|

I strongly recommend that you read Part 1 of these Blogs before attacking this chunk - otherwise it probably won’t make a whole lot of sense and it is really key that you understand what is meant by Upside Breakouts and Consolidations in particular. You can find Part 1 here:

http://wheeliedealer.weebly.com/educational-blogs/a-truly-genius-system-for-making-money-part-1-of-2 The Stages of the ‘Trading Bases’ Approach Right, you need to concentrate for this bit. If you are a bit jaded - you know, big night on the Fevertree and Gin last night or ‘too many beers’ (yeah, I know that is impossible but I‘m sure that never stops you trying to find the limit) - then go and get a stiff Black Coffee and take some deep breaths to get mentally and emotionally focused.

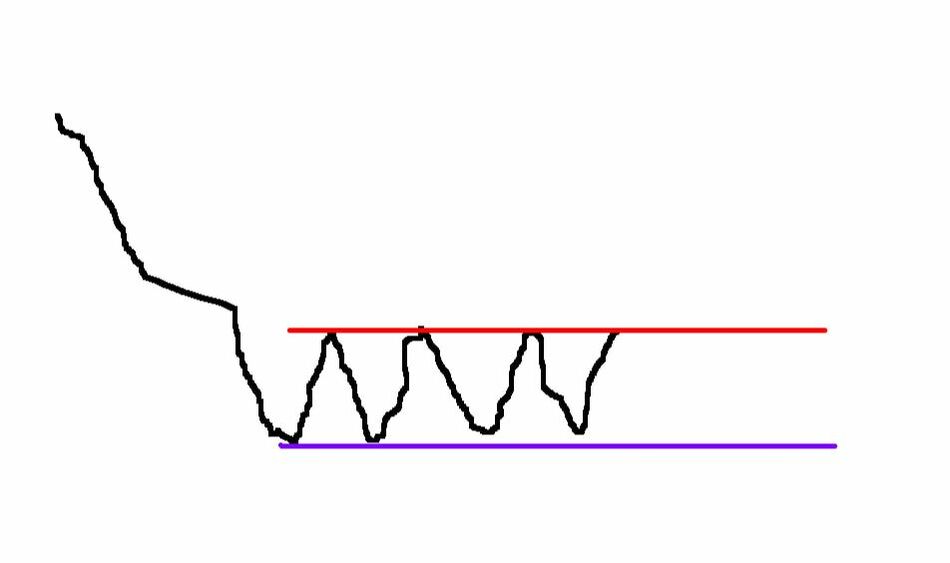

In the diagram below we have a Price that has been moving down for probably quite some time (in a Downtrend) and then it has started to move sideways between my Blue Line at the bottom and my Red Line at the top. This is the process of forming a Base.

Note, I have drawn and talked about this in the context of a Share Price that was in a sustained Downtrend before but it is also very possible that a Small Stock which has not done much for years and has largely gone sideways, can suddenly pick up (for example, it might have done a game-changing acquisition or a Product it has been developing for some time has finally got traction in the Marketplace) and start to form a proper decent Uptrend. In truth, the previous history perhaps doesn’t matter all that that much - this is really above identifying the start of a Base forming and then to be ready for when it Breaks-out to the upside. At this point in time, two things could happen - either the Price could break below the Blue Line and continue a Downtrend move or it could break higher above the Red Line and this would be the start of a new Uptrend (ok, that is not always what happens but in the vast majority of cases it will play out that way. To be clear, what I mean is that it can break to the upside but not then become a proper and sustained Uptrend - that is unusual though).

