|

THIS IS NOT A TIP OR RECOMMENDATION. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITE. IF YOU COPY MY TRADES, YOU WILL PROBABLY LOSE MONEY. I HAVE A VERY LARGE PORTFOLIO AND I USE DIVERSIFICATION TO SPREAD RISK ALONG WITH TRICKS LIKE HEDGING AND OCCASIONALLY BY THE USE OF STOPLOSSES - IF YOU BUY ANY STOCK YOU REALLY SHOULD FOCUS ON HOW IT FITS IN YOUR PORTFOLIO AND KEEP RISK MANAGEMENT AT THE FOREFRONT OF EVERYTHING YOU DO. BE AWARE THAT ALL INVESTORS/TRADERS GET THINGS WRONG AND MANY STOCK SELECTIONS WILL WORK OUT BADLY - MAKE SURE YOU UNDERSTAND THIS.

Boohoo.com BOO came out with Interim Results today and I thought they were superb. Of course, the Market thinks completely differently and the Shares got beat up 15% - it is my Biggest Holding so it did make me wince a little. Anyway, you can read the RNS for the Interims here: http://otp.investis.com/clients/uk/boohoo/rns/regulatory-story.aspx?cid=798&newsid=930898 The big stand out for me is the Growth Rate of the Revenues - up 106% over the 6 months (up 101% in Constant Currencies). Of course, many will trot out the “Revenue is Vanity, Profit is Sanity” adage and this is fair enough - but as often is the case, such simplistic phrases may not always be appropriate (bit like the “Never buy an IPO” which I think is just garbage). My take on this is that BOO is quite simply a Growth Company in the Hottest Growth Sector most of us will probably ever have the good fortune to trip over in our lifetimes - I cannot stress enough how unusual it is to have a Company that can grow at such a stellar pace - from recent memory, only Fevertree FEVR gets even remotely close (bored Readers might want to apply the kind of principles/modelling that I use in this Blog to FEVR and see what pops out at the end).

There is another important thing to understand - Revenue is the difficult element to achieve whereas Profit is relatively simple IF YOU HAVE THE REVENUES. This is worth remembering in Recovery situations as well - if a Company has big Revenues, then it doesn’t take much restructuring, cost cutting, closing loss-making bits etc. to turn a Profit. You try making a Profit if you have barely any Revenue - that is the problem the majority of Junky AIM Companies face - it most certainly does not apply to BOO.

The point is that BOO is investing in Rapid Growth. Many will take the view that it is one thing to grow Revenue at 100%+ but entirely another thing when Profits ‘only’ grow 41% (still an incredibly fast rate and most Listed Companies couldn’t even dream of such numbers), and Earnings Per Share grow 24%. But this entirely misses the Point - BOO has Rapid Revenue Growth because it is using the Cash it generates (boosted with a recent Share Issue as well which was arguably unnecessary - I suspect the reality is that Institutions wanted in on the game and they were desperate for Stock) to invest in that Growth. To illustrate this, look at the Adjusted EBITDA Line - this shows growth of 68% and is probably a better reflection of what is really being delivered. I take the view that BOO has the strategy entirely correct - at this stage of their Lifecycle (in truth BOO is an extremely young company being Founded in 2006 and has achieved a lot already) they are doing the right thing to get Revenues growing Super Fast and to create a powerful Brand as fast as they can. These Investments have included:

