|

THIS IS NOT A TIP OR RECOMMENDATION. I AM NOT A TIPSTER. PLEASE DO YOUR OWN RESEARCH. PLEASE READ THE DISCLAIMER ON THE HOME PAGE OF MY WEBSITES. IF YOU COPY MY TRADES, YOU WILL PROBABLY LOSE MONEY.

Earlier today I was talking to someone on Twitter about Quantum Pharma QP. which they were thinking of Buying. Anyway, as with all these things, the first action by me was to quickly go to my ADVFN Fone App (which is simply brilliant by the way, and FREE) and to have a look at the Chart - that is always a very simple way of screening things in or out for me. In simple terms, I want to buy Stocks in Uptrends.

Anyway, on further discussion it became clear that this would be a great Chart to share with people and it’s quick and easy for me to write which is always a bonus !!

OK, let’s be clear on this, I know Sweet Fanny Adams about this Stock, apart from the fact it seems to be something a bit medicinal and it only Floated back at the end of 2014. So it has very little history as a Public Company. My contention from seeing the Charts was that currently the Share is in a “Horrible Downtrend Channel” - I think this caused a few coronaries on Twitter so let me explain…………. Technicals On the Chart below that I have scraped from ShareScope, I am showing the Full History of QP. so far. There are 3 distinct phases as follows:

The Black Arrow marks the Long Term Support line which comes from just after the Floatation of the Company - it is very important that this Support Holds for the Bulls or it is going down much lower.

On the Chart below, I have zoomed in to just show the Green Downtrend Channel from Phase 3. As I continually mention, Momentum has immense power and once a Stock gets into a Downtrend like this it can keep going a lot lower than you think - so buying a Stock whilst in such a Downtrend Channel will often end badly.

For Short Term Traders who want to grab moves of maybe a few days or a coupe of weeks etc. buying when the Price hits the Lower Line of the Downtrend Channel might seem quite sensible. However, the problem with this is that if you are Buying for a move Up you are going AGAINST THE MAJOR TREND. The Safest and often much more lucrative way to trade is to Sell a Downtrend - i.e. you Sell at the Top Line for the move down. Anyway, the current situation is that the Price is on the bottom line and looks oversold on the RSI (Relative Strength Index - I have not included a Chart for this), and my Blue Arrow points to a Big Up Candle today which has engulfed the Candle from the day before - this is a very good sign for the Bulls. However, where it gets less good is that the most likely scenario now is that the Price will move up towards the Top Channel Line where I have put the Big Black Splodge (Circle). OK, the Black Circle perhaps should be lower down but the point is the same - the most likely event here is that the Price moves up to the Black Spot and then drops again as the Downtrend continues. If the Bulls are extremely lucky, then the Price will move up to the Black Spot and then Breakout of the Downtrend Channel - however, this might just mean that the Price moves into a Sideways Channel rather than going back into an Uptrend - who knows? For People who want to buy this Stock, by far the Safest way is to wait for the Downtrend Channel to Breakout - you cannot guarantee that it will move into an Uptrend straightaway, but at least you are out of the Dangers of the Downtrend which could take you a lot lower - and you know how upset that will make you !!

A Safer Way to Trade

On the Chart below, I have just included the original Uptrend Channel which was formed in Phase 1 just after the IPO. Remember what I said about Trading with the Major Trend? Well in this case, if you Buy after a Pullback (Retracement) within the Uptrend Channel, then you are riding the next leg up IN THE DIRECTION OF THE MAJOR TREND. This is far safer and you are much more likely to be right - lower Risk and more reward. These concepts of Trading with the Trend will work on any Timeframe - from minutes to months etc. I have shown this by marking that you could have bought at the Blue Arrow when the Price had retraced to the Bottom Line of the Uptrend Channel and you could have Sold at the Green Arrow when it reached the Top Line of the Uptrend Channel. Of Course, it probably would have been better to take a Long Term view and to have rode the Trend much higher before Selling. Remember, Momentum is one of the very few ‘Free Lunches’ in Investment / Trading - so you want to ride these Trends as long as possible.

A Ray of Hope?

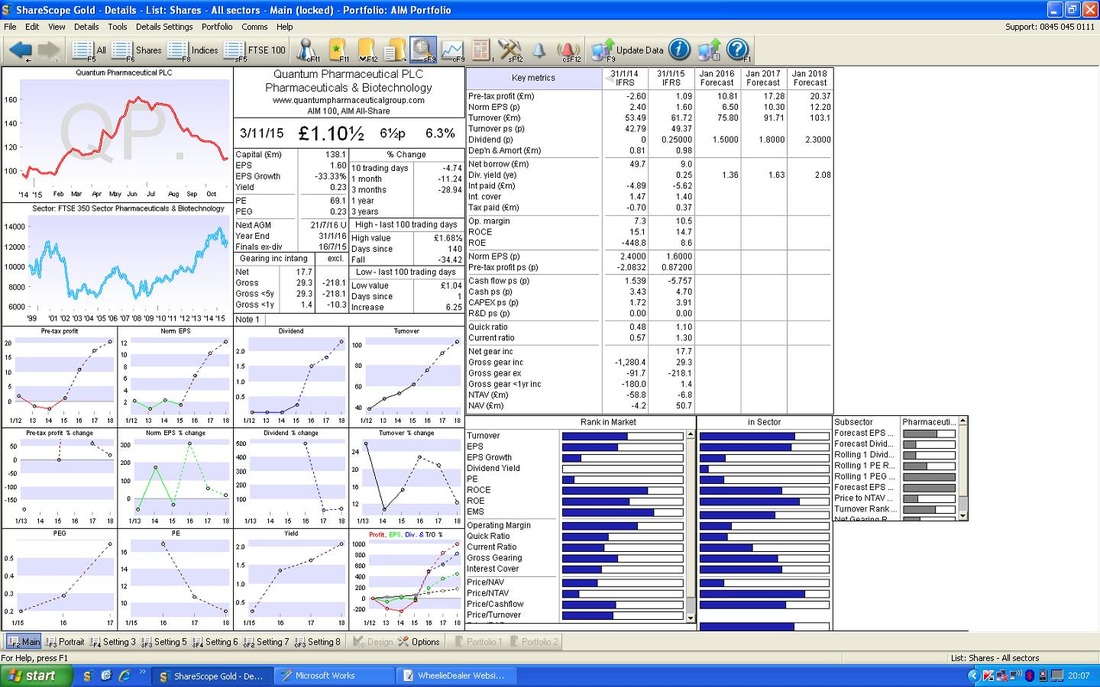

I said before that I know nothing about the Stock, and my instant reaction was to think “oh no, not more biotech AIM crap” but if you look at the Details Screen from ShareScope below, the Numbers don’t look too bad. Obviously lots of research is needed for anyone thinking of buying. One approach is you really, really, really, must own the Shares is to buy a Little Nibble of Stock initially and then if you get the Breakout, you can Buy Mountains more of them - Add to Winners. Remember - Buy Uptrends, Sell Downtrends. OK, here endeth the Lesson, WD

2 Comments

WheelieDealer

20/12/2015 11:24:55 pm

Hi this site,

Reply

Leave a Reply. |

'Educational' WheelieBlogsWelcome to my Educational Blog Page - I have another 'Stocks & Markets' Blog Page which you can access via a Button on the top of the Homepage. Archives

May 2024

Categories

All

Please see the Full Range of Book Ideas in Wheelie's Bookshop.

|