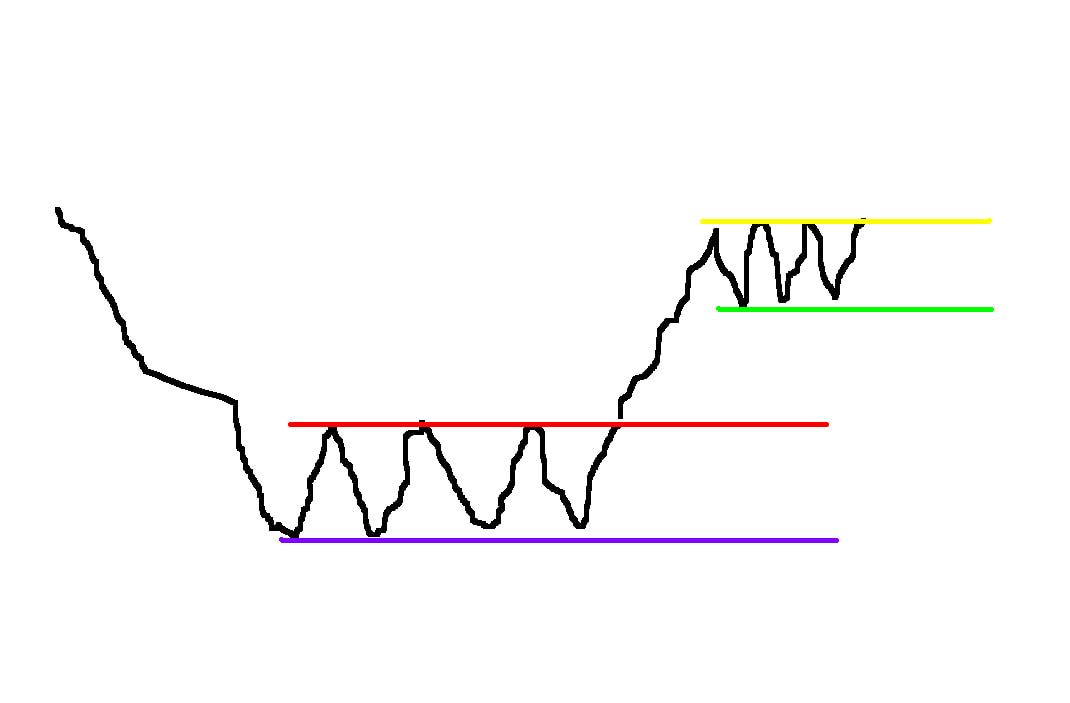

On the next picture, the Share Price has broken-out above the Red Line and it has moved upwards and then started to form a new Sideways move between my Green and Yellow Lines (as I mentioned before in Part 1, the Price is Consolidating by going sideways). I might have my terminology slightly wrong, but I think what this shows is the Price breaking higher from ‘Base 1’ and then moving up to start the Sideways move which is ‘Base 2’.

Now this is where it starts getting clever. Up until now no Trades would have been placed but the way Jason’s system works is that once you Breakout of Base 1, i.e. the Price moves above the Red Line, then you Buy your first Position (Jason has very precise and important Risk Management Rules that go along with this but I will let you dig around his Website to figure that side of things out), and you place a Stoploss just below the bottom of the Base - in other words, your Stoploss goes just below my Blue Line.

Now it gets really super damn clever and this is how it makes serious Money. In fact, I must say I think this is probably the most amazing system I have ever seen and it is so simple and mechanical - although in truth, that is a limitation for me personally because I enjoy the ‘art’ of Investing in Shares as much as the fact that it pays for me to eat and shove gas in the Cupra. It has often struck me that there must be a way to programme a Computer to follow exactly this system and to do the Trades automatically for you !!