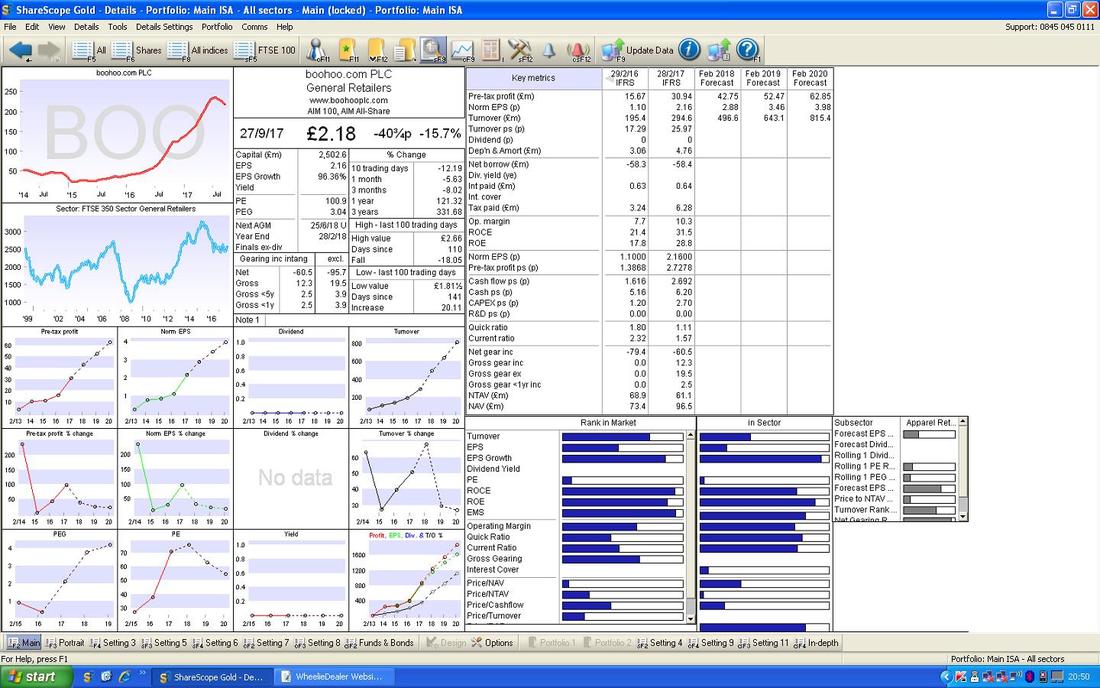

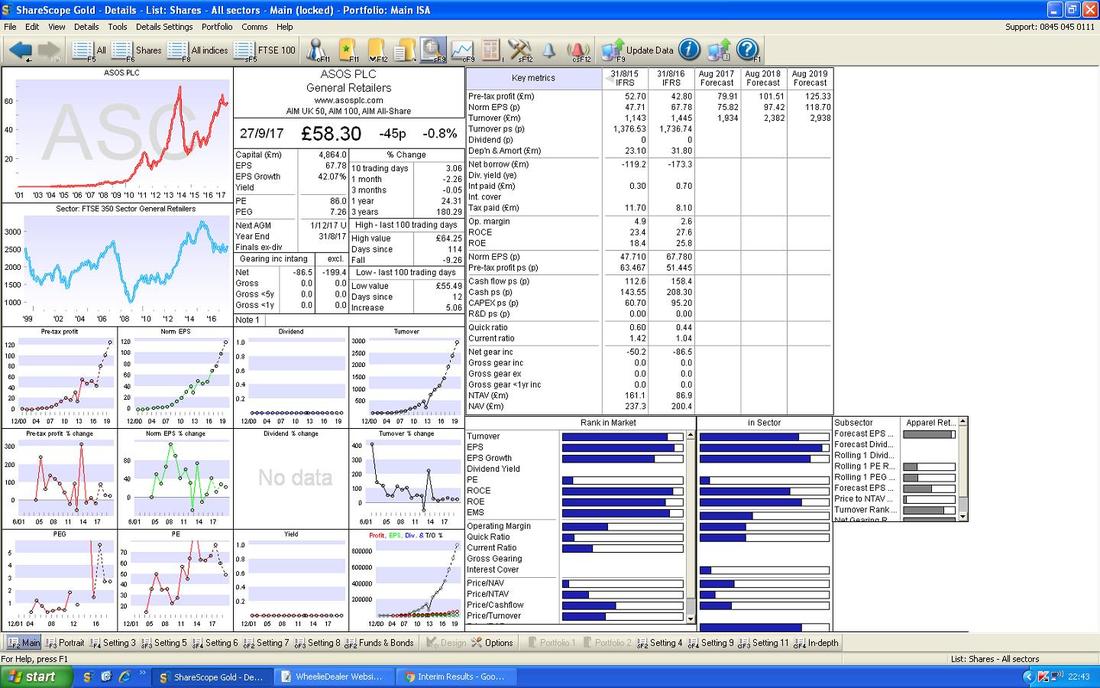

Modelling the Growth I suspect much of the reason behind Today’s huge drop in the Share Price (particularly surreal after such Strong Results and with Guidance raised !!) is to do with Short Term Thinking vs. Long Term Thinking. It is probably reasonable to say that in the Short Term the Valuation had perhaps run a bit too high, but as I take a viewpoint looking out Years or Decades even, I suspect such Selling is a bit mistaken and the Modelling I will do below might shine light on this. The Trading/Investing Legend Cockney Rebel (@RebelHQ on the Tweeting) did a Podcast with Paul Scott a while back (I am sure you all know Paul Scott but if not he writes on StockoPedia and Tweets as @Paulypilot), where he was talking about some or other Stock (it could even have been BOO !!) and he said about a High Valuation “It is no big deal, it will grow into the Valuation” - that really chimed with me and it is one of those Comments that someone very switched on makes that really sticks in my Brain - I had never really thought this way before and I think it is very useful when considering Rapid Growth Businesses which don’t easily lend themselves to traditional Valuation Methods and certainly do not make sense if you have a focus on the Historic Results of the Company. So really the Modelling Ideas I have here are based very much on that Concept of “Growing into the Valuation”. The idea for this Blog came about because I was having a chat on Twitter this morning with my mate Chriss (@BritishInvestor) and we were talking about the relevance of Historic Results and Historic Valuation methods like a raw P/E etc. (personally I think they are useless and I rarely look at Historic Numbers - I am more interested in the Likely Future and the Forward Numbers and Valuations float the WheelieBoat), and we also had a discussion about the Discounted Cash Flow (DCF) technique to Value Companies which again I think is a bit of a Chocolate Teapot and it reminds me far too much of how Pension Scheme Deficits are calculated - there are too many Assumptions needed and the Sensitivity of the Inputs/Outputs is far too high - Garbage in, Garbage out. Another flaw is that no one really uses DCFs - most people in the Markets use P/E Ratio above all else - this is relevant because it is impossible to judge what an appropriate Market Valuation is if everyone is using a different method. Chriss runs an excellent Website here - it is worth a look and he writes some very interesting and useful Blogs etc. with very much a Value Investor bent: https://thebritishinvestor.com/ I find that Simple is always best. I like the humble P/E Ratio but I slant it towards the Future and I am particularly interested in the PEG Ratio (Price Earnings divided by the Growth Rate). Anyway, my Simple Modelling that I am at some point going to start in this Blog, is very much based around these simple ideas and I think anyone could do this whereas that is certainly not the case with DCF models which are far too theoretical for me. “WheelieDealer - Investing in the Real World“ ……….as the Strapline goes. Note this paragraph from the RNS in particular because it is very relevant to our Modelling: “Guidance The group's revenue growth is now expected to be around 80%, up from our previous guidance of