do this. This property is called ‘Stability’ in the trade. We were talking about Durability - let me elaborate. Due to this low expansion and Water resistant nature, a piece of Accoya left outside will last for maybe 70 years. In comparison, a piece of Pine, even if painted, will last maybe 10 years outside. A key point here is that if you paint normal Pine, the movement as it expands and contracts with moisture actually makes the paint crack - so you need to keep repainting it. Because Accoya does not move about like this, a painted finish stays nice for much longer - maybe 20 years. As a consequence of this Durability, many Architects are specifying Accoya for new houses and commercial properties like Shops and stuff. It is mainly used for Window Frames and for outside Doors and Door Frames. There is a problem however. Accoya is more expensive than Hardwood like Teak, Oak etc. But, my brother has found that once they can persuade a Joinery Company to adopt it, there is no going back - they love it. Right, I better explain the Industry Structure here. The way it works is that you get the normal Housebuilders (like PSN, BWY, CRST, TW., etc.) and they tend to fit standardised, mass produced, Door Frames and Window Frames - they are not the buyers for Accoya. These mainstream house builders want cheap inputs to their houses and are not too bothered if they fall apart in under 10 years. No, the market for Accoya is the one-off, small production, individual houses or a few houses in a group, built by a specialist small Housebuilder. These are often custom-built houses which are individually designed by Architects with the owners. One of the biggest Risks to the Investment Case is Cyclicality - the Housebuilding and Construction Sectors are extremely prone to huge Booms and Busts. This is a Risk that has to be taken on with the Investment - there is no escaping it. However, one thing in AXS’s favour is that the Market they serve is ‘Top-End’ and very specialist. The End Customers are wealthy (they are Architect designed one-off houses) and this Niche may be less Cyclical. In future, it is likely that the Products will find many more applications. These custom-built houses are supplied by small Joinery Companies that make the Door and Window wood bits. So, the raw timber planks and Boards get delivered from Timber Merchants (think LTHM) to the Joiners and then they chop them up and make them into the end products. When I say “chop them up” I mean that the Joiners take the input and use a Specialist Saw thing that has loads of rotating blades that whizz around at very high speeds (keep your fingers out !!). Accoya has several advantages here which hugely make up for the higher initial costs compared to normal Hardwoods:

As I understood it, Accoya is currently being produced at AXS’s Treatment Plant in The Netherlands - this is small scale as it was originally the ‘Pilot Plant’ to prove the concept. Accoya has been around for about 10 years. One drawback of Accoya is that it is not good with the most common and cheapest glue products (PVA) that are used by builders. However, it will work with more expensive glues (I think called Polyurethane) that are a bit messier to use - it is a pain, but doesn’t seem to put the builders off too much - I suspect they have to go with what the Architect and House Owner want anyway. The glues are awkward to use but with experience the problem seems to go away. Another big advantage of Accoya is ‘Dimension‘. This really surprised me, I had not realised how this works in the Timber Industry. In simple terms (hey, I can only do Simple so that is all you get) when a Joiner gets a delivery of Planks and stuff, it is all of varied sizes - so they get lots of odd cuts and left over bits - lots of waste. Hardwoods are supplied in random widths to maximise yield for the Sawmill; cheaper softwoods are sawn to size at source. With Accoya, AXS put a lot of effort into ’dimensioning’ the stuff. This means that if you order a certain, specific size of Plank or Board then that is what you actually receive. Accoya ‘Grading’ (i.e. the quality of each board ) is very consistent so this also reduces waste for the Joiner. Recently imposed European Union Timber Rules (EUTR) require that all timber imported into Europe must be at the very least legally exported from the Country of Origin; this has reduced the availability of some popular hardwoods. Accoya is fully FSC (Forest Stewardship Council) certified, non-toxic and recyclable. With such Accreditation, Accoya scores well on ‘Sustainability.’ Tricoya This is fairly new as it has been in production for 2 years roughly. I was really surprised by this - I thought it was just made out of off-cut stuff like Sawdust etc. - but obviously there would not be enough of it to make the volumes of Board needed. Tricoya is essentially a Medium Density Fibreboard (MDF). I have no idea what MDF is so I stole this from Wikipedia: “Medium-density fibreboard (MDF) is an engineered wood product made by breaking down hardwood or softwood residuals into wood fibres, often in a defibrator, combining it with wax and a resin binder, and forming panels by applying high temperature and pressure. MDF is generally denser than plywood. It is made up of separated fibres, but can be used as a building material similar in application to plywood. It is stronger and much denser than particle board. The name derives from the distinction in densities of fibreboard. Large-scale production of MDF began in the 1980s, in both North America and Europe.” I couldn’t put it better myself (literally, I couldn’t) so I didn’t. Normally, MDF is not particularly durable, so tends not to be External Facing. Tricoya is very durable as it is made from Chopped up Accoya - so it is used outside. This is the USP (Unique Selling Point). This needs stressing. Tricoya is a Board that can be used OUTSIDE. Normal MDF would just collapse into a soggy mess. Some Commercial Aspects My brother told me some very interesting history of Accoya and how it has progressed. I already knew about the big deal with Solvay (a large Belgian Chemical Company) which has huge potential - the plan is to licence the Treatment Process to Solvay and get paid a Royalty on Accoya amounts sold. Solvay would hopefully create Treatment Plants all over the world. In the UK, Accoya has been pretty much driven to market by LTHM, who put in a lot of effort to persuade Joiners to use Accoya over recent years. At first they were reluctant as it costs more, but once they had machined it, they realised what the true benefits to them were. It is notable that in LTHM’s recent results, they state how fast Accoya sales were growing. I understand that recent sales are stunning also. Apparently there is a similar competing product for Accoya - however, it is much smaller in its market share and a long way behind Accoya on the road to proper commercialisation. Accoya is only available through a limited number of suppliers of which LTHM have the largest share of the market and basically created the market through dedication to the product. Diamond Wood AXS has been hampered in recent years by a disastrous attempt to exploit the Chinese Market by signing an Agreement with a company called ‘Diamond Wood’ who were supposed to build a Treatment Plant and sell Accoya in China. I don’t know much about this (to be honest, I am not that bothered, it seems to be a past event and the Directors are all different now) but it seems like the Legal Situation has been resolved and I think Diamond Wood retain some Rights to sell into China. The following text was in the Recent Trading Update: “We have recorded an exceptional cost of €3.1m relating to the arbitration ruling received in the period in respect of the dispute with Diamond Wood, following our decision to terminate the licence agreement in August 2013. The charge reflects an award of damages of €250,000, payment of Diamond Wood's costs of €2.1m and our own costs of €0.7m.” It seems to me that the China thing is pretty irrelevant - if AXS can exploit the Rest of the World, then any progress in China would be Icing on the top. I don’t see this as vital for any Investment Case - the issue is Supply anyway, not Demand. Key Points from Recent Trading Update In the last Trading Update from November 2014, Accoya sales Revenue in the First Half of the Year increased by 43% over the same Period in 2013. Total revenue increased 38% compared to the corresponding period last year, and by 23% compared to the preceding six month period - on the face of this, it appears that Revenue Growth might be slowing - I am not sure why this happened, but I did note in the following chunk of Text that they were doing some Annual Maintenance - maybe that explains a bit of the apparent Slowdown. Note also that they are pushing through Higher Prices - this is good as it shows some Pricing Power: “During the period, we sold 16,840 cubic meters of Accoya®, a 39% increase compared to the same period in the previous year. We successfully optimised short term production constraints and recently completed our annual maintenance stop during which we implemented changes which will help enable us to increase manufacturing capacity. A further price increase is being implemented in the second half of the financial year for all of our customers which we expect to further improve profitability.” This is a key part of the recent Update: “Solvay Acetow has announced that it is progressing to the next stage of the preparation of the Accoya plant in Freiburg, which includes amongst other works the completion of the Detailed Engineering and the physical clearing and preparation of the site. The next construction milestone is mid-2015, in line with the expected schedule of completion by 2016. This follows on from the binding term sheet agreed with Solvay in August 2014 in respect of a three year global co-operation agreement to develop Accoya® under which Solvay is expected to engage Accsys to carry out targeted marketing activities outside of Europe. In addition the term sheet allows for Accsys to grant Solvay a non-exclusive global Accoya® licence option for available regions and for Solvay to grant Accsys the option to invest in a substantial minority share in the European project and future Accoya® production projects. The full marketing agreement is expected to be finalised in December 2014.” It is clear that getting more Capacity to meet Demand is what is desperately needed. It seems likely to me that the Share Price could rise as the Importance of this New Processing Plant sinks in to Investors. This is due to be built in 2016 which is only a year away - I think this could drive the shares higher over 2015 as people get with the Story. I suspect we will see the likes of Investors Chronicle and Shares Mag tipping it also - this would be very sweet for people who are in early. The Recent Trading Update contained the following comments on Tricoya and Accoya: “Our joint venture with Ineos, Tricoya Technologies Limited ('TTL') also continues to progress the development of Tricoya. Market development activities continue with Medite and Masisa, with Masisa extending the duration of its licence option for Latin America. The progress is demonstrated by sales of Accoya to Medite for the manufacture of Medite Tricoya, prior to dedicated facilities being built, with revenue having increased by 68% to €2.4m compared to the same period last year. The licence with Medite remains conditional upon the approval from its Board of Directors.” Chart On a small Speculative Stock like this, the Chart isn’t all that useful - although over a Longer Period, it does give a feel. On this 4 year Chart, the peak from July 2014 is about 95p ish. This will probably Cap gains in the short term but if we see a Breakout from this level, then the Shares really could run. I think there is a good chance we can see this Peak again during 2015 and the Breakout and much higher is very possible. In my view, this has the capability to be a proper Multi Bagger - and I will be holding for years to try and catch that. If things go wrong, then I will sell out - but my Risk is pretty small from my ‘Pilot’ position. As you can see, the Price is down near the bottom, so this seems a good time to be ‘Buying Low’. In addition, the Company put out a Trading Update in Early February last year - so I expect an Update very soon - this could be a Trigger for an upmove. There is a bit of an Uptrend Channel going on - I have marked this with the Black and Red lines. Conclusion