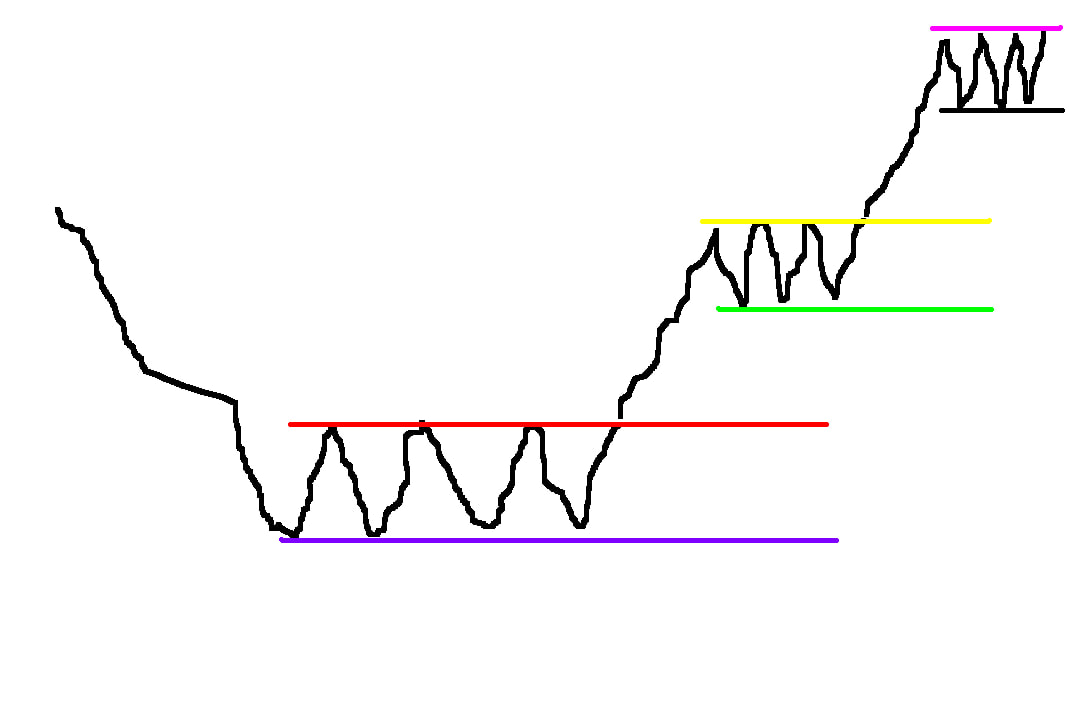

On my last picture the Price has broken higher out of Base 1 and has started to form Base 2 with the Sideways move between my Green and Yellow Lines - now we are waiting for the Breakout of Base 2 and for the Price to go above the Yellow Line and when that happens we Buy more of the Stock and now we move the Stoploss up from below Base 1 (below the Blue Line) and we move it up to just below Base 2 - i.e. just below the Green Line. It should be apparent from this simple piece of extremely effective Trading Action, that we have perhaps doubled our Position in the Stock (assuming we put the same amount of Cash/Exposure in on both Buy Trades) but note that we have also de-risked the Trade to an extent because we have the moved the Stoploss up (the same Stoploss applies to both Trades you have put on). I told you it was truly genius. Note, as I mentioned before Jason has very strict rules on how he sizes Positions and the level of Risk he takes - see his Website for more clarity on this. Then the Price moves up again and we start to form Base 3 with a Sideways move - and again we would repeat the Buy Process by buying more of the Stock when it Breaks higher above the sort of Pinky/Purple Line and we would move the Stoploss up to just below the Black Horizontal Line - so we would again have increased the size of our Position (it could now be 3 times as big if we buy equal amounts) and we have de-risked again by raising the Stoploss. Obviously a key feature of the System is that we must 100% obey the Stoplosses and be robotic and mechanical. Along similar lines, I think Jason says we should buy as soon as the Price breaks higher - so we can buy Intraday and not just wait for an End of Day Close - that captures more of the move up although you do run the risk of false breakouts. A tweak could be to only act after an End of Day Close but that is not how Jason does it I understand (although of course if you have distractions during the day like a Job or something then maybe an EOD Close approach might work for you).