around 60%. Revenue growth from the boohoo brand is expected to be at the upper end of previous guidance at around 30%. Revenue growth from the PrettyLittleThing brand is now expected to be approximately 150% above the 12 month revenue to 28 February 2017 of £55 million (double the previous guidance of 75%). The balance of the group's growth will come from the Nasty Gal brand. As a result of significantly better-than-expected revenue growth from PrettyLittleThing and our investment in price, promotion and marketing, we now expect group adjusted EBITDA margins to be between 9% and 10%.” Right, turn your Brains on, let’s get stuck in. The simple logic here is that we will take a Starting Earnings Per Share (EPS) figure and then we will apply a Growth Rate to it and see how the P/E Ratio falls over the coming Years - it really is that simple. Of course the skill/judgement comes in around what Growth Rate to use - and I will do several Scenarios and Readers can make their own minds up. This is a Framework I use a lot myself and Readers may have realised I am doing something similar on my Individual Buy Rationale Blogs when I come up with Target Prices etc. I will do a simple but silly example first which should help understanding. Growth Scenario 1 - 100% growth and totally daft If you scroll down to the bottom of this Blog you will find a ‘Details’ Screen that I have shoved in from the stupendous ShareScope Software that I use and subscribe to. In the Top Right Hand Corner of this you should find a ‘Feb 2018 Forecast’ figure for ‘Norm EPS (p)’ of 2.88p. We need a Starting Figure for our Scenario and we could take this raw 2.88p figure but after reading that Paragraph on Guidance higher up, I will use 3p as my Base Figure - this doesn’t seem ridiculous to me and I think they will hit this figure (these ShareScope figures are updated on the Evening of Wednesday 27th September 2017 and they are no different to the figures from the Night before - so any Upgrades are not included yet and I expect we will get plenty in coming days from the Analysts who cover the Stock - so I am just pre-empting them by assuming 3p EPS as my Start Point.) Using 3p as the Start Point, the figures I am interested in over the next 5 years will be as follows if we assume a ‘Straight Line Growth Rate’ of 100% (this is of course stupid and it is merely to illustrate the Method at this point) and I am using Today’s Closing Share Price of 218p for the P/E figure (this is arguably conservative because you could Strip the Cash out and lower that Number which would mean a Lower P/E Ratio): 2018 - 3p EPS - P/E Ratio 72.6 (218p divided by 3p) 2019 - 6p EPS - P/E Ratio 36.3 (remember, this silly example is growing Earnings at 100%) 2020 - 12p EPS - P/E Ratio 18.2 2021 - 24p EPS - P/E Ratio 9.1 2022 - 48p EPS - P/E Ratio 4.5 Note I have chosen 5 years entirely arbitrarily - I actually started off with 6 years but then decided that was even more daft - a lot can happen in 6 years (a lot can happen in 6 months !!) and the further out we ‘Forecast’ the more uncertain and inaccurate we will inevitably be. Anyway, the key takeaway here is that it shows the point that with Fast Growth, a Share Price can quickly ‘grow’ into a High Valuation (in this crazy and unrealistic example a very high P/E of 72.6 soon drops to a tiny P/E of 4.5). So a Fast Growing Company on