I hope this Blog has given you a good understanding of some pretty impressive products. The benefits of Accoya are Durability, Stability, Ease of Machining and Sustainability. One thing I particularly like is that the Free ADVFN Bulletin Board for AXS is pretty quiet - so the stock is fairly unloved by the usual crowd and seems to be ‘Under the Radar’. It is worth noting that a few years back, this really was a ‘go go’ stock, with all the usual Crowd getting massively over-excited. I suspect we might be able to get back to those days if the Company can keep making progress. It is my understanding that AXS are looking to increase production in 2015 through efficiency changes at the Pilot Plant and the building of the New Plant by Solvay will mean more Capacity from 2016. This could be a big catalyst for Growth. The fact that big players like Solvay and Ineos are involved, can only be seen as a Positive. It is vital to understand the Supply and Demand Dynamics here. From what I hear, Demand is utterly booming - both from Joiners and for Tricoya (which uses chopped up Accoya remember) and the Supply is very limited because AXS can only supply from the Pilot Plant. Once the New Freiburg Plant comes online, the Supply could bump up to fulfil some Demand - but the shortage of Product is an issue apparently. I have just dipped my toe in the water at this stage with a tiny ‘Pilot‘ purchase of the Shares. I find this means I continue to monitor the developing story closely and if the company makes good progress with commercialising their superb products, then I would more likely buy a lot more shares. It is just too risky for me to do anything else. Anyone with huge money in this is bonkers in my view - unless of course they are Company Directors or something !! OK, that’s enough, I think you should get the picture and this should be a good springboard for further research if anyone wants to know more - of course this is not a Tip and I make no Recommendation whatsoever that you should buy some Stock. My fingers are well and truly crossed and I hope I am on the verge of a great Investment that I will be able to Topup on and hold for many years as the price soars into the Stratosphere. Maybe that should be StratosFEAR (wasn’t that a 70s Rock Album?) Cheers, Woody WD.

2 Comments

WheelieDealer

18/11/2015 11:52:19 pm

Hi ccde - thank you for your comments. I fully agree with what you say - I took advantage of my Brother's knowledge to really understand the Products and to share that out. It is very much a Blue Sky Stock and I only took a tiny 'Pilot' position but if it does start to deliver real Cash, then I would love to be able to buy a lot more. Will be some time I suspect if it does get there.

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|