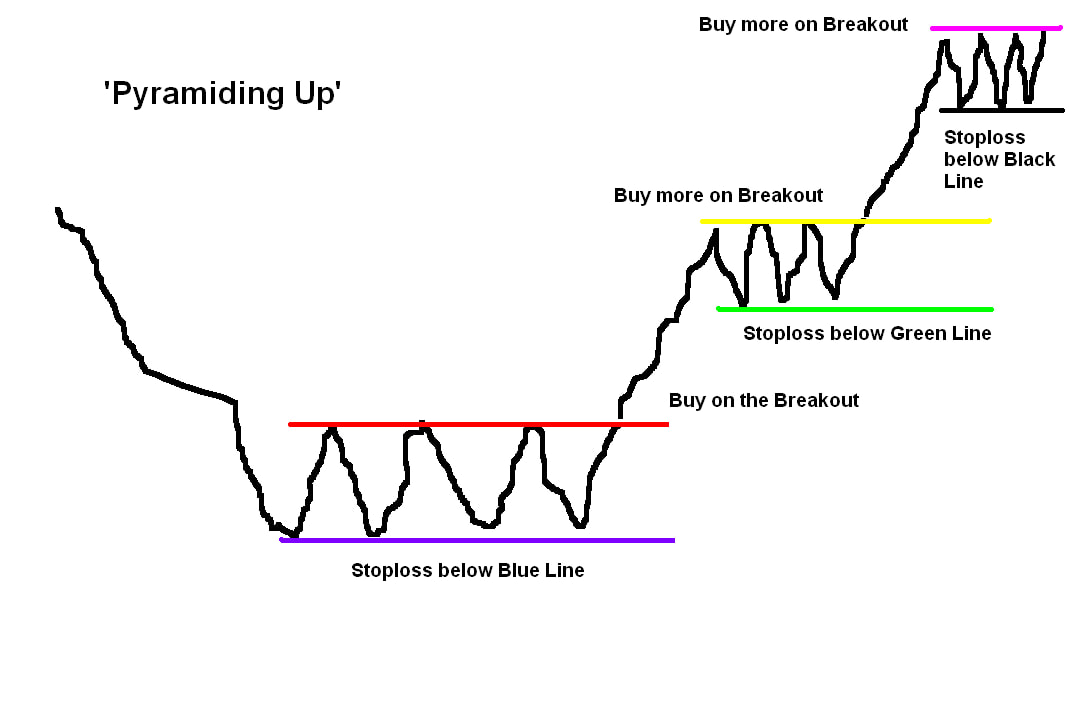

Pyramiding Up

In summary then, the Picture below shows the full process for the 3 Bases I have discussed and I have put in some text which hopefully makes it simple to understand. In practice Jason tells me that Uptrends can be of perhaps 5 or 6 Bases but I don’t think they ever do more without dropping back - although of course there might be the odd exception. No doubt there will be Uptrends which only have 3 or 4 bases etc. but the point is that the Stoploss does the work for you and tells you when to Sell out. It takes out the emotion and the psychological stuff to a large extent which of course is a proper full-on beauty of the system because we are all prone to Emotional and Psychological biases.

You can of course follow exactly this system and I think that if you have a ‘Trading’ bent then it would most definitely be in your interest to do so but if you are not so interested and have an Investing Approach that you are very happy with, then it might be worth thinking about the ideas of the Breakouts and how you can buy more after such moves and it will probably work out very well. Likewise, the positioning of the Stoplosses might give you some useful pointers as to how you can refine your approach. In addition, the concept of how Uptrends and Downtrends move in Channels with strong Price moves followed by Consolidation Periods (by time or by Price) may help you understand what a Share Price is doing when you are looking at a Chart.

I cannot reiterate enough how much the Market continually uses all sorts of tricks to shake you out of a great Stock - a better appreciation of how Prices move can help you avoid the subconscious psychological desires to Sell a Stock way too early - irrespective of what sort of approach you use at the moment. Something that in particular appeals to me about Jason’s approach is the Pyramiding Up concept. If you think about it, the method most of us use is to TopChop or TopSlice a Holding as it grows so we are ‘controlling Risk’ but Jason controls his Risk by very strict discipline and a systematic approach combined with careful Stoploss Rules. If you think about it, by TopChopping we are reducing our Exposure and Weight to a good Stock which when compared to Jason’s brilliant approach, is not so great because Jason is actually ADDING to his Exposure and Weight but in a very controlled manner and he is optimising the Returns he can make from a given Stock and a given Trade. That certainly gets me thinking and mulling over how I could perhaps adapt my own approach to something which takes more advantage of a Stock that is doing well - but without getting into a pickle by having too much uncontrolled Risk. And of course, by having strict Stoploss Rules and implementing them without question, Jason is very quickly reducing his exposure to weak Stocks that are falling and therefore he is heavily weighted to Winners and has tiny exposure to Losers. Think about that……. Anyway, I hope you understood what I have scribbled and drawn here and check out Jason’s Website at: www.tradingbases.co.uk And you can follow him on the Tweets as @Stealthsurf which I strongly recommend and I must also mention that he has some other methods such as ‘Swing Trading‘ sort of approaches but I have not really dug into the details of how he does these. I’m sure you can always ask him if you are intrigued. Cheers, WD. PS. Whilst uploading this Blog to the Website it suddenly hit me that I had not mentioned that you could use a similar system to trade Stocks in a Downtrend - and let’s face it there are plenty such woofers about. In this case everything is reversed - so you would place a Sell Trade when a Sideways Consolidation (Ledge) breaks-down and you would put your Stoploss (where you buy the Position back) just above the top of the Sideways Range. Then as the Stock falls through successive Ledges you would place more Sell Trades and move your Stoploss down each time with it always being just above the Sideways move of the Ledge. Related Blogs This one also has loads of MS Paint pictures in it !!! http://wheeliedealer.weebly.com/educational-blogs/the-mechanics-of-a-trade-part-3-of-3

2 Comments

Jase TB

10/5/2019 11:34:18 am

Cheers WD. I love the charts. My rules are EOD for entries but not for exits. I sometimes nibble intraday on special ones. Cheers again.

Reply

WheelieDealer

15/5/2019 10:01:43 pm

Hi Jase,

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|