a High Valuation may not be at all overvalued if the Growth is delivered - and that is of course where the Risk and Uncertainty lie and it is our job as Investors to figure out how to manage that and to use appropriate methods like Diversification, Averaging Down, Averaging Up and Position Size etc. etc. For BOO, I would see a P/E around 35 as probably being a ‘fair’ Valuation and in this silly example we get to that number in just 1 year. Growth Scenario 2 - 30% over 5 years To keep things simple we will go ‘Straight Line’ again and assume EPS grows 30% each Year for the next 5 years - from Today’s numbers, this is not an absurd assumption although of course it is flawed in many ways (again we will start at 3p EPS and 218p Share Price): 2018 - 3p EPS - P/E Ratio 72.6 (218p divided by 3p) 2019 - 3.9p EPS - P/E Ratio 55.9 (I calculate the EPS figure by multiplying by 130 and dividing by 100 - Percentages and all that - didn’t you learn anything at school?) 2020 - 5.1p EPS - P/E Ratio 42.7 2021 - 6.6p EPS - P/E Ratio 33 2022 - 8.6p EPS - P/E Ratio 25.3 It is interesting in this Scenario that we get to a reasonable P/E Ratio for a Stock like BOO at about 2021 when it hits 33 - this implies that on Today’s Valuation of 72.6 Forward P/E, it is perhaps rather expensive if it only grows at 30%. What happens if we straight-line the growth and up it a bit to 40%? Growth Scenario 3 - 40% over 5 years Straight Line again and starting from EPS 3p and 218p Share Price - I don’t think this is hugely unrealistic and might actually be the most appropriate of these Simple Valuation Scenarios: 2018 - 3p EPS - P/E Ratio 72.6 (218p divided by 3p) 2019 - 4.2p EPS - P/E Ratio 51.9 2020 - 5.9p EPS - P/E Ratio 36.9 (starting to get realistic on the P/E) 2021 - 8.3p EPS - P/E Ratio 26.3 (arguably cheap now) 2022 - 11.6p EPS - P/E Ratio 18.8 (that’s cheap). Just look how that P/E Ratio falls - that is what growth is all about !! I actually think this is the best and most realistic Scenario but of course it is very simple and the ‘straight-line’ method is sub-optimal - to get around this, I will do one more Scenario which uses varying Growth Rates over the years - here it comes……. Growth Scenario 4 - Variable growth and slowing This one is very difficult and open to interpretation/judgement which is of course a failing of such a method - although the numbers are actually dead simple as with the previous Scenarios I have shown. On this one, let’s use the same Starting Points but say that the Growth Changes as follows: 2018 to 2019 - 35% (note, this gives an EPS figure in line with the ShareScope Forecasts below) 2019 to 2020 - 35% 2020 to 2021 - 30% 2021 to 2022 - 25% I have entirely guessed at these and Readers can mess around with the Growth Rates as they see fit. My hunch is that I have been too pessimistic in the later years as Costs will drop as Scale Economies kick in as Revenue grows. This gives the Output as follows: 2018 - 3p EPS - P/E Ratio 72.6 (218p divided by 3p) 2019 - 4.1p EPS - P/E Ratio 53.2 2020 - 5.5p EPS - P/E Ratio 39.6 2021 - 7.2p EPS - P/E Ratio 30.3 2022 - 9p EPS - P/E Ratio 24.2 On this one after about 3 Years (although bear in mind 2018 really is the ‘Current Year’ as it ends on April 31st 2018 - so it is only 6 months away), the Valuation gets to a realistic level for the Growth and Quality of the Company. In PEG terms this would be getting to about 1.0 which is seen as cheap - however, it is worth appreciating that Asos ASC is on a Forward P/E of 76.8 now (not wildly different to BOO on a Forward P/E 72.6 by my calculations) and a PEG of about 2.0 on this basis - quite similar to BOO and arguably BOO will deliver faster Growth as it is earlier in its lifecycle. And of course BOO might be a takeover target for ASC - that would not be a shock to anyone and clearly a pretty good fit. I have included the ShareScope ‘Details’ Screenshot for ASC also further down. Something I haven’t mentioned so far is how the UK experience of BOO so far gives a good steer on how Growth is likely to go in Overseas Markets - at this point in time the Growth Overseas is very strong but obviously it will mature and the same principle will apply to the new Brands. Another thing I have not mentioned is the Forecasted Revenue Growth - it looks way too light to me. Look at that ShareScope Screen and you will see Revenue is forecasted to grow from £496m in 2018 to £643m in 2019 - I think this hugely understates what is being achieved and what is likely to be achieved. Firstly, these figures do not include today’s Upgraded Guidance by the Management - and secondly I just think they are way too conservative, with Growth here as only 29.6% - I can see that easily being beaten which will mean higher Earnings and EPS Forecasts as well - this could easily mean that even my Best Scenario above is too light and the Stock is cheaper than I thought. I hope that helps Readers think about BOO and the ways to ascertain the Value of a Growth Company - I find this a useful Framework when other methods are often way too complex and not really appropriate. Cheers, WD. Related Blogs Starting off here is a Blog I did on BOO a long time back - the numbers will be pretty much nonsense but there is a fair bit about the business here and the Risks and stuff: http://wheeliedealer.weebly.com/blog/boohoocom-boo-topup-buy-rationale Here is the one I did on how to Value Stocks - I am particularly fond of this one as I think Readers have generally found it quite decent (there are links at the bottom to all parts of the series): http://wheeliedealer.weebly.com/blog/valuation-valuation-valuation-bursting-for-a-pe-part-4-of-4 This one is about Analyst Forecasts and Upgrades etc. and very relevant for BOO as any Upgrades lower the Valuation: http://wheeliedealer.weebly.com/blog/analysing-the-analysts Here is a set of Blogs on how I do Targets: http://wheeliedealer.weebly.com/blog/targets-helping-improve-your-aim-part-1-of-3 http://wheeliedealer.weebly.com/blog/targets-helping-improve-your-aim-part-2-of-3 http://wheeliedealer.weebly.com/blog/targets-helping-improve-your-aim-part-3-of-3 This one is about the importance of Future Gazing rather than being wedded to History: http://wheeliedealer.weebly.com/blog/look-to-the-future-now-its-only-just-begun-with-special-guest-star-utw-part-1-of-2 http://wheeliedealer.weebly.com/blog/look-to-the-future-now-its-only-just-begun-with-special-guest-star-utw-part-2-of-2 And finally one on thinking like an Owner: http://wheeliedealer.weebly.com/blog/price-vs-value-think-like-an-owner-part-2-of-2

2 Comments

Mr catflap

28/9/2017 01:11:55 pm

Reply

WheelieDealer

1/10/2017 01:08:42 am

Hi Mr catflap,

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|